Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following is additional information regarding Mr. Yours: a) He had the following receipts during 2020: a. A lump-sum payment of $20,000 out of

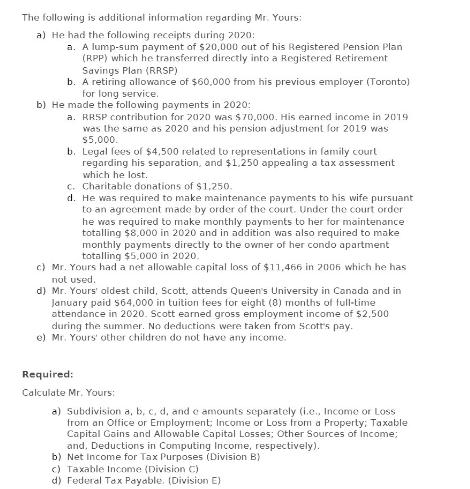

The following is additional information regarding Mr. Yours: a) He had the following receipts during 2020: a. A lump-sum payment of $20,000 out of his Registered Pension Plan (RPP) which he transferred directly into a Registered Retirement Savings Plan (RRSP) b. A retiring allowance of $60,000 from his previous employer (Toronto) for long service. b) He made the following payments in 2020: a. RRSP contribution for 2020 was $70,000. His earned income in 2019 was the same as 2020 and his pension adjustment for 2019 was $5,000. b. Legal fees of $4.500 related to representations in family court regarding his separation, and $1,250 appealing a tax assessment which he lost. c. Charitable donations of $1,250. d. He was required to make maintenance payments to his wife pursuant to an agreement made by order of the court. Under the court order he was required to make monthly payments to her for maintenance totalling $8,000 in 2020 and in addition was also required to make monthly payments directly to the owner of her condo apartment totalling $5,000 in 2020. c) Mr. Yours had a net allowable capital loss of $11,466 in 2006 which he has not used. d) Mr. Yours' oldest child, Scott, attends Queen's University in Canada and in January paid $64,000 in tuition fees for eight (8) months of full-time attendance in 2020. Scott earned gross employment income of $2,500 during the summer. No deductions were taken from Scott's pay. e) Mr. Yours' other children do not have any income. Required: Calculate Mr. Yours: a) Subdivision a, b, c, d, and c amounts separately (i.c., Income or Loss from an Office or Employment; Income or Loss from a Property; Taxable Capital Gains and Allowable Capital Losses: Other Sources of Income; and, Deductions in Computing Income, respectively). b) Net Income for Tax Purposes (Division B) c) Taxable Income (Division C) d) Federal Tax Payable. (Division E)

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Mr Yours income and taxes we need to consider the information provided Here are the calculations for each subdivision a Income or Loss fr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started