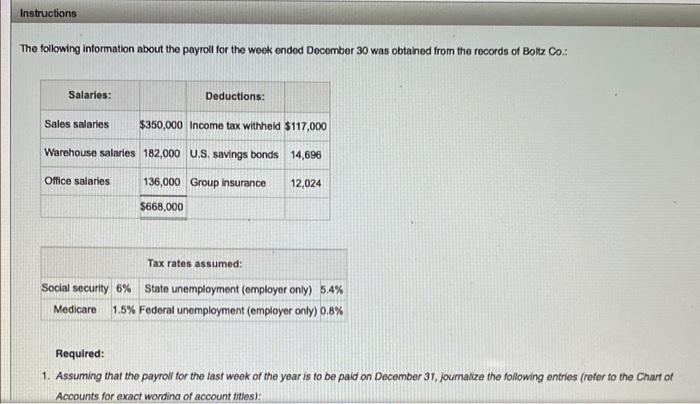

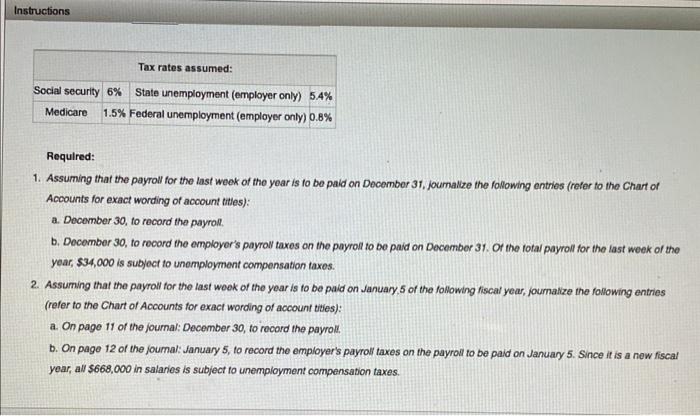

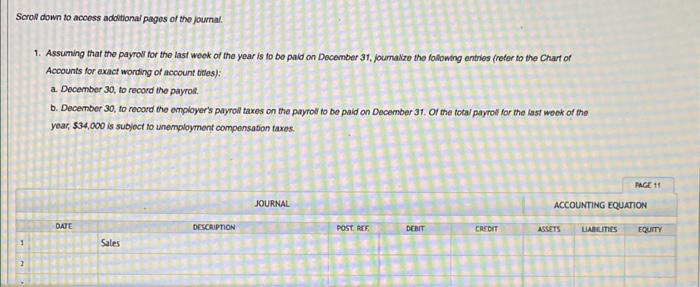

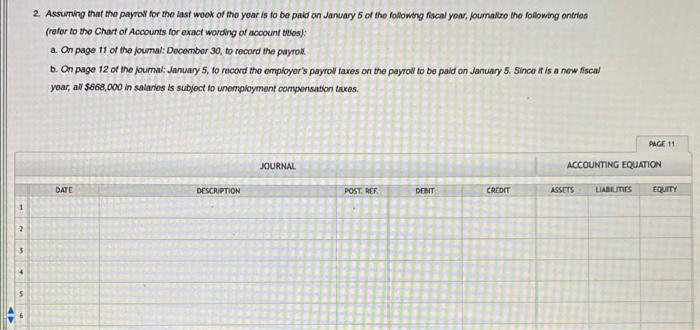

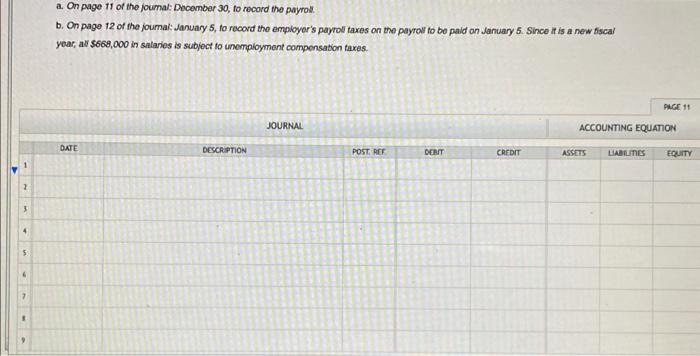

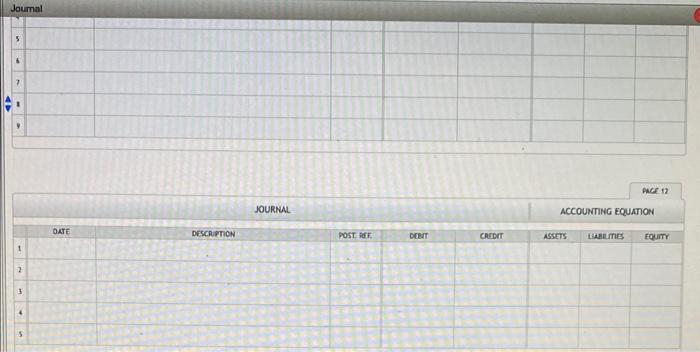

The following intormation about the payroll for the week onded Docomber 30 was obtained from the rocords of Boliz Co.: Required: 1. Assuming that the payroll for the last week of the year is to be paid on December 31 , journalize the following entries (refer to the Chart of Accounts for exact wordina of account ttites): Required: 1. Assuming that the payroll for the last week of the year is to be paid on December 31, joumalize the following entries (reter to the Chart of Accounts for exact wording of account tittes): a. Docember 30 , to record the payroll. b. December 30, to record the employer's payroll taxes on the payroll to be paid on December 31. Of the fotal payroll for the last week of the year, $34,000 is subject to unomployment compensation taxos. 2. Assuming that the payroll for the last woek of the year is to be paid on January 5 of the following fiscal year, joumatize the following entries (refer to the Chart of Accounts for exact wording of account tijies): a. On page 11 of the joumal: December 30 , to record the payroll. b. On page 12 of the joumal: January 5, to record the employer's payroll taxes on the payroll to be paid on January 5. Since it is a new fiscal yoar, all $668,000 in salaries is subject to unemployment compensation taxes. Scroll down to accoss adbitional pages of the joumal. 1. Assuming that the payrol for the last week of the year is to bo paid on December 31, joumalze the fallowing antries froter to the Chart of Accounts for exact wording of account tittes): a. December 30 , to record the payrol. b. December 30, to rocord the employer's payrol taxes on the payrol to be paid on December 31. Of the total payroll for the last wook of the year, $34,000 is subjact to unemployment componsation taxes. Joumal \begin{tabular}{l} 1 \\ 2 \\ \hline 1 \end{tabular} 2. Assuming that the payrol for the Last wook of the yoar is to be paid on January 5 of the following fiscal yoar, foumallze the following ontrias (rafor to the Chart of Accounts for exact wording of account tilios): a. On page 11 of the joumal: Docomber 30 , to record the payrove b. On page 12 of the joumal: Januay 5 , to record the employer's payroll taxes on the payroll to be paid on January 5 . Sinco it is a new fiscal year, av $668,000 in salarios is subject to unemploymant compensabion trues. a. On page it of the joumal: December 30 , to record the payrol. b. On page 12 of the joumal: January 5 , to record the employor's payrol taxes on the payroll to be pald an January 5 . Since if is a new fiscal yoar, al $668,000 in salaries is subjoct to unempioyment compensation taxes. Joumal 5 4 7 1 9