Question

The following is the closing trial balance of XYZ Services Limited as at 31.12.2020: Eur Eur Share capital --------------------------------------------------------------------------------------------1000 Bank account --------------------------- 1250 Office equipment

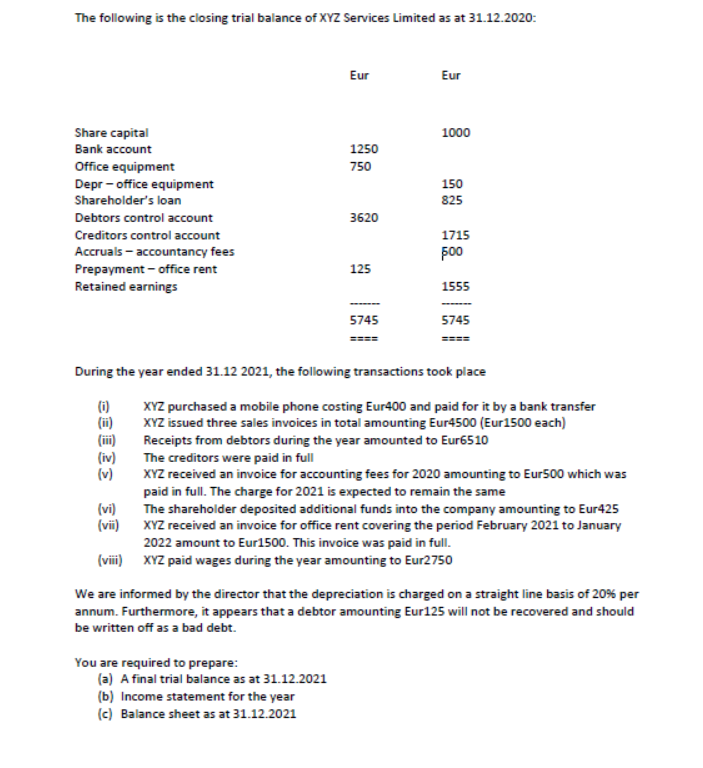

The following is the closing trial balance of XYZ Services Limited as at 31.12.2020:

Eur  Eur

Eur

Share capital --------------------------------------------------------------------------------------------1000 Bank account --------------------------- 1250 Office equipment ------------------------ 750 Depr office equipment ---------------------------------------------------------------------------------150 Shareholders loan ------------------------------------------------------------------------------------------825 Debtors control account--------------3620 Creditors control account------------------------------------------------------------------------------------1715 Accruals accountancy fees---------------------------------------------------------------------------------500 Prepayment office rent---------------125 Retained earnings-----------------------------------------------------------------------------------------------1555 ------- ------- ---------------------------------------------- 5745 -----------------------------------------------------------5745 ==== ==== During the year ended 31.12 2021, the following transactions took place (i) XYZ purchased a mobile phone costing Eur400 and paid for it by a bank transfer (ii) XYZ issued three sales invoices in total amounting Eur4500 (Eur1500 each) (iii) Receipts from debtors during the year amounted to Eur6510 (iv) The creditors were paid in full (v) XYZ received an invoice for accounting fees for 2020 amounting to Eur500 which was paid in full. The charge for 2021 is expected to remain the same (vi) The shareholder deposited additional funds into the company amounting to Eur425 (vii) XYZ received an invoice for office rent covering the period February 2021 to January 2022 amount to Eur1500. This invoice was paid in full. (viii) XYZ paid wages during the year amounting to Eur2750

We are informed by the director that the depreciation is charged on a straight line basis of 20% per annum. Furthermore, it appears that a debtor amounting Eur125 will not be recovered and should be written off as a bad debt. You are required to prepare:

Income statement for the year

The following is the closing trial balance of XYZ Services Limited as at 31.12.2020: Eur Eur 1000 Share capital Bank account 1250 Office equipment 750 150 Depr - office equipment Shareholder's loan 825 3620 1715 Debtors control account Creditors control account Accruals - accountancy fees Prepayment - office rent 500 125 Retained earnings 1555 5745 5745 During the year ended 31.12 2021, the following transactions took place (1) XYZ purchased a mobile phone costing Eur400 and paid for it by a bank transfer XYZ issued three sales invoices in total amounting Eur4500 (Eur1500 each) (ii) Receipts from debtors during the year amounted to Eur6510 (iv) The creditors were paid in full (v) XYZ received an invoice for accounting fees for 2020 amounting to Eur500 which was paid in full. The charge for 2021 is expected to remain the same (vi) (vii) The shareholder deposited additional funds into the company amounting to Eur425 XYZ received an invoice for office rent covering the period February 2021 to January 2022 amount to Eur1500. This invoice was paid in full. (viii) XYZ paid wages during the year amounting to Eur2750 We are informed by the director that the depreciation is charged on a straight line basis of 20% per annum. Furthermore, it appears that a debtor amounting Eur125 will not be recovered and should be written off as a bad debt. You are required to prepare: (a) A final trial balance as at 31.12.2021 (b) Income statement for the year (c) Balance sheet as at 31.12.2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started