Question

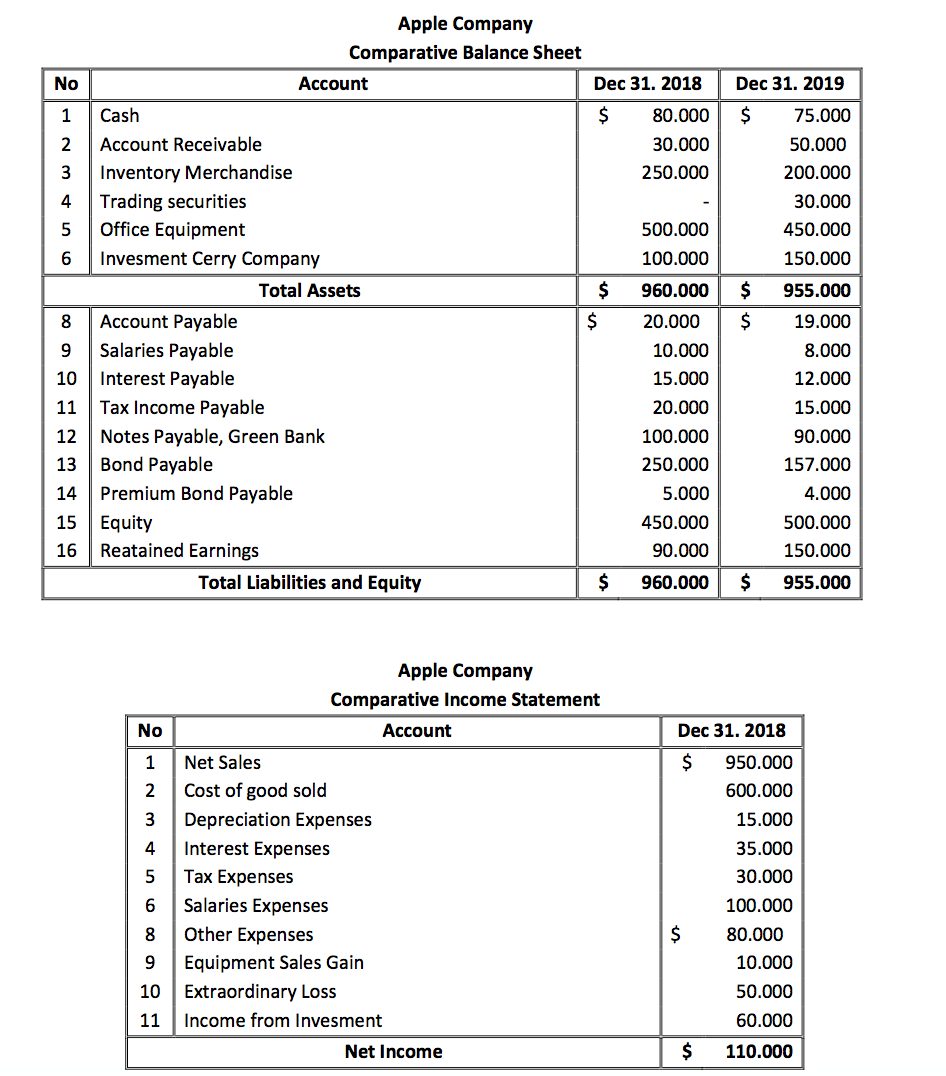

The following is apple company financial information: Other information is as follows: A. Trading securities purchased in 2019 at a cost of $30,000 B. Equipment

The following is apple company financial information:

Other information is as follows:

A. Trading securities purchased in 2019 at a cost of $30,000

B. Equipment with a book value of 50,000 sold during 2019 for 55,000

C. Equipment with a book value of 45,000 was damaged by natural disasters in 2019. The equipment has no insurance.

D. Amortized bond premium of 15,000 for 2019

e. Apple Company has 30% investment in Cherry Company and is recorded using equity equity method

F. Apple company receives 20,000 dividends from Cherry Company in 2019

G. Apple companies apply a 30% tax rate

H. Note Payable pay to Green Bank, interest rate 15%. Interest payment due on the first day of each month

I. The interest rate on bond debt is 12%. Interest is paid every July 1 and January 1 (other information for direct methods)

A. The Company sold shares during 2019 for 70,000 cash (other information for direct methods)

What it takes:

1. Present the cash flow report using the direct method, the indirect method, and explain the differences between the two methods!

2. Explain the constraints that occur in the input of cash flow statements (minimum 3)!

Apple Company Comparative Balance Sheet Account No Dec 31. 2019 $ Dec 31. 2018 $ 80.000 30.000 250.000 75.000 50.000 200.000 30.000 450.000 150.000 500.000 100.000 960.000 $ $ $ $ 1 Cash 2 Account Receivable 3 Inventory Merchandise 4 Trading securities 5 Office Equipment 6 Invesment Cerry Company Total Assets 8 Account Payable 9 Salaries Payable 10 Interest Payable 11 Tax Income Payable 12 Notes Payable, Green Bank 13 Bond Payable 14 Premium Bond Payable 15 Equity 16 Reatained Earnings Total Liabilities and Equity 20.000 10.000 15.000 20.000 100.000 250.000 5.000 450.000 90.000 955.000 19.000 8.000 12.000 15.000 90.000 157.000 4.000 500.000 150.000 $ 960.000 $ 955.000 Apple Company Comparative Income Statement Account No Dec 31. 2018 1 $ 950.000 600.000 2 3 15.000 4 5 6 Net Sales Cost of good sold Depreciation Expenses Interest Expenses Tax Expenses Salaries Expenses Other Expenses Equipment Sales Gain Extraordinary Loss Income from Invesment Net Income 35.000 30.000 100.000 80.000 10.000 50.000 $ 8 9 10 11 60.000 $ 110.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started