Question

The following is an incomplete balance sheet for the manufacturing company Roaring King A / S as of 31 December 2020. The accounts are listed

The following is an incomplete balance sheet for the manufacturing company Roaring King A / S as of 31 December 2020. The accounts are listed in random order. All postings and postings have been completed; the only exception is “Transferred Profit” (see “Additional Information” below). All accounts have positive / normal balances. Ie. assets have a debit balance, etc.

further info:

- Bank debt: one third of the amount is due on 1 March 2021, the rest is due on 22 December 2022.

- Transferred profit: The opening balance on 1 January 2020 was 500,000. The ultimo balance sheet on “Transferred profit” is missing, which is why you are asked to calculate it (ie you are asked to calculate the correct balance at the end of the balance sheet).

Note:

• You can use accounts in addition to those that already exist.

• Do not aggregate too much.

• Include an appropriate heading for each item in the accounts.

• Comparative figures from previous years do not exist, as can be seen

Question 1.1

Prepare the balance sheet for Roaring King A / S as of 31 December 2020. The financial year ended 31 December 2020.

Question 1.2

Prepare the income statement for Roaring King A / S regarding the financial year 2020.

Question 1.3

Show how you found the final balance for "Transferred Profit".

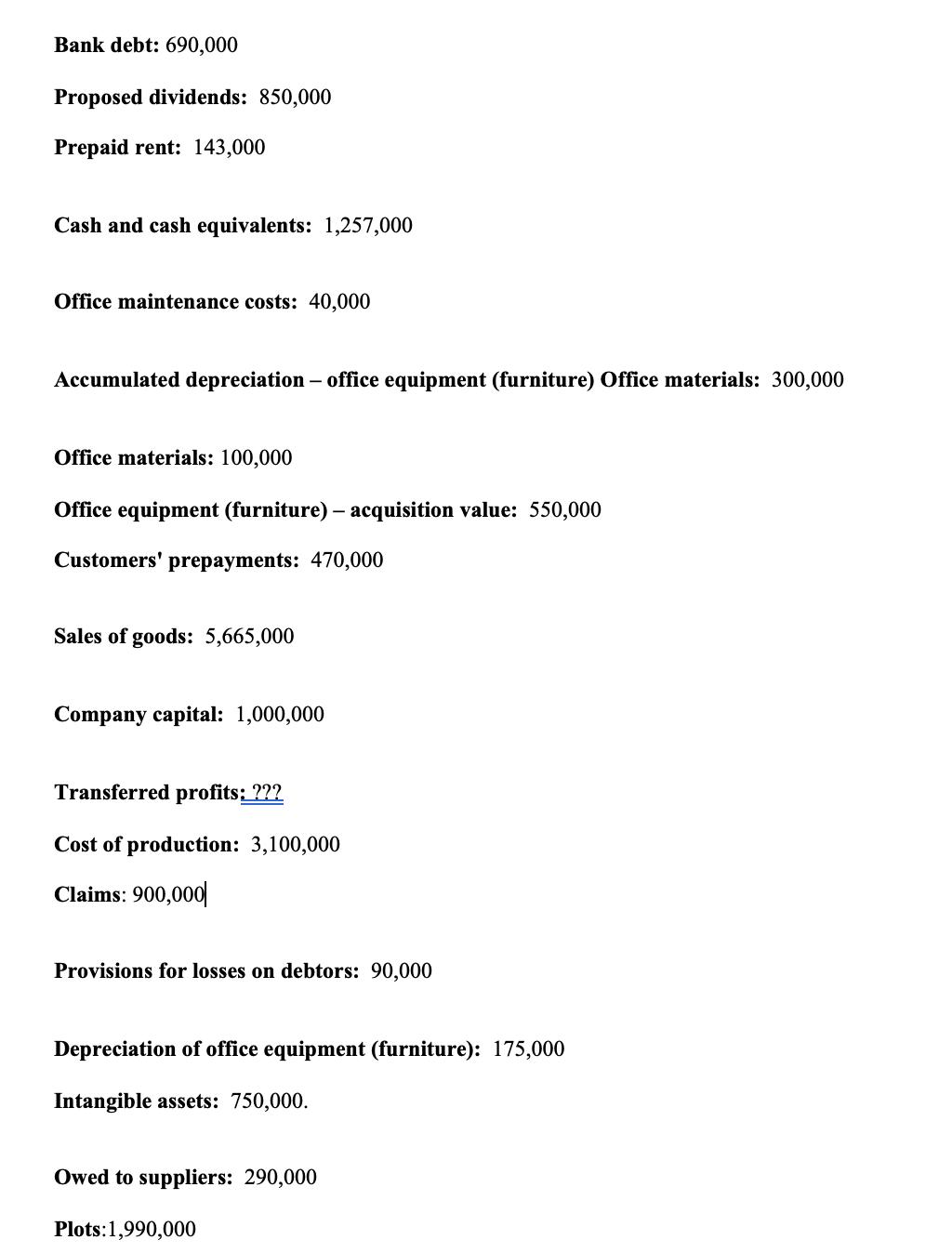

Bank debt: 690,000 Proposed dividends: 850,000 Prepaid rent: 143,000 Cash and cash equivalents: 1,257,000 Office maintenance costs: 40,000 Accumulated depreciation office equipment (furniture) Office materials: 300,000 Office materials: 100,000 Office equipment (furniture) acquisition value: 550,000 Customers' prepayments: 470,000 Sales of goods: 5,665,000 Company capital: 1,000,000 Transferred profits: ??? Cost of production: 3,100,000 Claims: 900,000 Provisions for losses on debtors: 90,000 Depreciation of office equipment (furniture): 175,000 Intangible assets: 750,000. Owed to suppliers: 290,000 Plots:1,990,000

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6363a1ed3ad74_238429.pdf

180 KBs PDF File

6363a1ed3ad74_238429.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started