Answered step by step

Verified Expert Solution

Question

1 Approved Answer

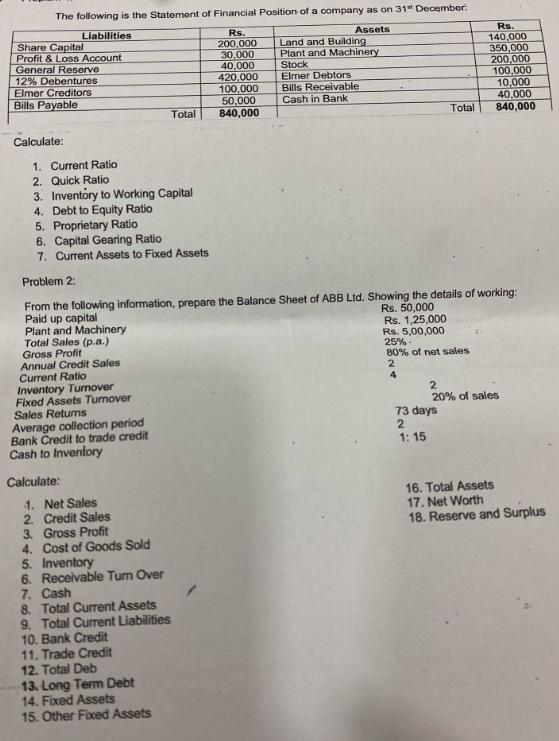

The following is the Statement of Financial Position of a company as on 31 December: Assets Liabilities Share Capital Profit & Loss Account General

The following is the Statement of Financial Position of a company as on 31 December: Assets Liabilities Share Capital Profit & Loss Account General Reserve 12% Debentures Elmer Creditors Bills Payable Calculate: 1. Current Ratio 2. Quick Ratio 3. Inventory to Working Capital Plant and Machinery Total Sales (p.a.) Gross Profit Annual Credit Sales Current Ratio Inventory Turnover Fixed Assets Turnover Sales Returns Average collection period Bank Credit to trade credit Cash to Inventory Calculate: 1. Net Sales 2. Credit Sales 3. Gross Profit 4. Cost of Goods Sold 5. Inventory 6. Receivable Turn Over 7. Cash 8. Total Current Assets 9. Total Current Liabilities 10. Bank Credit Total 11. Trade Credit 12. Total Deb 13. Long Term Debt 14. Fixed Assets 15. Other Fixed Assets Rs. 200,000 30,000 40,000 4. Debt to Equity Ratio 5. Proprietary Ratio 6. Capital Gearing Ratio 7. Current Assets to Fixed Assets Problem 2: From the following information, prepare the Balance Sheet of ABB Ltd. Showing the details of working: Paid up capital Rs. 50,000 Land and Building Plant and Machinery Stock 420,000 Elmer Debtors 100,000 Bills Receivable 50,000 Cash in Bank 840,000 Rs. 1,25,000 Rs. 5,00,000 25%- 80% of net sales 2 4 Total 73 days 2 1:15 Rs. 140,000 350,000 200,000 100,000 10,000 40,000 840,000 2 20% of sales 16. Total Assets 17. Net Worth 18. Reserve and Surplus

Step by Step Solution

★★★★★

3.40 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep workings for the two problems Problem 1 1 Current Ratio Current Assets Current Liabilities Stock Debtors Bills Receivable Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started