Answered step by step

Verified Expert Solution

Question

1 Approved Answer

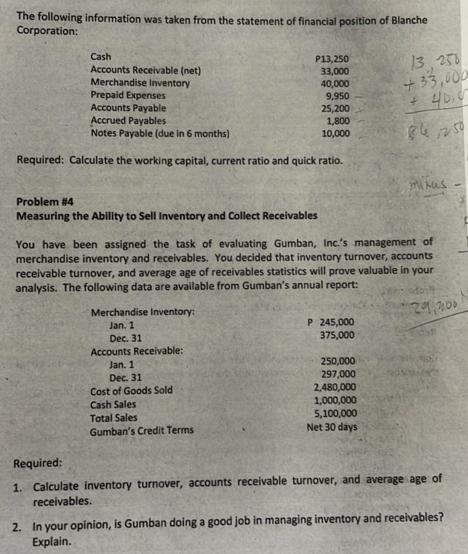

The following information was taken from the statement of financial position of Blanche Corporation: Cash Accounts Receivable (net) Merchandise Inventory P13,250 33,000 40,000 9,950

The following information was taken from the statement of financial position of Blanche Corporation: Cash Accounts Receivable (net) Merchandise Inventory P13,250 33,000 40,000 9,950 25,200 1,800 10,000 Prepaid Expenses Accounts Payable Accrued Payables Notes Payable (due in 6 months) Required: Calculate the working capital, current ratio and quick ratio. Problem #4 Measuring the Ability to Sell Inventory and Collect Receivables Merchandise Inventory: Jan. 1 Dec. 31 Accounts Receivable: Jan. 1 Dec. 31 Cost of Goods Sold Cash Sales Total Sales Gumban's Credit Terms P 245,000 375,000 250,000 297,000 13.258 +33,000 You have been assigned the task of evaluating Gumban, Inc.'s management of merchandise inventory and receivables. You decided that inventory turnover, accounts receivable turnover, and average age of receivables statistics will prove valuable in your analysis. The following data are available from Gumban's annual report: 2,480,000 1,000,000 5,100,000 Net 30 days + 84,250 mikas 29,2:00 Required: 1. Calculate inventory turnover, accounts receivable turnover, and average age receivables. 2. In your opinion, is Gumban doing a good job in managing inventory and receivables? Explain.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Inventory Turnover Cost of Goods SoldAverage Inventory Average Inventory Inventory on Jan 1 Invent...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started