Answered step by step

Verified Expert Solution

Question

1 Approved Answer

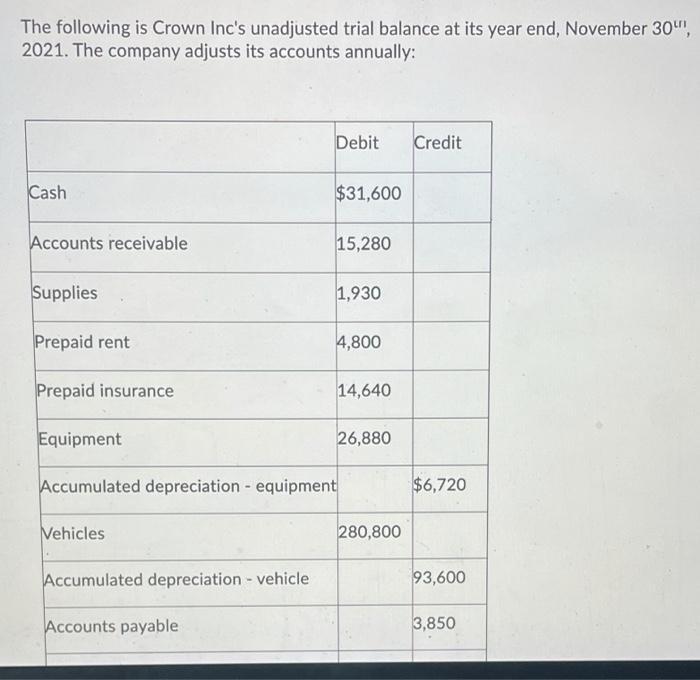

The following is Crown Inc's unadjusted trial balance at its year end, November 30, 2021. The company adjusts its accounts annually: Cash Accounts receivable

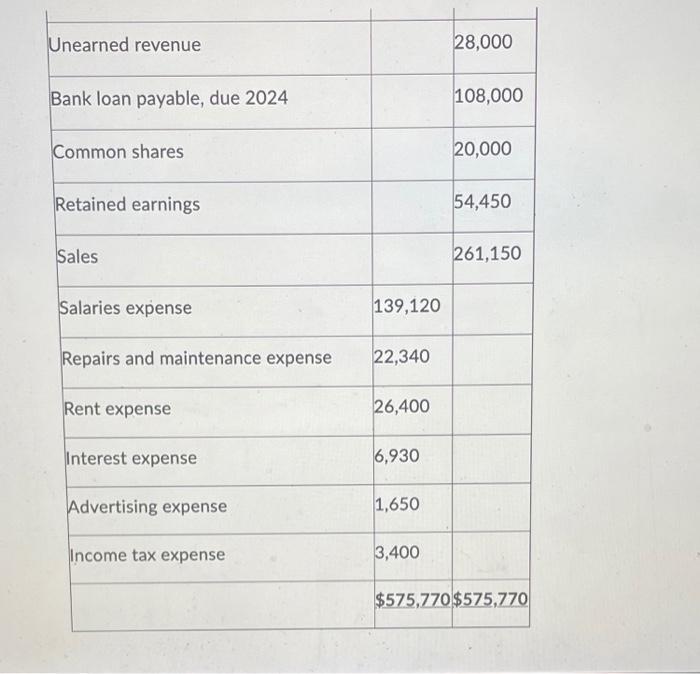

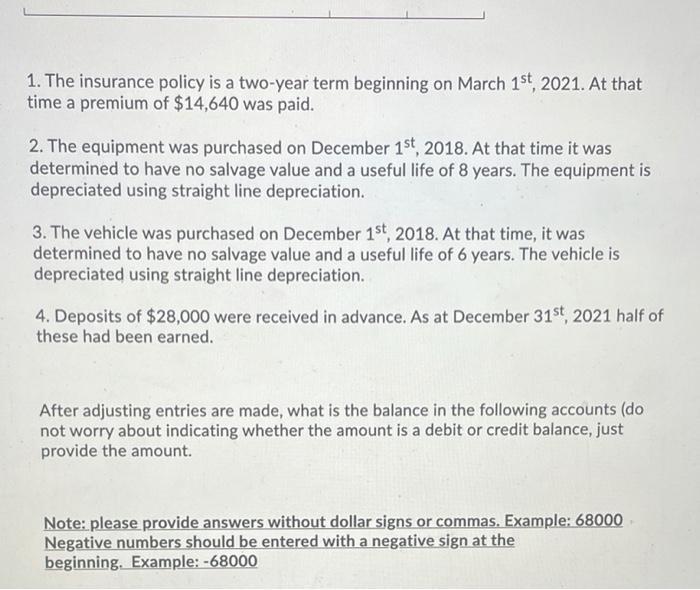

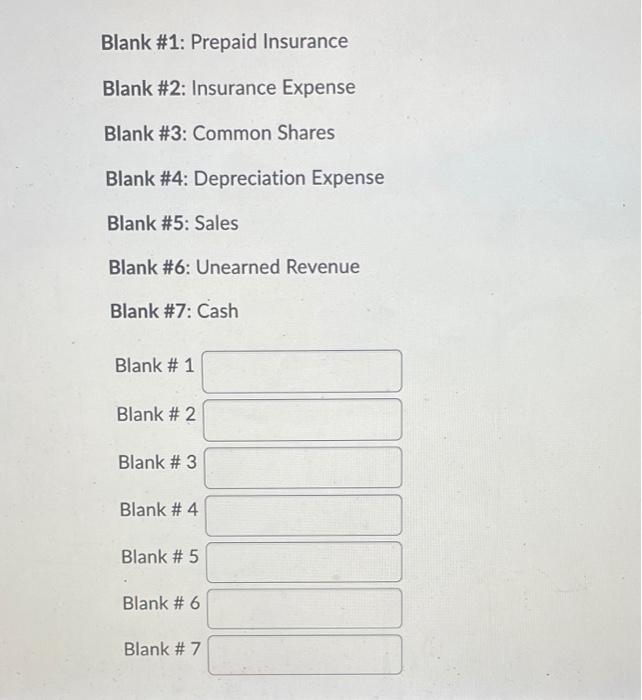

The following is Crown Inc's unadjusted trial balance at its year end, November 30, 2021. The company adjusts its accounts annually: Cash Accounts receivable Supplies Prepaid rent Prepaid insurance Equipment Vehicles Accumulated depreciation - vehicle Debit Credit Accounts payable $31,600 15,280 1,930 4,800 Accumulated depreciation equipment 14,640 26,880 280,800 $6,720 93,600 3,850 Unearned revenue Bank loan payable, due 2024 Common shares Retained earnings Sales Salaries expense Repairs and maintenance expense Rent expense Interest expense Advertising expense Income tax expense 139,120 22,340 26,400 6,930 1,650 3,400 28,000 108,000 20,000 54,450 261,150 $575,770 $575,770 1. The insurance policy is a two-year term beginning on March 1st, 2021. At that time a premium of $14,640 was paid. 2. The equipment was purchased on December 1st, 2018. At that time it was determined to have no salvage value and a useful life of 8 years. The equipment is depreciated using straight line depreciation. 3. The vehicle was purchased on December 1st, 2018. At that time, it was determined to have no salvage value and a useful life of 6 years. The vehicle is depreciated using straight line depreciation. 4. Deposits of $28,000 were received in advance. As at December 31st, 2021 half of these had been earned. After adjusting entries are made, what is the balance in the following accounts (do not worry about indicating whether the amount is a debit or credit balance, just provide the amount. Note: please provide answers without dollar signs or commas. Example: 68000 Negative numbers should be entered with a negative sign at the beginning. Example: -68000 Blank #1: Prepaid Insurance Blank #2: Insurance Expense Blank #3: Common Shares Blank #4: Depreciation Expense Blank #5: Sales Blank #6: Unearned Revenue Blank #7: Cash Blank # 1 Blank # 2 Blank # 3 Blank # 4 Blank # 5 Blank # 6 Blank # 7

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 2 3 4 Blank 1 Blank 2 Blank 3 Blank 4 Blank 5 Blank 6 Blan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started