Answered step by step

Verified Expert Solution

Question

1 Approved Answer

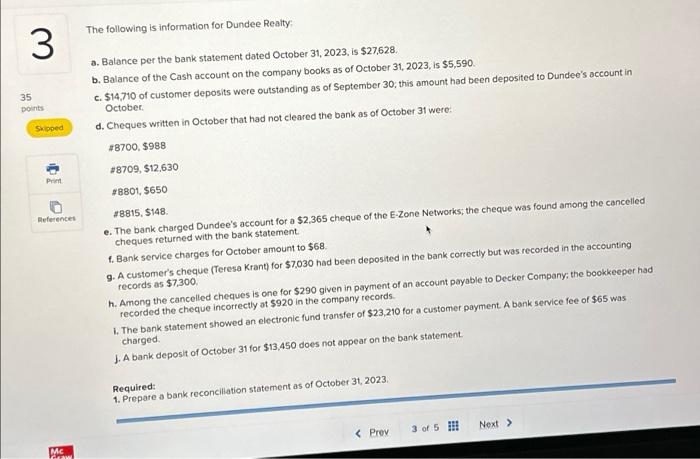

The following is information for Dundee Realty: a. Balance per the bank statement dated October 31, 2023, is $27,628. b. Balance of the Cash account

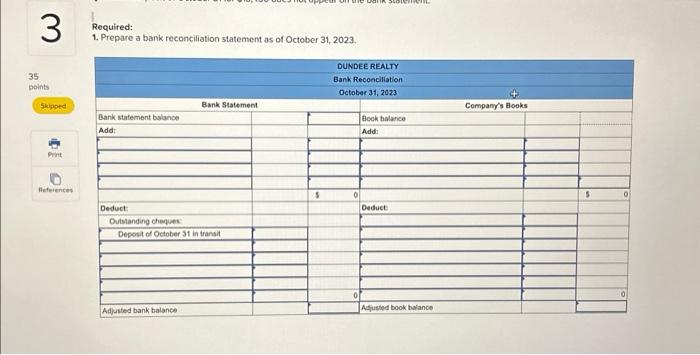

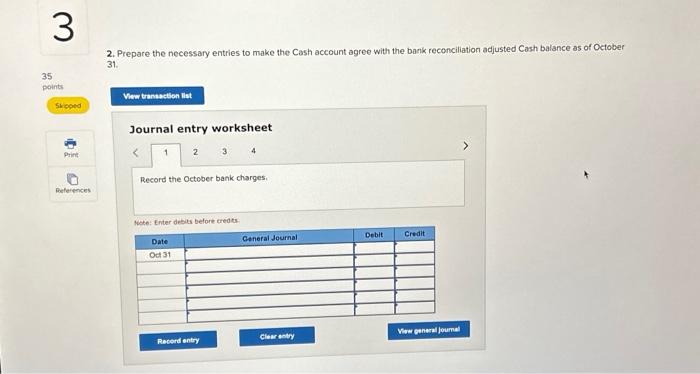

The following is information for Dundee Realty: a. Balance per the bank statement dated October 31, 2023, is $27,628. b. Balance of the Cash account on the company books as of October 31, 2023, is $5,590. c. $14,710 of customer deposits were outstanding as of September 30; this amount had been deposited to Dundee's account in October. d. Cheques written in October that had not cleared the bank as of October 31 were: #8700, $988 # 8709, $12,630 # 8801, $650 #8815, $148. e. The bank charged Dundee's account for a $2,365 cheque of the E-Zone Networks; the cheque was found among the cancelled cheques returned with the bank statement. f. Bank service charges for October amount to $68. g. A customer's cheque (Teresa Krant) for $7,030 had been deposited in the bank correctly but was recorded in the accounting records as $7,300. h. Among the cancelled cheques is one for $290 given in payment of an account payable to Decker Company; the bookkeeper had recorded the cheque incorrectly at $920 in the company records. i. The bank statement showed an electronic fund transfer of $23,210 for a customer payment. A bank service fee of $65 was charged. j. A bank deposit of October 31 for $13,450 does not appear on the bank statement. Required: 1. Prepare a bank reconciliation statement as of October 31, 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started