Answered step by step

Verified Expert Solution

Question

1 Approved Answer

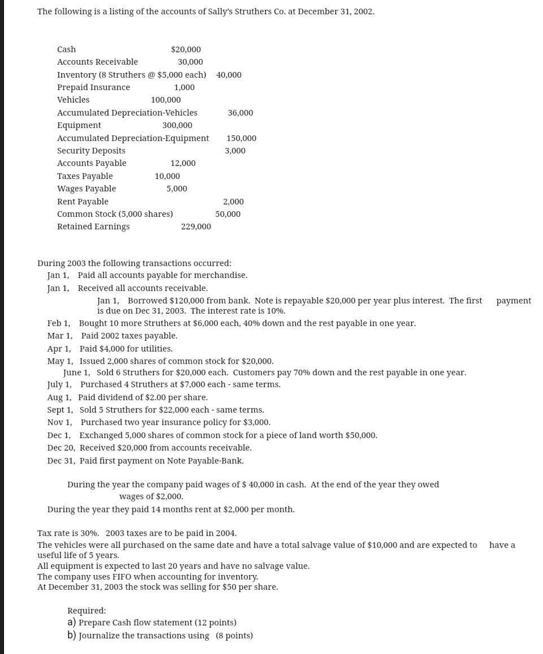

The following is a listing of the accounts of Sally's Struthers Co. at December 31, 2002. Cash $20,000 30,000 Accounts Receivable Inventory (8 Struthers

The following is a listing of the accounts of Sally's Struthers Co. at December 31, 2002. Cash $20,000 30,000 Accounts Receivable Inventory (8 Struthers @ $5,000 each) 40,000 1,000 Prepaid Insurance Vehicles 100,000 Accumulated Depreciation-Vehicles Equipment 300,000 Accumulated Depreciation-Equipment Security Deposits Accounts Payable Taxes Payable Wages Payable Rent Payable 12,000 10,000 5,000 Common Stock (5,000 shares) Retained Earnings 229,000 36,000 150,000 3,000 2,000 50,000 During 2003 the following transactions occurred: Jan 1, Paid all accounts payable for merchandise. Jan 1. Received all accounts receivable. Jan 1, Borrowed $120,000 from bank. Note is repayable $20,000 per year plus interest. The first is due on Dec 31, 2003. The interest rate is 10%. Feb 1. Mar 1. Apr 1, May 1, Issued 2,000 shares of common stock for $20,000. June 1, Sold 6 Struthers for $20,000 each. Customers pay 70% down and the rest payable in one year. July 1, Purchased 4 Struthers at $7.000 each-same terms. Bought 10 more Struthers at $6,000 each, 40% down and the rest payable in one year. Paid 2002 taxes payable. Paid $4,000 for utilities. Aug 1, Paid dividend of $2.00 per share. Sept 1. Sold 5 Struthers for $22,000 each-same terms. Nov 1, Purchased two year insurance policy for $3,000. Dec 1, Exchanged 5,000 shares of common stock for a piece of land worth $50,000. Dec 20, Received $20,000 from accounts receivable. Dec 31, Paid first payment on Note Payable-Bank. During the year the company paid wages of $ 40,000 in cash. At the end of the year they owed wages of $2,000. During the year they paid 14 months rent at $2,000 per month. Tax rate is 30%. 2003 taxes are to be paid in 2004. The vehicles were all purchased on the same date and have a total salvage value of $10,000 and are expected to useful life of 5 years. All equipment is expected to last 20 years and have no salvage value. The company uses FIFO when accounting for inventory. At December 31, 2003 the stock was selling for $50 per share. Required: a) Prepare Cash flow statement (12 points) b) Journalize the transactions using (8 points) payment have a

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started