Question

The following is a summary of the Companys significant accounting policies: The consolidated financial statements include the accounts of Perry Ellis International, Inc. and its

The following is a summary of the Company’s significant accounting policies:

The consolidated financial statements include the accounts of Perry Ellis International, Inc. and its wholly-owned and controlled subsidiaries. All intercompany transactions and balances have been eliminated in consolidation. The ownership interest in consolidated subsidiaries of non-controlling shareholders is reflected as noncontrolling interest. The Company’s consolidation principles would also consolidate any entity in which the Company would be deemed a primary beneficiary.

USE OF ESTIMATES — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts in the consolidated financial statements and the accompanying footnotes. Actual results could differ from those estimates.

Required

a. 1. Comment on the principles of consolidation.

2. Does it appear that there is a 100% ownership in all consolidated subsidiaries?

b. Comment on the use of estimates.

c. Would you expect an impairment in marketable securities?

d. What type of “special item” would be “costs on early extinguishment debt”?

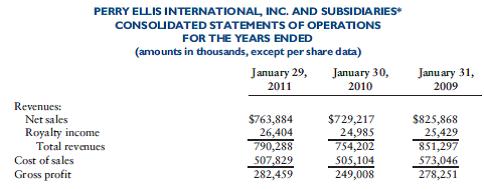

PERRY ELLIS INTERNATIONAL, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE YEARS ENDED (amounts in thousands, except per share data) Janu ary 31, January 29, 2011 January 30, 2010 2009 Revenues: Net sales Royalty income Total revenues Cost of sales $763,884 26,404 790,288 507,829 282,459 $729,217 24,985 754,202 505,104 249,008 $825,868 25,429 851,297 573,046 278,251 Gross profit

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution a 1 The principle of consolidation represents the control of parent company o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started