Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following is a list of accounts for Ducel Incorporated. Included is an Aging of Accounts Receivable schedule for the year before an adjustment to

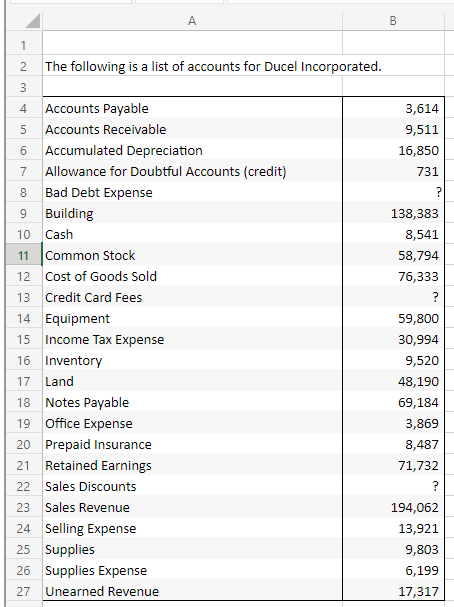

The following is a list of accounts for Ducel Incorporated.

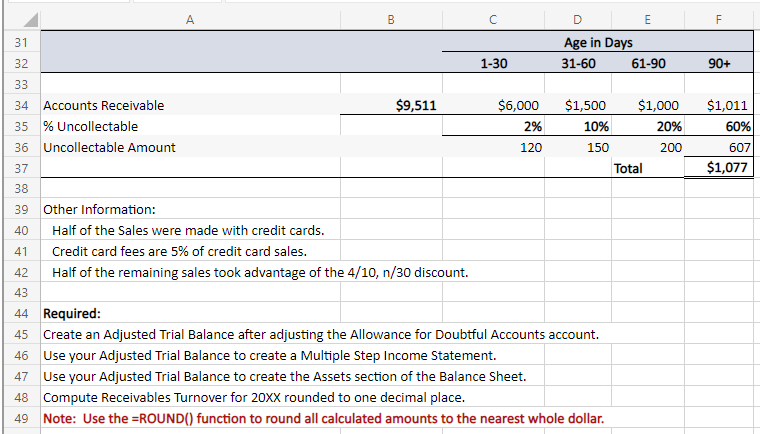

Included is an Aging of Accounts Receivable schedule for the year before an adjustment to the Allowance for Doubtful Accounts account.

PLEASE USE EXCEL FUNCTION THANKS! :D

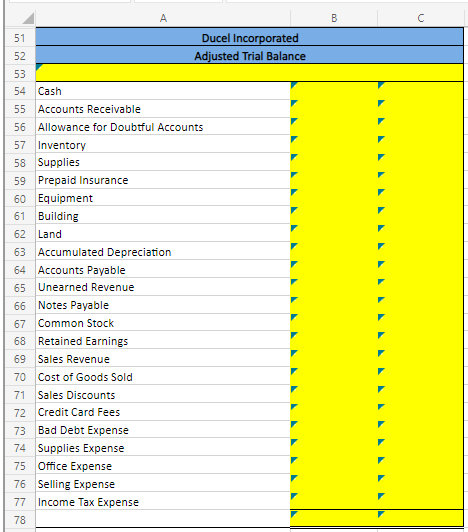

\begin{tabular}{|r|l|r|} \hline & \multicolumn{1}{|c|}{ A } \\ \hline 1 & & \\ \hline 2 & The following is a list of accounts for Ducel Incorporated. \\ \hline 3 & & \\ \hline 4 & Accounts Payable & 3,614 \\ \hline 5 & Accounts Receivable & 9,511 \\ \hline 6 & Accumulated Depreciation & 16,850 \\ \hline 7 & Allowance for Doubtful Accounts (credit) & 731 \\ \hline 8 & Bad Debt Expense & ? \\ \hline 9 & Building & 138,383 \\ \hline 10 & Cash & 8,541 \\ \hline 11 & Common Stock & 58,794 \\ \hline 12 & Cost of Goods Sold & 76,333 \\ \hline 13 & Credit Card Fees & ? \\ \hline 14 & Equipment & 59,800 \\ \hline 15 & Income Tax Expense & 30,994 \\ \hline 16 & Inventory & 9,520 \\ \hline 17 & Land & 48,190 \\ \hline 18 & Notes Payable & 69,184 \\ \hline 19 & Office Expense & 3,869 \\ \hline 20 & Prepaid Insurance & 8,487 \\ \hline 21 & Retained Earnings & 71,732 \\ \hline 22 & Sales Discounts & 9,803 \\ \hline 23 & Sales Revenue & 6,199 \\ \hline 24 & Selling Expense & 17,317 \\ \hline 25 & Supplies & 1921 \\ \hline 26 & Supplies Expense & \\ \hline 27 & Unearned Revenue & \\ \hline \end{tabular} Other Information: Half of the Sales were made with credit cards. Credit card fees are 5% of credit card sales. Half of the remaining sales took advantage of the 4/10,n/30 discount. Required: Create an Adjusted Trial Balance after adjusting the Allowance for Doubtful Accounts account. Use your Adjusted Trial Balance to create a Multiple Step Income Statement. Use your Adjusted Trial Balance to create the Assets section of the Balance Sheet. Compute Receivables Turnover for 20XX rounded to one decimal place. Note: Use the =ROUND() function to round all calculated amounts to the nearest whole dollar. \begin{tabular}{|l|l|l|} \hline & & \multicolumn{1}{c|}{ A } \\ \hline 51 & \multicolumn{1}{|c|}{ Ducel Incorporated } \\ \hline 52 & & Adjusted Trial Balance \\ \hline 53 & & \\ \hline 54 & Cash & \\ \hline 55 & Accounts Receivable & \\ \hline 56 & Allowance for Doubtful Accounts & \\ \hline 57 & Inventory & \\ \hline 58 & Supplies & \\ \hline 59 & Prepaid Insurance & \\ \hline 60 & Equipment & \\ \hline 61 & Building & \\ \hline 62 & Land & \\ \hline 63 & Accumulated Depreciation & \\ \hline 64 & Accounts Payable & \\ \hline 65 & Unearned Revenue & \\ \hline 66 & Notes Payable & \\ \hline 67 & Common Stock & \\ \hline 68 & Retained Earnings & \\ \hline 69 & Sales Revenue & \\ \hline 70 & Cost of Goods Sold \\ \hline 71 & Sales Discounts & \\ \hline 72 & Credit Card Fees & \\ \hline 73 & Bad Debt Expense \\ \hline 74 & Supplies Expense & \\ \hline 75 & Office Expense & \\ \hline 76 & Selling Expense & \\ \hline 77 & Income Tax Expense \\ \hline 78 & & \\ \hline \end{tabular} Note: Negative amounts or amounts to be deducted should be input and displayed as negative values. All other answers should be input and displayed as positive 96 valuesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started