Answered step by step

Verified Expert Solution

Question

1 Approved Answer

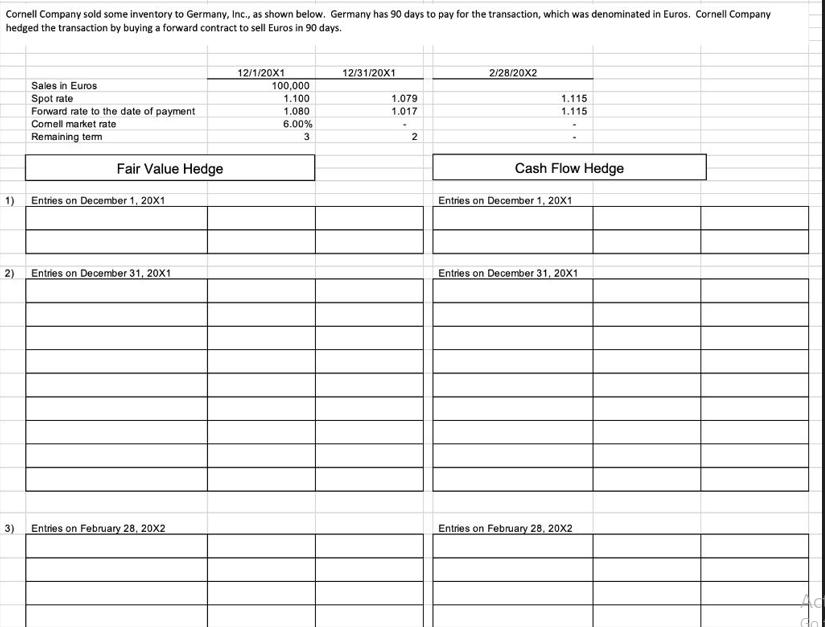

Cornell Company sold some inventory to Germany, Inc., as shown below. Germany has 90 days to pay for the transaction, which was denominated in

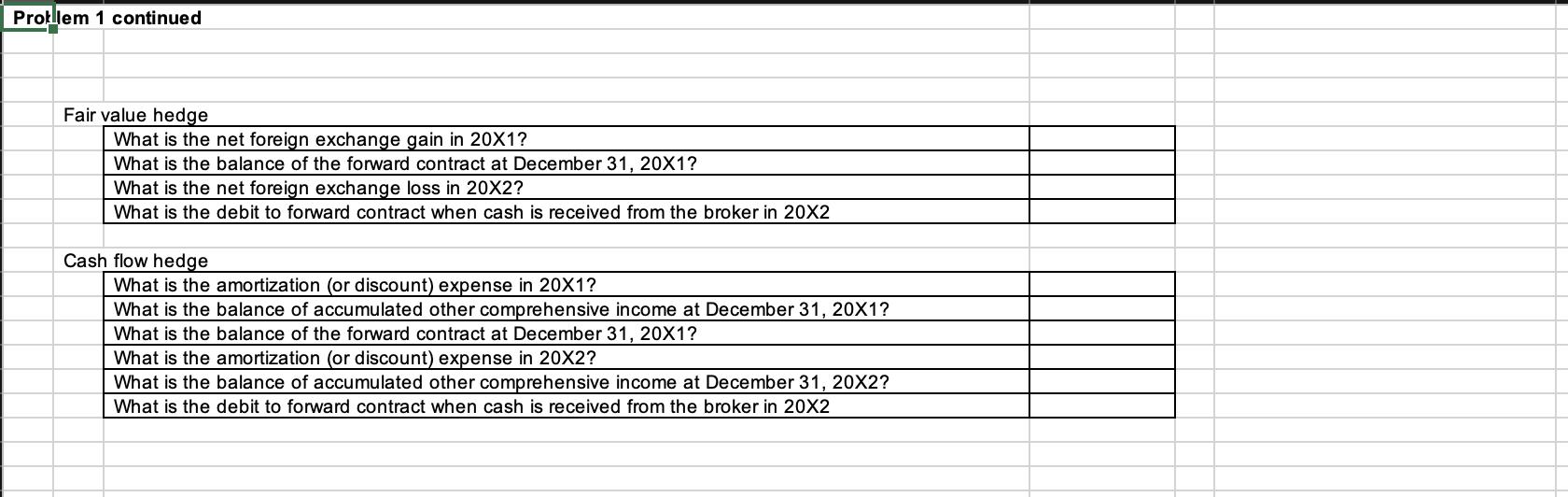

Cornell Company sold some inventory to Germany, Inc., as shown below. Germany has 90 days to pay for the transaction, which was denominated in Euros. Cornell Company hedged the transaction by buying a forward contract to sell Euros in 90 days. 1) 2) 3) Sales in Euros Spot rate Forward rate to the date of payment Comell market rate Remaining term Fair Value Hedge Entries on December 1, 20X1 Entries on December 31, 20X1 Entries on February 28, 20X2 12/1/20X1 100,000 1.100 1.080 6.00% 3 12/31/20X1 1.079 1.017 . 2 2/28/20X2 1.115 1.115 Cash Flow Hedge Entries on December 1, 20X1 Entries on December 31, 20X1 Entries on February 28, 20X2 Ac Problem 1 continued Fair value hedge What is the net foreign exchange gain in 20X1? What is the balance of the forward contract at December 31, 20X1? What is the net foreign exchange loss in 20X2? What is the debit to forward contract when cash is received from the broker in 20X2 Cash flow hedge What is the amortization (or discount) expense in 20X1? What is the balance of accumulated other comprehensive income at December 31, 20X1? What is the balance of the forward contract at December 31, 20X1? What is the amortization (or discount) expense in 20X2? What is the balance of accumulated other comprehensive income at December 31, 20X2? What is the debit to forward contract when cash is received from the broker in 20X2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Fair Value Hedge 1 Net foreign exchange gain in 20X1 The net foreign exchange gain in 20X1 is calculated as the difference between the forward rate at ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started