Question

The following is a list of prices for zero coupon bonds with different maturities and par value of $1,000. Maturity (Years) Price 1 234

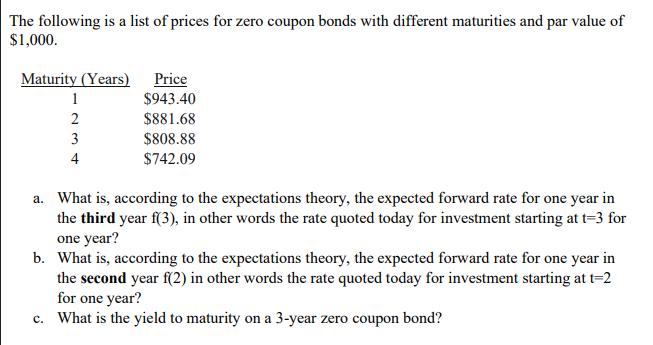

The following is a list of prices for zero coupon bonds with different maturities and par value of $1,000. Maturity (Years) Price 1 234 4 $943.40 $881.68 $808.88 $742.09 a. What is, according to the expectations theory, the expected forward rate for one year in the third year f(3), in other words the rate quoted today for investment starting at t=3 for one year? b. What is, according to the expectations theory, the expected forward rate for one year in the second year f(2) in other words the rate quoted today for investment starting at t=2 for one year? c. What is the yield to maturity on a 3-year zero coupon bond?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Information Systems

Authors: Ulric J. Gelinas, Richard B. Dull

10th edition

9781305176218, 113393594X, 1305176219, 978-1133935940

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App