Question

The following is PT Mystic's comparative financial position statement for 2020 and 2019: The following is additional information obtained from transactions during 2020: 1. PT.

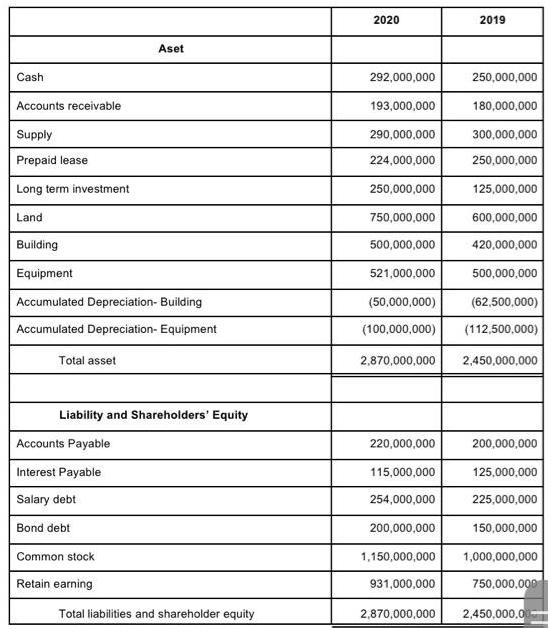

The following is PT Mystic's comparative financial position statement for 2020 and 2019:

The following is additional information obtained from transactions during 2020:

1. PT. Mystic declares and distributes cash dividends.

2. Buildings, equipment and land purchased in cash

3. A building with an acquisition cost of Rp100,000,000 and has been depreciated by Rp45,000,000 is sold for Rp60,000,000.

4. Equipment with an acquisition cost of Rp90,000,000, has a book value of Rp69,000,000 and a loss of Rp6,000,000.

5. PT. Mystic issues and sells bonds at a book value of Rp100,000,000.

6. Sales in 2020 amounted to Rp. 500,000,000 with cost of goods sold of 35% of sales. Operating expenses in the year amounted to Rp135,000,000 and interest expenses of Rp15,000,000. The total other loss from the gain/loss on the sale of assets is Rp1,000,000,000, resulting in a net profit before tax of Rp174,000,000. It is known that the current tax rate was 20%. ( information number 6 is Net Income, just Rp. 208.800.000,-)

7. Common stock is issued to buy long-term investment and the rest receive cash.

Requested:

- Prepare a cash flow statement using the indirect method for 2020.

- Calculate the ratios for the year below using the comparative financial position report data in question 3.

a. working capital

b. Current ratio

c. Quick ratio

d. Ratio of fixed assets to long-term liabilities

e. Ratio of liabilities to stockholders' equity

Cash Accounts receivable Supply Prepaid lease Long term investment Land Building Equipment Accumulated Depreciation- Building Accumulated Depreciation- Equipment Total asset Aset Liability and Shareholders' Equity Accounts Payable Interest Payable Salary debt Bond debt Common stock Retain earning Total liabilities and shareholder equity 2020 2019 250,000,000 180,000,000 300,000,000 250,000,000 125,000,000 600,000,000 420,000,000 292,000,000 193,000,000 290,000,000 224,000,000 250,000,000 750,000,000 500,000,000 521,000,000 500,000,000 (50,000,000) (62,500,000) (100,000,000) (112,500,000) 2,870,000,000 2,450,000,000 220,000,000 200,000,000 115,000,000 125,000,000 254,000,000 225,000,000 200,000,000 150,000,000 1,150,000,000 1,000,000,000 931,000,000 750,000,000 2,870,000,000 2,450,000,00

Step by Step Solution

3.46 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Data is Insufficient for solving cash flow statement Given that The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started