Answered step by step

Verified Expert Solution

Question

1 Approved Answer

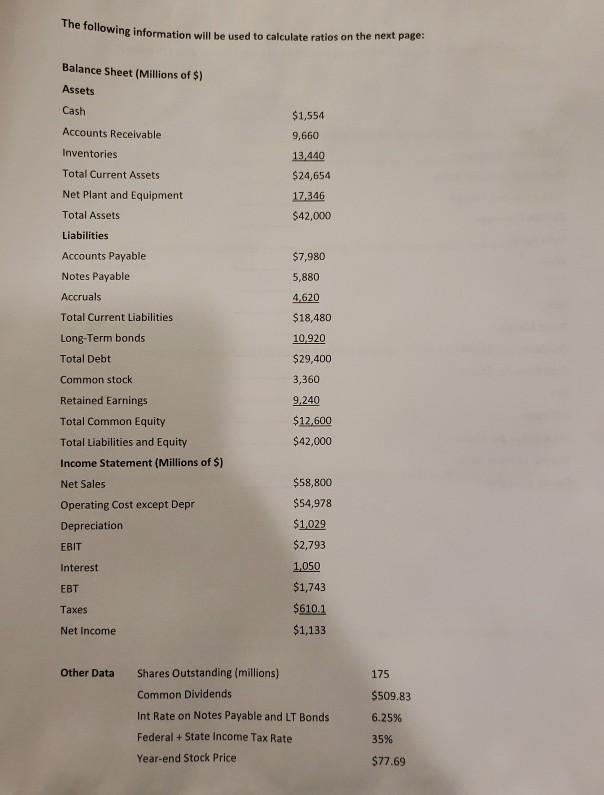

The following information will be used to calculate ratios on the next page: Balance Sheet (Millions of $) Assets Cash $1,554 Accounts Receivable Inventories 9,660

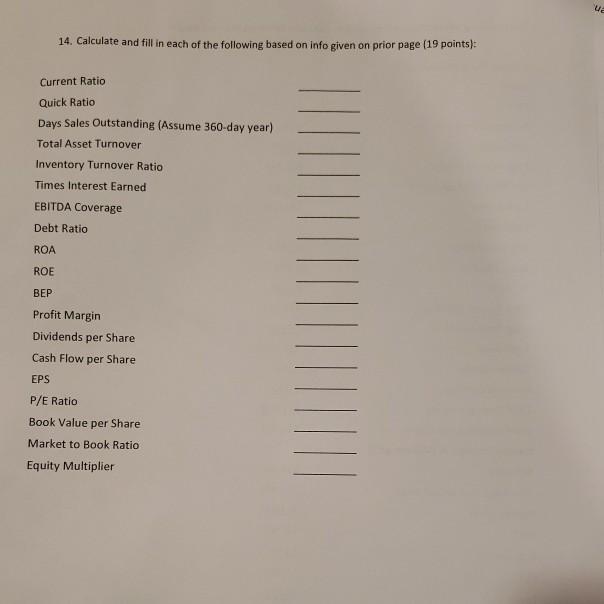

The following information will be used to calculate ratios on the next page: Balance Sheet (Millions of $) Assets Cash $1,554 Accounts Receivable Inventories 9,660 13,440 Total Current Assets $24,654 17,346 Net Plant and Equipment Total Assets $42,000 Liabilities $7,980 5,880 4.620 $18,480 10920 $29,400 3,360 Accounts Payable Notes Payable Accruals Total Current Liabilities Long-Term bonds Total Debt Common stock Retained Earnings Total Common Equity Total Liabilities and Equity Income Statement (Millions of $) Net Sales Operating Cost except Depr Depreciation EBIT 9,240 $12,600 $42,000 $58,800 $54,978 $1,029 $2,793 1,050 $1,743 $6101 $1,133 Interest EBT Taxes Net Income Other Data 175 $509.83 Shares Outstanding (millions) Common Dividends Int Rate on Notes Payable and LT Bonds Federal + State Income Tax Rate Year-end Stock Price 6.25% 35% $77.69 wa 14. Calculate and fill in each of the following based on info given on prior page (19 points): Current Ratio Quick Ratio Days Sales Outstanding (Assume 360-day year) Total Asset Turnover Inventory Turnover Ratio Times Interest Earned EBITDA Coverage Debt Ratio ROA ROE BEP Profit Margin Dividends per Share Cash Flow per Share EPS P/E Ratio Book Value per Share Market to Book Ratio Equity Multiplier

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started