Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following is information for XYZ, Inc. (same one we used in our review) Results from 2021 Sales Depreciation expense Amortization expense Interest Expense

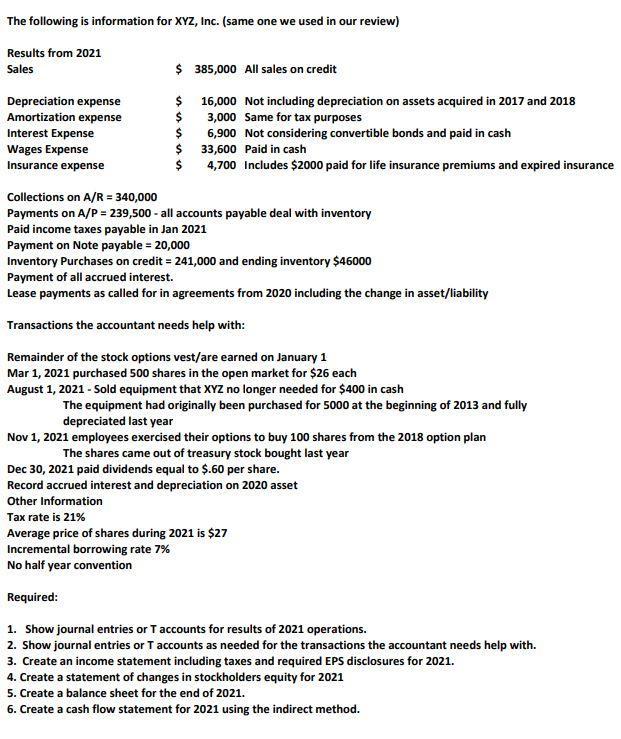

The following is information for XYZ, Inc. (same one we used in our review) Results from 2021 Sales Depreciation expense Amortization expense Interest Expense Wages Expense Insurance expense $385,000 All sales on credit $ 16,000 Not including depreciation on assets acquired in 2017 and 2018 3,000 Same for tax purposes $ 6,900 Not considering convertible bonds and paid in cash 33,600 Paid in cash 4,700 Includes $2000 paid for life insurance premiums and expired insurance $ $ $ Collections on A/R = 340,000 Payments on A/P = 239,500 - all accounts payable deal with inventory Paid income taxes payable in Jan 2021 Payment on Note payable = 20,000 Inventory Purchases on credit = 241,000 and ending inventory $46000 Payment of all accrued interest. Lease payments as called for in agreements from 2020 including the change in asset/liability Transactions the accountant needs help with: Remainder of the stock options vest/are earned on January 1 Mar 1, 2021 purchased 500 shares in the open market for $26 each August 1, 2021 - Sold equipment that XYZ no longer needed for $400 in cash The equipment had originally been purchased for 5000 at the beginning of 2013 and fully depreciated last year Nov 1, 2021 employees exercised their options to buy 100 shares from the 2018 option plan The shares came out of treasury stock bought last year Dec 30, 2021 paid dividends equal to $.60 per share. Record accrued interest and depreciation on 2020 asset Other Information Tax rate is 21% Average price of shares during 2021 is $27 Incremental borrowing rate 7% No half year convention Required: 1. Show journal entries or T accounts for results of 2021 operations. 2. Show journal entries or T accounts as needed for the transactions the accountant needs help with. 3. Create an income statement including taxes and required EPS disclosures for 2021. 4. Create a statement of changes in stockholders equity for 2021 5. Create a balance sheet for the end of 2021. 6. Create a cash flow statement for 2021 using the indirect method.

Step by Step Solution

★★★★★

3.62 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal Entries or T Accounts for Results of 2021 Operations Sales 385000 Depreciation expense 16000 Amortization expense 3000 Interest Expense 6900 Wages Expense 33600 Insurance expense 4700 Collec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started