Answered step by step

Verified Expert Solution

Question

1 Approved Answer

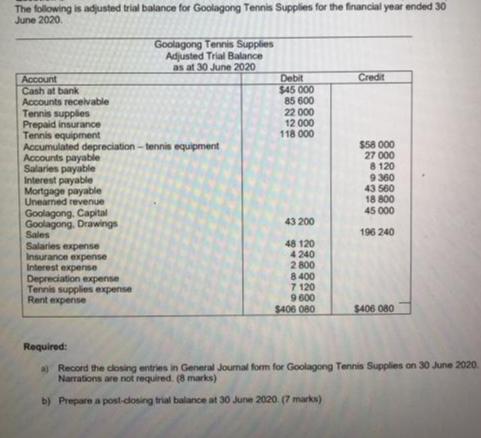

The following is adjusted trial balance for Goolagong Tennis Supplies for the financial year ended 30 June 2020. Goolagong Tennis Supplies Adjusted Trial Balance

The following is adjusted trial balance for Goolagong Tennis Supplies for the financial year ended 30 June 2020. Goolagong Tennis Supplies Adjusted Trial Balance as at 30 June 2020 Credit Account Cash at bank Accounts recelvable Tennis supplies Prepaid insurance Tennis equipment Accumulated depreciation tennis equipment Accounts payable Salaries payable Interest payable Mortgage payable Uneamed revenue Goolagong, Capital Goolagong, Drawings Sales Salaries expense Insurance expense Interest expernse Depreciation expense Tennis supplies expense Rent expense Debit $45 000 85 600 22 000 12 000 118 000 $58 000 27 000 8 120 9360 43 560 18 800 45 000 43 200 196 240 48 120 4 240 2 800 8 400 7 120 9 600 $406 080 $406 080 Required: Record the closing entries in General Journal form for Goolagong Tennis Supplies on 30 June 2020. Narrations are not required. (8 marks) b) Prepare a post-dosing trial balance at 30 June 2020. (7 marks)

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Parta Clsoing Entries Account 30 June 20Sales Date Debit Credit 196240 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started