Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information was extracted from the financial statements of Andrew Hunt plc on 31 December 2018: Sales Cost of sales Gross profit Operating

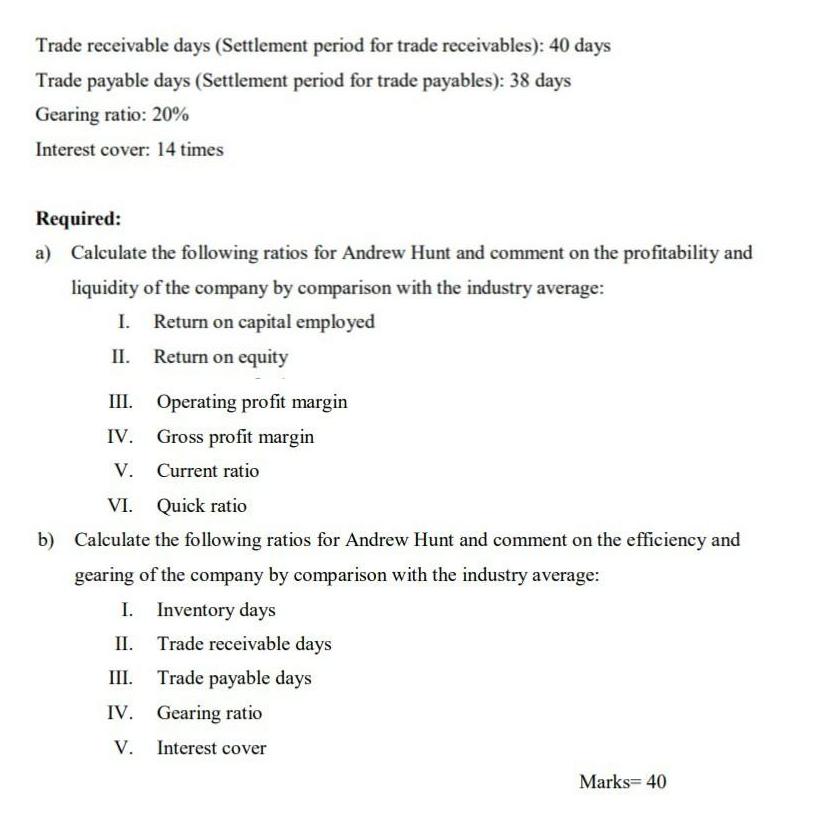

The following information was extracted from the financial statements of Andrew Hunt plc on 31 December 2018: Sales Cost of sales Gross profit Operating profit Interest expense Profit after interest and tax Total non-current assets Total current assets Inventories Trade receivables Total non-current liabilities Total current liabilities Trade payables Total equity Sm 4,420 2,810 1,610 610 30 435 1,050 1,000 330 470 400 465 290 1,185 Industry average ratios Return on capital employed: 35% Return on equity (Return on ordinary shareholders' funds): 25% Operating profit margin: 20% Gross profit margin: 40% Current ratio: 1.5:1 Quick ratio (Acid test ratio): 0.9:1 Inventory days (Inventory turnover period): 65 days Trade receivable days (Settlement period for trade receivables): 40 days Trade payable days (Settlement period for trade payables): 38 days Gearing ratio: 20% Interest cover: 14 times Required: a) Calculate the following ratios for Andrew Hunt and comment on the profitability and liquidity of the company by comparison with the industry average: I. Return on capital employed II. Return on equity III. IV. V. Operating profit margin Gross profit margin Current ratio VI. Quick ratio b) Calculate the following ratios for Andrew Hunt and comment on the efficiency and gearing of the company by comparison with the industry average: I. Inventory days II. III. Trade receivable days Trade payable days IV. Gearing ratio V. Interest cover Marks = 40

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Andrew Hunt Profitability and Liquidity II Return on equity III Operating profit margin I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started