Question

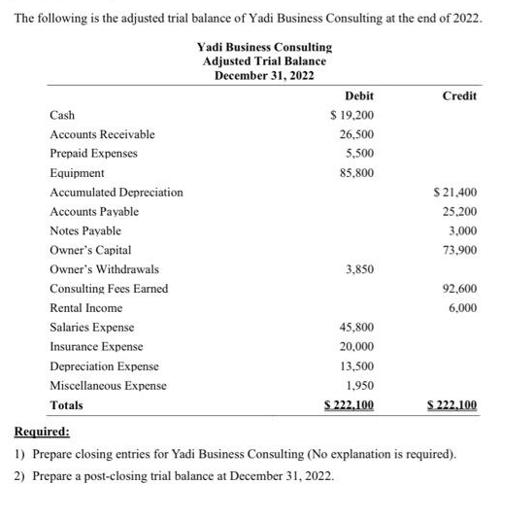

The following is the adjusted trial balance of Yadi Business Consulting at the end of 2022. Yadi Business Consulting Adjusted Trial Balance December 31,

The following is the adjusted trial balance of Yadi Business Consulting at the end of 2022. Yadi Business Consulting Adjusted Trial Balance December 31, 2022 Cash Accounts Receivable Prepaid Expenses Equipment Accumulated Depreciation Accounts Payable Notes Payable Owner's Capital Owner's Withdrawals Consulting Fees Earned Rental Income Salaries Expense Insurance Expense Depreciation Expense Miscellaneous Expense Totals Debit $ 19,200 26,500 5,500 85,800 3,850 45,800 20,000 13,500 1,950 $ 222.100 Credit $21,400 25.200 3,000 73,900 92,600 6,000 S222,100 Required: 1) Prepare closing entries for Yadi Business Consulting (No explanation is required). 2) Prepare a post-closing trial balance at December 31, 2022.

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Information For Decisions

Authors: John J. Wild

10th Edition

1260705587, 978-1260705584

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App