Answered step by step

Verified Expert Solution

Question

1 Approved Answer

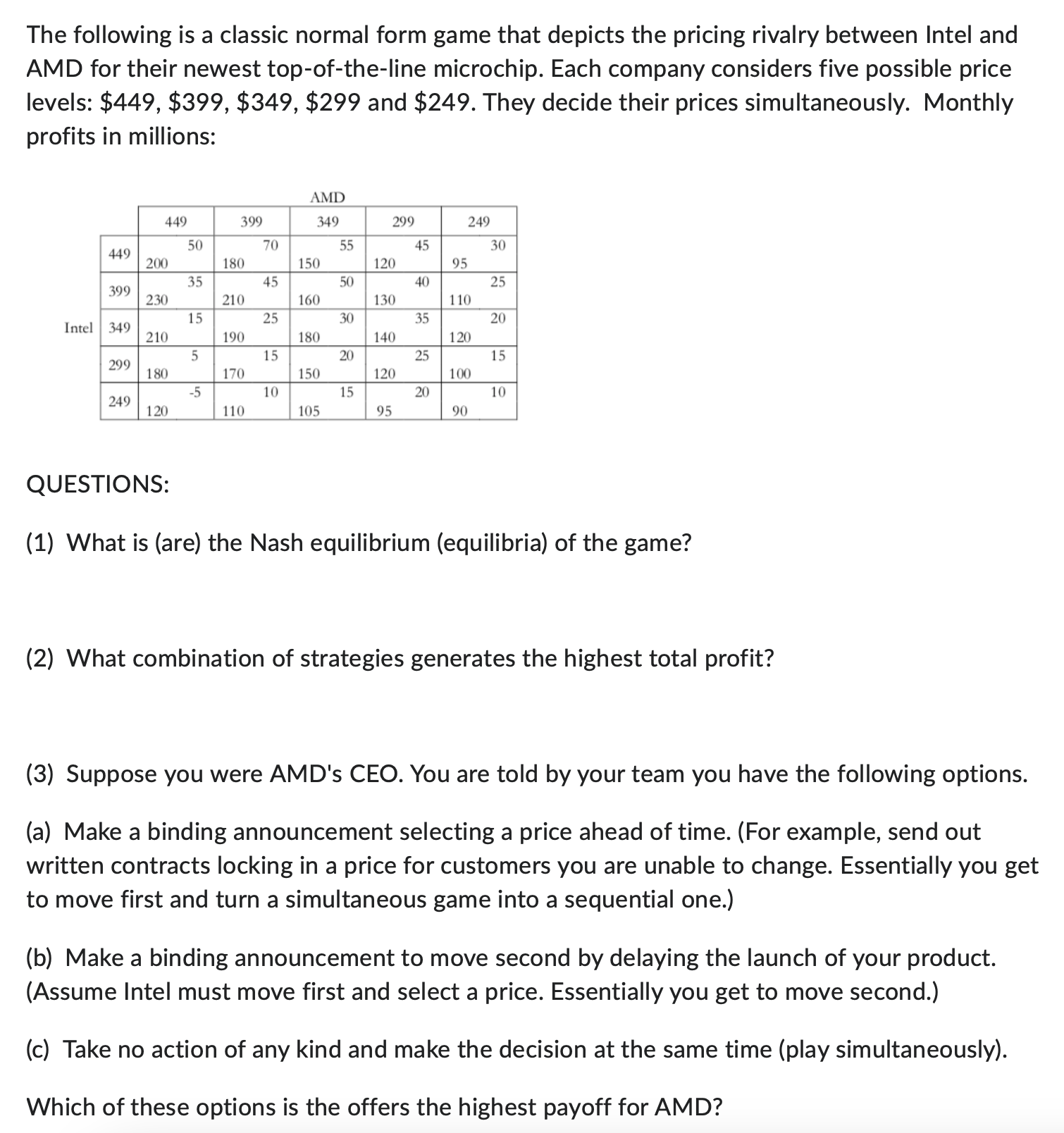

The following is a classic normal form game that depicts the pricing rivalry between Intel and AMD for their newest top-of-the-line microchip. Each company

The following is a classic normal form game that depicts the pricing rivalry between Intel and AMD for their newest top-of-the-line microchip. Each company considers five possible price levels: $449, $399, $349, $299 and $249. They decide their prices simultaneously. Monthly profits in millions: 449 399 Intel 349 299 249 449 200 230 210 180 120 50 35 15 5 -5 399 180 210 190 170 110 70 45 25 15 10 AMD 349 150 160 180 150 105 55 50 30 20 15 299 120 130 140 120 95 45 40 35 25 20 249 95 110 120 100 90 30 25 20 15 10 QUESTIONS: (1) What is (are) the Nash equilibrium (equilibria) of the game? (2) What combination of strategies generates the highest total profit? (3) Suppose you were AMD's CEO. You are told by your team you have the following options. (a) Make a binding announcement selecting a price ahead of time. (For example, send out written contracts locking in a price for customers you are unable to change. Essentially you get to move first and turn a simultaneous game into a sequential one.) (b) Make a binding announcement to move second by delaying the launch of your product. (Assume Intel must move first and select a price. Essentially you get to move second.) (c) Take no action of any kind and make the decision at the same time (play simultaneously). Which of these options is the offers the highest payoff for AMD?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER 1 The Nash equilibria of the game are 349 349 399 399 449 449 299 299 and 249 249 These equilibria arise because each player chooses the price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started