Answered step by step

Verified Expert Solution

Question

1 Approved Answer

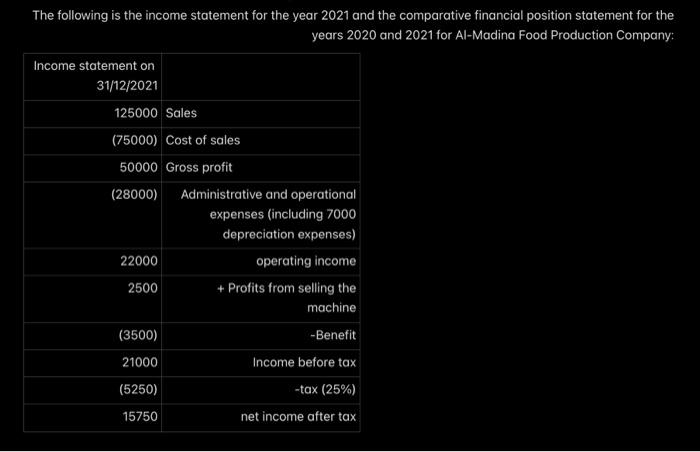

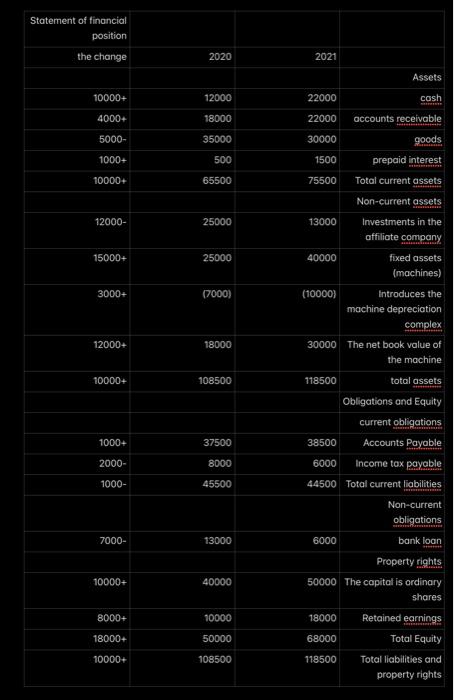

The following is the income statement for the year 2021 and the comparative financial position statement for the years 2020 and 2021 for Al-Madina

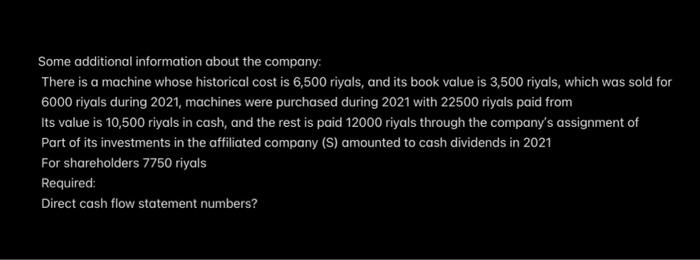

The following is the income statement for the year 2021 and the comparative financial position statement for the years 2020 and 2021 for Al-Madina Food Production Company: Income statement on 31/12/2021 125000 Sales (75000) Cost of sales 50000 Gross profit (28000) Administrative and operational expenses (including 7000 depreciation expenses) 22000 operating income 2500 + Profits from selling the machine (3500) -Benefit 21000 Income before tax (5250) -tax (25%) 15750 net income after tax Statement of financial position the change 2020 2021 Assets 10000+ 12000 22000 cash 4000+ 18000 22000 accounts receivable 5000- 35000 30000 goods 1000+ 500 1500 prepaid interest 10000+ 65500 75500 Total current assets Non-current assets 12000- 25000 13000 Investments in the affiliate company 15000+ 25000 40000 fixed assets (machines) 3000+ (7000) (10000) Introduces the machine depreciation complex 12000+ 18000 30000 The net book value of the machine 10000+ 108500 118500 total assets Obligations and Equity current obligations 1000+ 37500 38500 Accounts Payable 2000- 8000 6000 Income tax payable 1000- 45500 44500 Total current liabilities Non-current obligations 7000- 13000 6000 bank loan Property rights 10000+ 40000 50000 The capital is ordinary shares 8000+ 10000 18000 Retained earnings 18000+ 50000 68000 Total Equity 10000+ 108500 118500 Total liabilities and property rights Some additional information about the company: There is a machine whose historical cost is 6,500 riyals, and its book value is 3,500 riyals, which was sold for 6000 riyals during 2021, machines were purchased during 2021 with 22500 riyals paid from Its value is 10,500 riyals in cash, and the rest is paid 12000 riyals through the company's assignment of Part of its investments in the affiliated company (S) amounted to cash dividends in 2021 For shareholders 7750 riyals Required: Direct cash flow statement numbers?

Step by Step Solution

★★★★★

3.29 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Cash flow statement for the year ended 2021 direct method in Riyals Cash flow from operating ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started