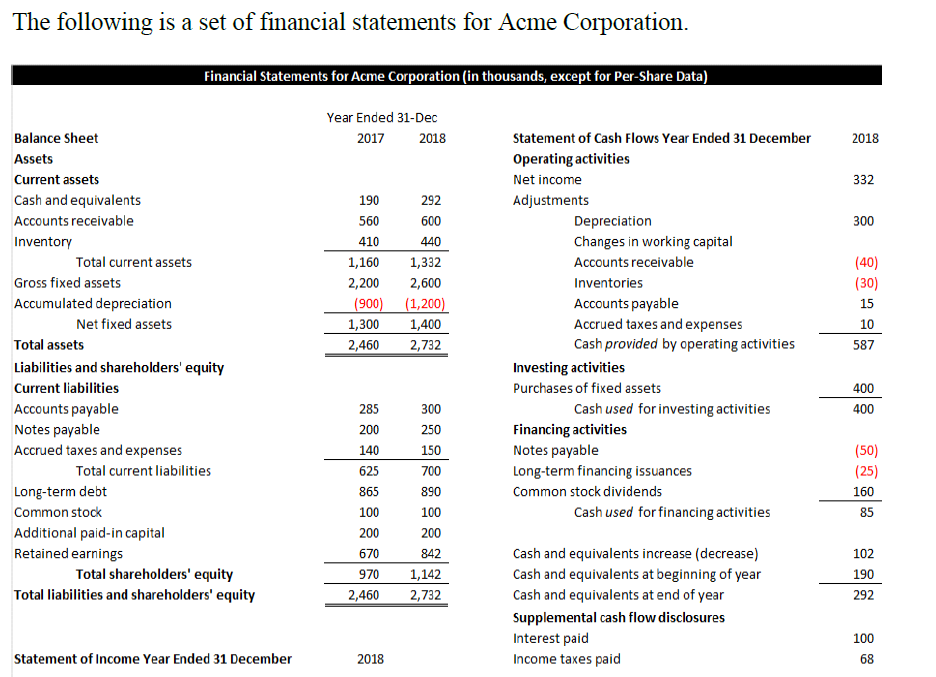

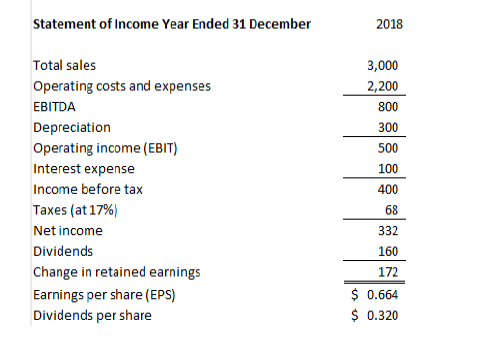

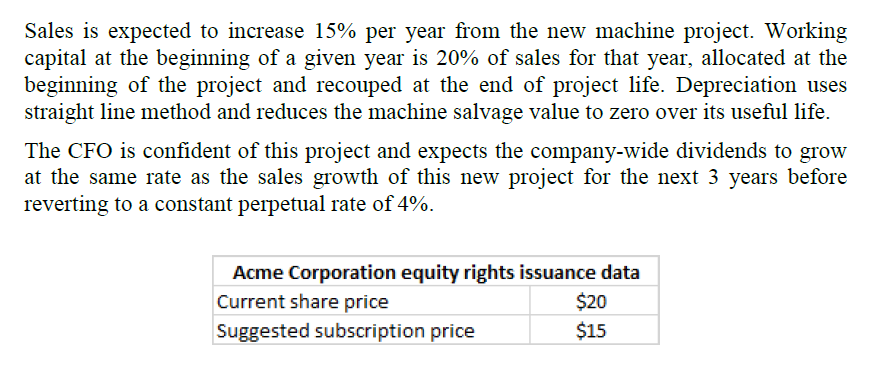

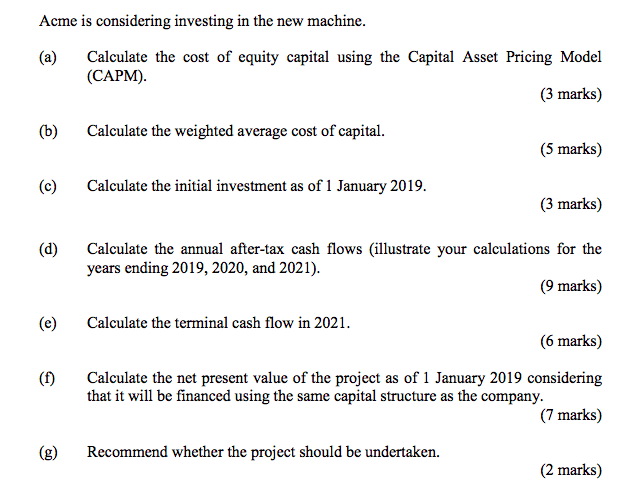

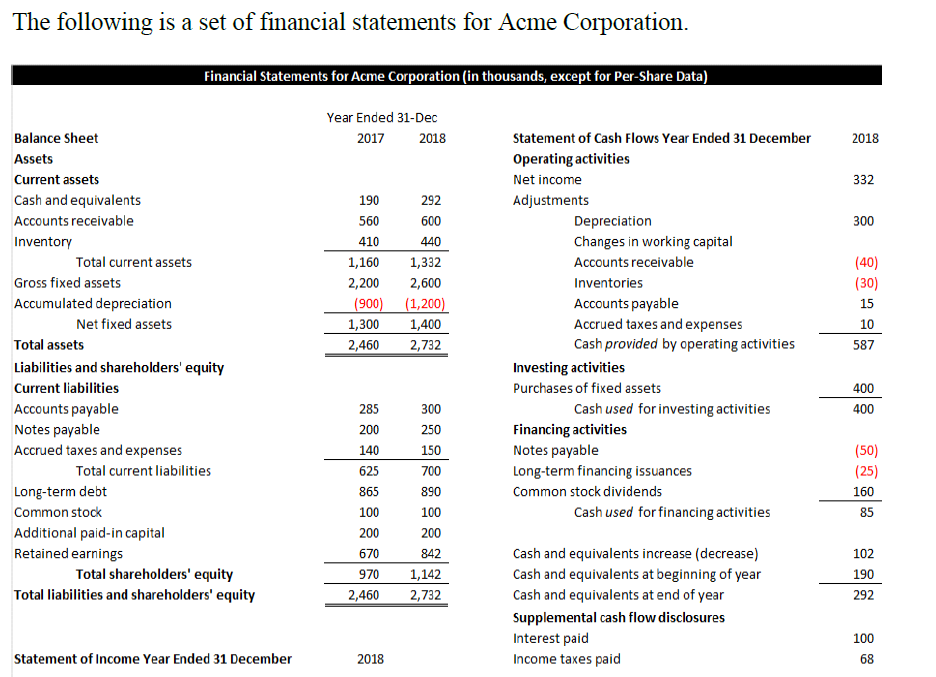

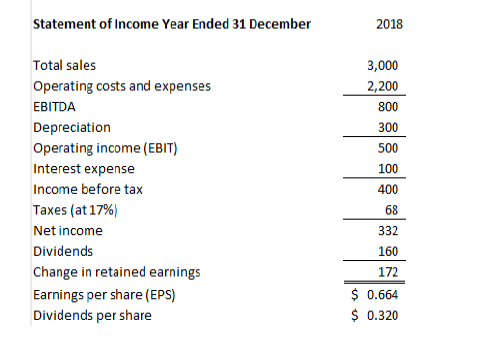

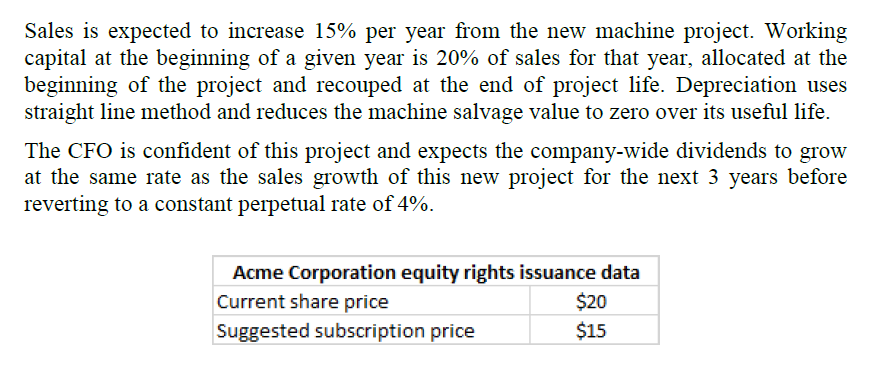

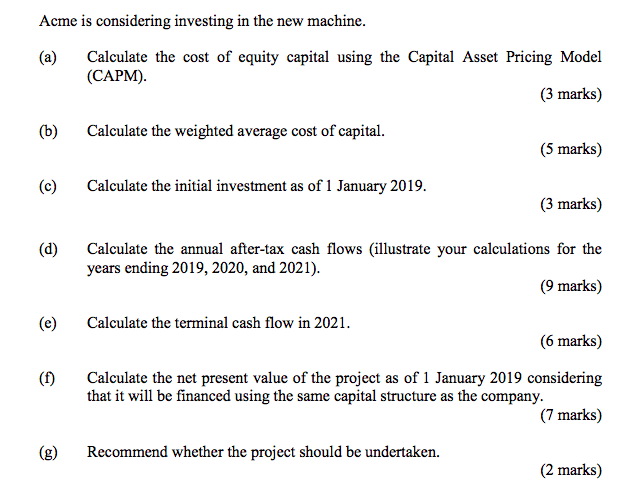

The following is a set of financial statements for Acme Corporation. Financial Statements for Acme Corporation in thousands, except for Per-Share Data) Year Ended 31-Dec 2017 2018 2018 332 300 (40) 190 560 410 1,160 2,200 (900) 1,300 2,460 292 600 440 1,332 2,600 (1,200) 1,400 2,732 (30) Balance Sheet Assets Current assets Cash and equivalents Accounts receivable Inventory Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities and shareholders' equity Current liabilities Accounts payable Notes payable Accrued taxes and expenses Total current liabilities Long-term debt Common stock Additional paid-in capital Retained earnings Total shareholders' equity Total liabilities and shareholders' equity Statement of Cash Flows Year Ended 31 December Operating activities Net income Adjustments Depreciation Changes in working capital Accounts receivable Inventories Accounts payable Accrued taxes and expenses Cash provided by operating activities Investing activities Purchases of fixed assets Cash used for investing activities Financing activities Notes payable Long-term financing issuances Common stock dividends Cash used for financing activities 300 250 285 200 140 625 150 (50) (25) 700 865 160 100 200 670 970 2,460 890 100 200 842 1,142 2,732 102 190 292 Cash and equivalents increase (decrease) Cash and equivalents at beginning of year Cash and equivalents at end of year Supplemental cash flow disclosures Interest paid Income taxes paid Statement of Income Year Ended 31 December 2018 Statement of Income Year Ended 31 December 2018 3,000 2,200 800 300 500 Total sales Operating costs and expenses EBITDA Depreciation Operating income (EBIT) Interest expense Income before tax Taxes (at 17%) Net income Dividends Change in retained earnings Earnings per share (EPS) Dividends per share 332 160 172 $ 0.664 $ 0.320 Sales is expected to increase 15% per year from the new machine project. Working capital at the beginning of a given year is 20% of sales for that year, allocated at the beginning of the project and recouped at the end of project life. Depreciation uses straight line method and reduces the machine salvage value to zero over its useful life. The CFO is confident of this project and expects the company-wide dividends to grow at the same rate as the sales growth of this new project for the next 3 years before reverting to a constant perpetual rate of 4%. Acme Corporation equity rights issuance data Current share price $20 Suggested subscription price $15 Acme is considering investing in the new machine. (a) Calculate the cost of equity capital using the Capital Asset Pricing Model (CAPM). (3 marks) (b) Calculate the weighted average cost of capital. (5 marks) Calculate the initial investment as of 1 January 2019. (3 marks) (d) Calculate the annual after-tax cash flows (illustrate your calculations for the years ending 2019, 2020, and 2021). (9 marks) (e) Calculate the terminal cash flow in 2021. (6 marks) (f) Calculate the net present value of the project as of 1 January 2019 considering that it will be financed using the same capital structure as the company. (7 marks) (g) Recommend whether the project should be undertaken. (2 marks) The following is a set of financial statements for Acme Corporation. Financial Statements for Acme Corporation in thousands, except for Per-Share Data) Year Ended 31-Dec 2017 2018 2018 332 300 (40) 190 560 410 1,160 2,200 (900) 1,300 2,460 292 600 440 1,332 2,600 (1,200) 1,400 2,732 (30) Balance Sheet Assets Current assets Cash and equivalents Accounts receivable Inventory Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities and shareholders' equity Current liabilities Accounts payable Notes payable Accrued taxes and expenses Total current liabilities Long-term debt Common stock Additional paid-in capital Retained earnings Total shareholders' equity Total liabilities and shareholders' equity Statement of Cash Flows Year Ended 31 December Operating activities Net income Adjustments Depreciation Changes in working capital Accounts receivable Inventories Accounts payable Accrued taxes and expenses Cash provided by operating activities Investing activities Purchases of fixed assets Cash used for investing activities Financing activities Notes payable Long-term financing issuances Common stock dividends Cash used for financing activities 300 250 285 200 140 625 150 (50) (25) 700 865 160 100 200 670 970 2,460 890 100 200 842 1,142 2,732 102 190 292 Cash and equivalents increase (decrease) Cash and equivalents at beginning of year Cash and equivalents at end of year Supplemental cash flow disclosures Interest paid Income taxes paid Statement of Income Year Ended 31 December 2018 Statement of Income Year Ended 31 December 2018 3,000 2,200 800 300 500 Total sales Operating costs and expenses EBITDA Depreciation Operating income (EBIT) Interest expense Income before tax Taxes (at 17%) Net income Dividends Change in retained earnings Earnings per share (EPS) Dividends per share 332 160 172 $ 0.664 $ 0.320 Sales is expected to increase 15% per year from the new machine project. Working capital at the beginning of a given year is 20% of sales for that year, allocated at the beginning of the project and recouped at the end of project life. Depreciation uses straight line method and reduces the machine salvage value to zero over its useful life. The CFO is confident of this project and expects the company-wide dividends to grow at the same rate as the sales growth of this new project for the next 3 years before reverting to a constant perpetual rate of 4%. Acme Corporation equity rights issuance data Current share price $20 Suggested subscription price $15 Acme is considering investing in the new machine. (a) Calculate the cost of equity capital using the Capital Asset Pricing Model (CAPM). (3 marks) (b) Calculate the weighted average cost of capital. (5 marks) Calculate the initial investment as of 1 January 2019. (3 marks) (d) Calculate the annual after-tax cash flows (illustrate your calculations for the years ending 2019, 2020, and 2021). (9 marks) (e) Calculate the terminal cash flow in 2021. (6 marks) (f) Calculate the net present value of the project as of 1 January 2019 considering that it will be financed using the same capital structure as the company. (7 marks) (g) Recommend whether the project should be undertaken. (2 marks)