Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following is a summary of share-based compensation data of PepsiCo (from 2019 annual report): Stock Options 2019 2018 2017 Total number of options

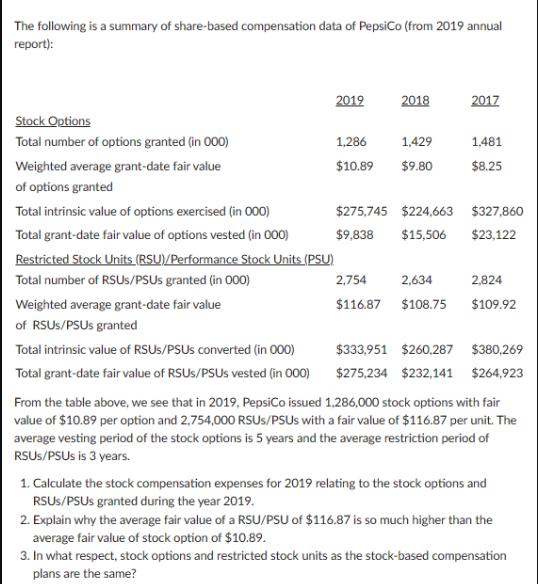

The following is a summary of share-based compensation data of PepsiCo (from 2019 annual report): Stock Options 2019 2018 2017 Total number of options granted (in 000) 1,286 1,429 1,481 Weighted average grant-date fair value $10.89 $9.80 $8.25 of options granted Total intrinsic value of options exercised (in 000) Total grant-date fair value of options vested (in 000) Restricted Stock Units (RSU)/Performance Stock Units (PSU) Total number of RSUS/PSUs granted (in 000) Weighted average grant-date fair value of RSUS/PSUs granted Total intrinsic value of RSUS/PSUS converted (in 000) Total grant-date fair value of RSUS/PSUs vested (in 000) $275,745 $224,663 $327,860 $9,838 $15,506 $23,122 2,754 $116.87 2,634 $108.75 $109.92 2,824 $333,951 $260,287 $380,269 $275,234 $232,141 $264,923 From the table above, we see that in 2019, PepsiCo issued 1,286,000 stock options with fair value of $10.89 per option and 2,754,000 RSUS/PSUS with a fair value of $116.87 per unit. The average vesting period of the stock options is 5 years and the average restriction period of RSUS/PSUs is 3 years. 1. Calculate the stock compensation expenses for 2019 relating to the stock options and RSUS/PSUs granted during the year 2019. 2. Explain why the average fair value of a RSU/PSU of $116.87 is so much higher than the average fair value of stock option of $10.89. 3. In what respect, stock options and restricted stock units as the stock-based compensation plans are the same?

Step by Step Solution

★★★★★

3.49 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the stock compensation expenses for 2019 relating to the stock options and RSUsPSUs granted during the year we need to consider th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started