Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information was taken from the records of Caton Co. for the year 2021. Income tax on the income from continuing operations was

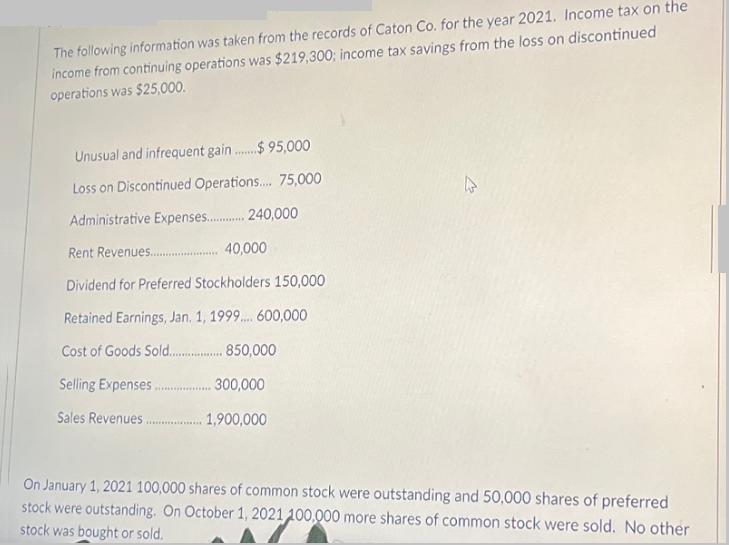

The following information was taken from the records of Caton Co. for the year 2021. Income tax on the income from continuing operations was $219,300; income tax savings from the loss on discontinued operations was $25,000. Unusual and infrequent gain.......$ 95,000 Loss on Discontinued Operations.... 75,000 Administrative Expenses...........240,000 Rent Revenue....................40,000. Dividend for Preferred Stockholders 150,000 Retained Earnings, Jan. 1, 1999.... 600,000 Cost of Goods Sold.............8850,000. Selling Expenses..............300,000 Sales Revenues..............1,900,000 On January 1, 2021 100,000 shares of common stock were outstanding and 50,000 shares of preferred stock were outstanding. On October 1, 2021 100,000 more shares of common stock were sold. No other stock was bought or sold.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To analyze Caton Cos financial information and compute various ratios well first calculate th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started