Answered step by step

Verified Expert Solution

Question

1 Approved Answer

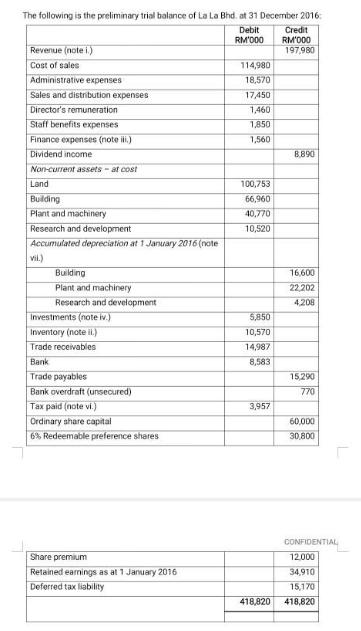

The following is the preliminary trial balance of La La Bhd. at 31 December 2016: Debit RM'000 Credit RM'000 197,980 Revenue (note i.) Cost

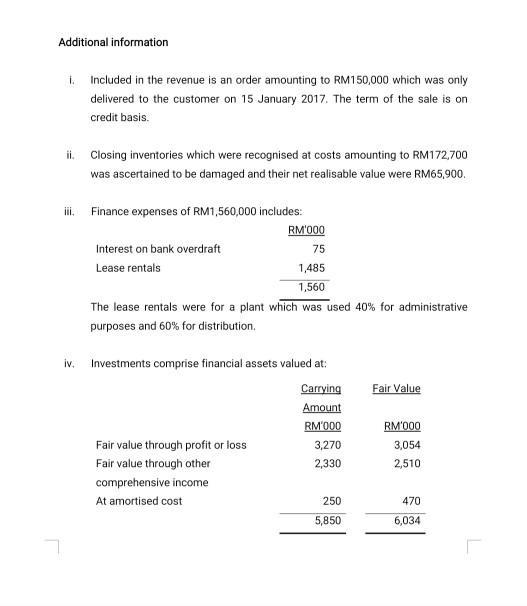

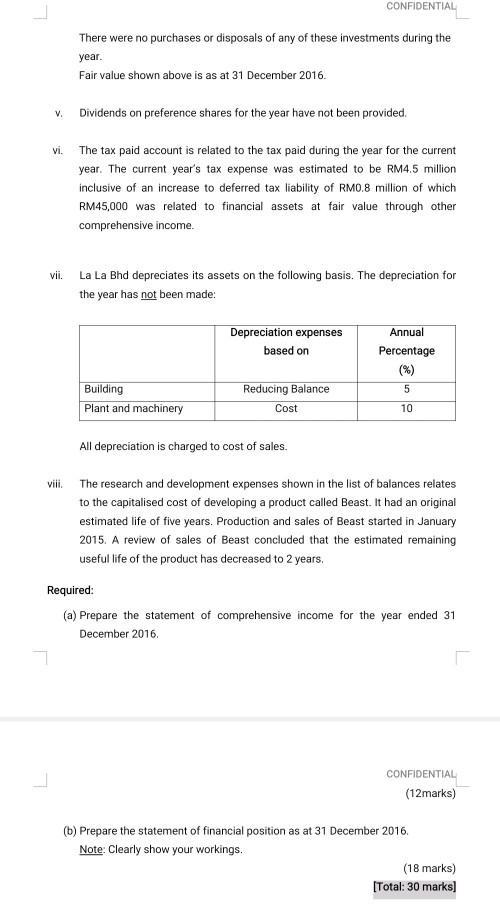

The following is the preliminary trial balance of La La Bhd. at 31 December 2016: Debit RM'000 Credit RM'000 197,980 Revenue (note i.) Cost of sales 114,980 Administrative expenses 18,570 Sales and distribution expenses 17450 Director's remuneration 1,460 Staff benefits expenses 1,850 Finance expenses (note ili.) 1,560 Dividend income B.890 Non-current assets - at cost Land 100,753 Building Plant and machinery 66,960 40,770 Research and development 10,520 Accumulated depreciation at 1 January 2016 (note vil) Building 16,600 Plant and machinery 22.202 Research and development 4,208 Investments (note iv.) 5,850 Inventory (note il.) Trade receivables 10,570 14,987 Bank 8,583 Trade payables 15,290 Bank overdraft (unsecured) Tax paid (note vi.) 770 3,957 Ordinary share capital 60,000 6% Redeemable preference shares 30,800 CONFIDENTIAL Share premium 12.000 Retained earnings as at 1 January 2016 Deferred tax liability 34,910 15,170 418,820 418,820 Additional information i. Included in the revenue is an order amounting to RM150,000 which was only delivered to the customer on 15 January 2017. The term of the sale is on credit basis. ii. Closing inventories which were recognised at costs amounting to RM172,700 was ascertained to be damaged and their net realisable value were RM65,900. ii, Finance expenses of RM1,560,000 includes: RM'000 Interest on bank overdraft 75 Lease rentals 1,485 1,560 The lease rentals were for a plant which was used 40% for administrative purposes and 60% for distribution. iv. Investments comprise financial assets valued at: Carrying Fair Value Amount RM'000 RM'000 Fair value through profit or loss 3,270 3,054 Fair value through other 2,330 2,510 comprehensive income At amortised cost 250 470 5,850 6,034 CONFIDENTIAL There were no purchases or disposals of any of these investments during the year. Fair value shown above is as at 31 December 2016. v. Dividends on preference shares for the year have not been provided. vi. The tax paid account is related to the tax paid during the year for the current year. The current year's tax expense was estimated to be RM4.5 million inclusive of an increase to deferred tax liability of RMO.8 million of which RM45,000 was related to financial assets at fair value through other comprehensive income. vii. La La Bhd depreciates its assets on the following basis. The depreciation for the year has not been made: Depreciation expenses Annual based on Percentage (%) Reducing Balance Cost Building Plant and machinery 10 All depreciation is charged to cost of sales. viii. The research and development expenses shown in the list of balances relates to the capitalised cost of developing a product called Beast. It had an original estimated life of five years. Production and sales of Beast started in January 2015. A review of sales of Beast concluded that the estimated remaining useful life of the product has decreased to 2 years. Required: (a) Prepare the statement of comprehensive income for the year ended 31 December 2016. CONFIDENTIAL (12marks) (b) Prepare the statement of financial position as at 31 December 2016. Note: Clearly show your workings. (18 marks) [Total: 30 marks)

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a La la Bhds Statement of comprehensive income For the year ended on 31 December 2016 Working Notes ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started