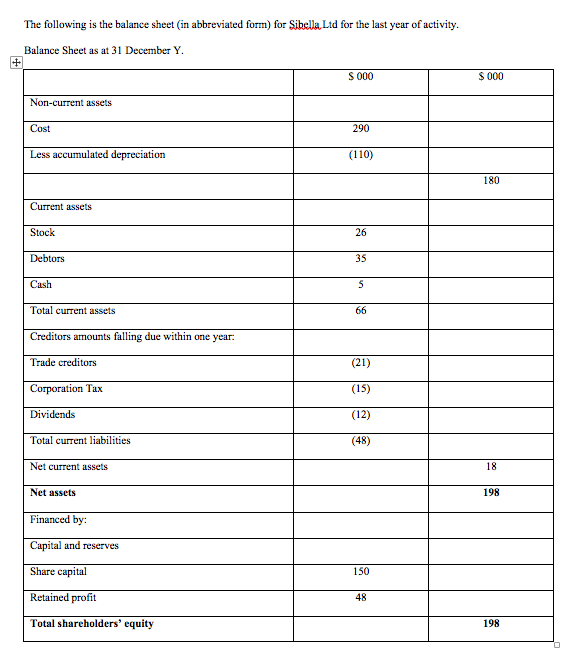

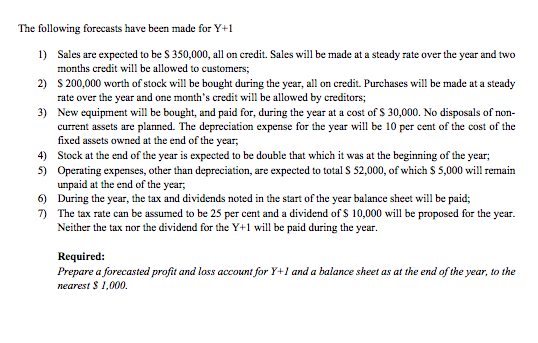

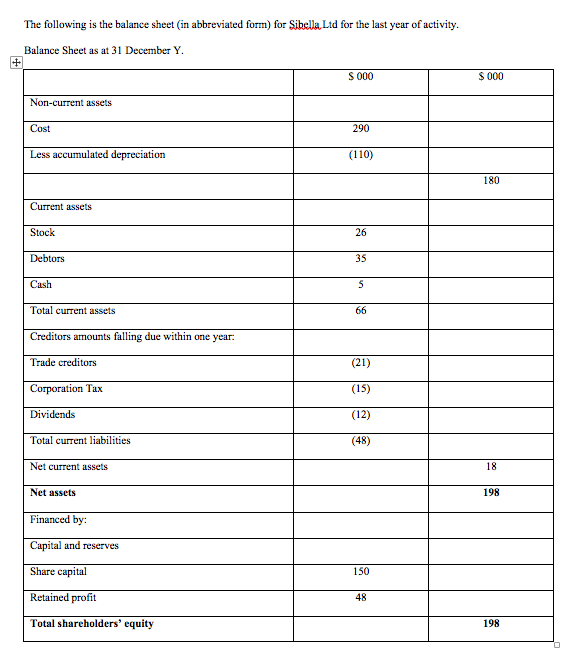

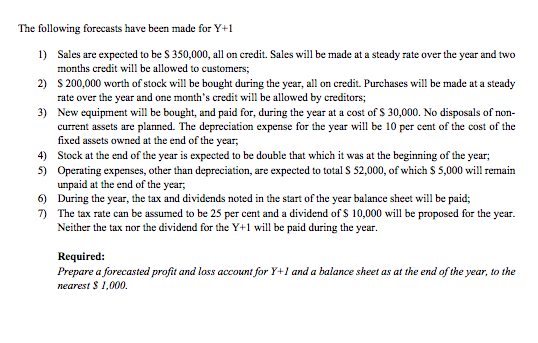

The following is the balance sheet (in abbreviated form) for Sibella Ltd for the last year of activity. Balance Sheet as at 31 December Y. + S 000 $ 000 Non-current assets Cost 290 Less accumulated depreciation (110) 180 Current assets Stock 26 Debtors 35 Cash 5 Total current assets 66 Creditors amounts falling due within one year: Trade creditors (21) Corporation Tax (15) Dividends (12) Total current liabilities (48) Net current assets 18 Net assets 198 Financed by: Capital and reserves Share capital 150 Retained profit 48 Total shareholders' equity 198 The following forecasts have been made for Y+1 1) Sales are expected to be S 350,000, all on credit. Sales will be made at a steady rate over the year and two months credit will be allowed to customers; 2) $200,000 worth of stock will be bought during the year, all on credit. Purchases will be made at a steady rate over the year and one month's credit will be allowed by creditors; 3) New equipment will be bought, and paid for, during the year at a cost of $ 30,000. No disposals of non- current assets are planned. The depreciation expense for the year will be 10 per cent of the cost of the fixed assets owned at the end of the year, 4) Stock at the end of the year is expected to be double that which it was at the beginning of the year; 5) Operating expenses, other than depreciation, are expected to total S 52,000, of which $5,000 will remain unpaid at the end of the year, 6) During the year, the tax and dividends noted in the start of the year balance sheet will be paid; 7) The tax rate can be assumed to be 25 per cent and a dividend of $ 10,000 will be proposed for the year. Neither the tax nor the dividend for the Y+1 will be paid during the year. Required: Prepare a forecasted profit and loss account for Y+1 and a balance sheet as at the end of the year, to the nearest $ 1,000. The following is the balance sheet (in abbreviated form) for Sibella Ltd for the last year of activity. Balance Sheet as at 31 December Y. + S 000 $ 000 Non-current assets Cost 290 Less accumulated depreciation (110) 180 Current assets Stock 26 Debtors 35 Cash 5 Total current assets 66 Creditors amounts falling due within one year: Trade creditors (21) Corporation Tax (15) Dividends (12) Total current liabilities (48) Net current assets 18 Net assets 198 Financed by: Capital and reserves Share capital 150 Retained profit 48 Total shareholders' equity 198 The following forecasts have been made for Y+1 1) Sales are expected to be S 350,000, all on credit. Sales will be made at a steady rate over the year and two months credit will be allowed to customers; 2) $200,000 worth of stock will be bought during the year, all on credit. Purchases will be made at a steady rate over the year and one month's credit will be allowed by creditors; 3) New equipment will be bought, and paid for, during the year at a cost of $ 30,000. No disposals of non- current assets are planned. The depreciation expense for the year will be 10 per cent of the cost of the fixed assets owned at the end of the year, 4) Stock at the end of the year is expected to be double that which it was at the beginning of the year; 5) Operating expenses, other than depreciation, are expected to total S 52,000, of which $5,000 will remain unpaid at the end of the year, 6) During the year, the tax and dividends noted in the start of the year balance sheet will be paid; 7) The tax rate can be assumed to be 25 per cent and a dividend of $ 10,000 will be proposed for the year. Neither the tax nor the dividend for the Y+1 will be paid during the year. Required: Prepare a forecasted profit and loss account for Y+1 and a balance sheet as at the end of the year, to the nearest $ 1,000