Question

The following is the post-closing trial balance of Grupo Kamuk S.A., as of December 31, 2018. 1.- Inventory of merchandise was purchased on credit for

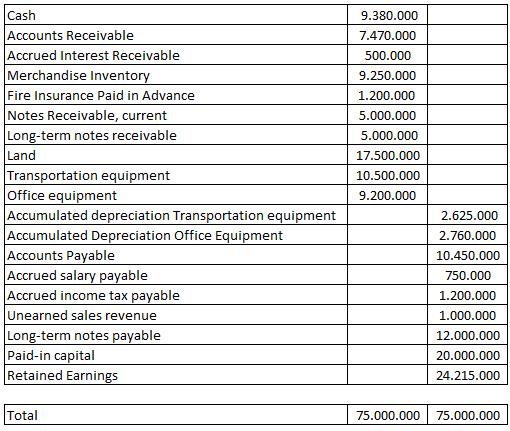

The following is the post-closing trial balance of Grupo Kamuk S.A., as of December 31, 2018.

1.- Inventory of merchandise was purchased on credit for 18,000,000

2.- Total sales increased to 35,000,000, 55 % of which were on credit.

3.- All goods ordered in advance and pending delivery as of 12/31/18 were delivered.

4.- The cost of goods sold for 2019 was 19,150,000, including the sales of item 3.

5.- 2,250,000 of accounts receivable was received.

6.- The notes receivable were signed on August 31, 2018. Interest for twelve months on ALL notes receivable was collected on August 31, 2019. The annual rate is 15%.

7.- Principal on the outstanding notes receivable was collected on July 31, 2019. Principal on all other notes will be due on July 30, 2020.

8.- 1,800,000 was paid on 08/31/2019 for a new insurance policy for fire, with a three-year term.

9.- 1,400,000 was paid in various expenses (water, electricity, telephones, etc.).

10.- Dividends of 1,250,000 were declared and will be paid in the fourth week of January 2020.

11.- 7,500,000 of accounts payable were paid.

12.- On December 20, 2019 new transportation equipment was purchased for 2,500,000, paying half in cash, it was agreed with the seller to pay the remaining balance in 30 days.

13.- 10,000,000 was paid in salaries, this amount includes the balance of salaries payable 12/31/18.

14.- 2,000,000 was received from customers who had paid in advance for merchandise not yet in inventory.

15.- A total of 950,000,000 in income tax was paid, including the balance as of Dec 31, 2018.

IT IS REQUIRED:

A.- Analyze and journalize all transactions.

B.- Transfer all journal entries to T-accounts.

C.- Prepare a trial balance, income statement, balance sheet and statement of changes in retained earnings, as of 12/31/2017.

Please send the Excel file to the email (amamartin508) or show the formulas to calculate each part.

Cash Accounts Receivable Accrued Interest Receivable Merchandise Inventory Fire Insurance Paid in Advance Notes Receivable, current Long-term notes receivable Land Transportation equipment Office equipment Accumulated depreciation Transportation equipment Accumulated Depreciation Office Equipment Accounts Payable Accrued salary payable Accrued income tax payable Unearned sales revenue Long-term notes payable Paid-in capital Retained Earnings Total 9.380.000 7.470.000 500.000 9.250.000 1.200.000 5.000.000 5.000.000 17.500.000 10.500.000 9.200.000 2.625.000 2.760.000 10.450.000 750.000 1.200.000 1.000.000 12.000.000 20.000.000 24.215.000 75.000.000 75.000.000

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries for Grupo Kamuk SA Transactions in 2019 Transaction 1 Debit Merchandise Inventory 18000000 Credit Accounts Payable 18000000 Transaction 2 Debit Accounts Receivable 35000000 Credit Sale...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started