Answered step by step

Verified Expert Solution

Question

1 Approved Answer

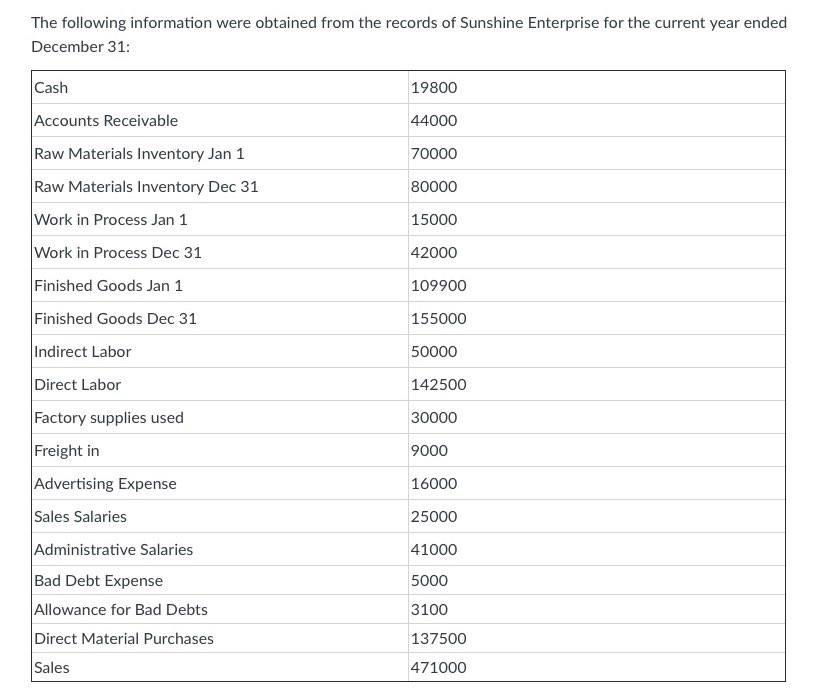

The following information were obtained from the records of Sunshine Enterprise for the current year ended December 31: Cash Accounts Receivable Raw Materials Inventory

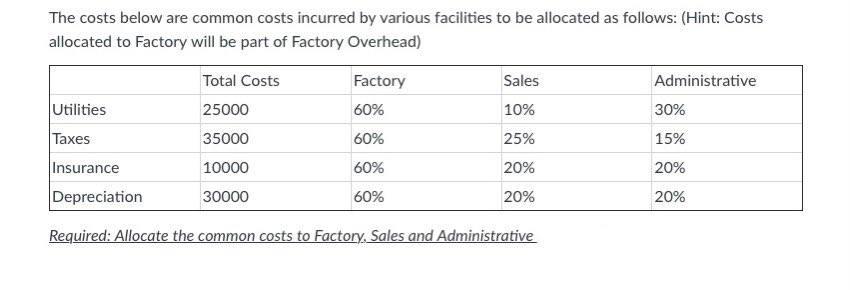

The following information were obtained from the records of Sunshine Enterprise for the current year ended December 31: Cash Accounts Receivable Raw Materials Inventory Jan 1 Raw Materials Inventory Dec 31 Work in Process Jan 1 Work in Process Dec 31 Finished Goods Jan 1 Finished Goods Dec 31 Indirect Labor Direct Labor Factory supplies used Freight in Advertising Expense Sales Salaries Administrative Salaries Bad Debt Expense Allowance for Bad Debts Direct Material Purchases Sales 19800 44000 70000 80000 15000 42000 109900 155000 50000 142500 30000 9000 16000 25000 41000 5000 3100 137500 471000 The costs below are common costs incurred by various facilities to be allocated as follows: (Hint: Costs allocated to Factory will be part of Factory Overhead) Utilities Taxes Insurance Depreciation Total Costs 25000 35000 10000 30000 Factory 60% 60% 60% 60% Sales 10% 25% 20% 20% Required: Allocate the common costs to Factory, Sales and Administrative Administrative 30% 15% 20% 20%

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started