Answered step by step

Verified Expert Solution

Question

1 Approved Answer

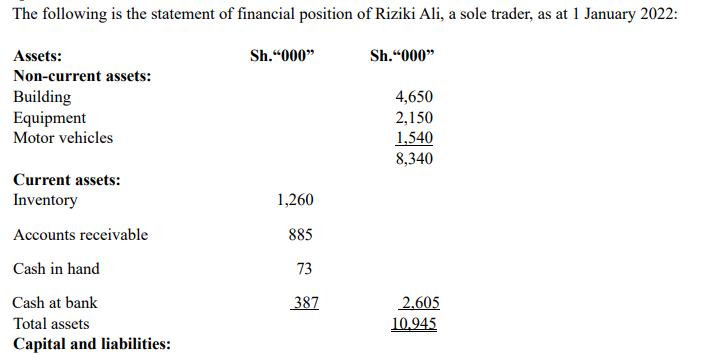

The following is the statement of financial position of Riziki Ali, a sole trader, as at 1 January 2022: Assets: Sh.000 Sh.000 Non-current assets:

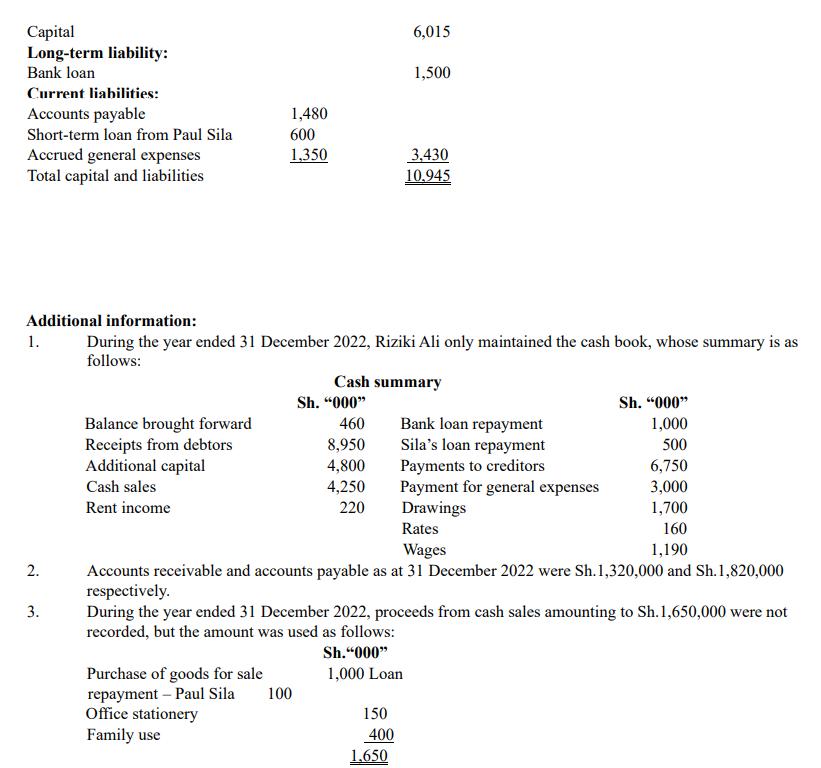

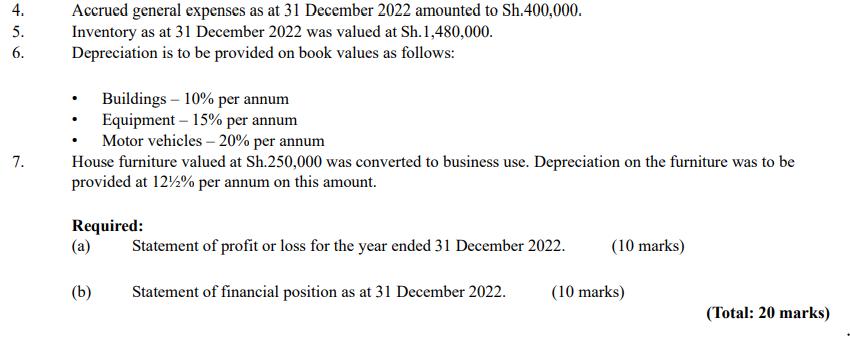

The following is the statement of financial position of Riziki Ali, a sole trader, as at 1 January 2022: Assets: Sh.000" Sh."000" Non-current assets: Building 4,650 Equipment 2,150 Motor vehicles 1,540 8,340 Current assets: Inventory 1,260 Accounts receivable 885 Cash in hand 73 Cash at bank 387 2.605 Total assets 10,945 Capital and liabilities: Capital Long-term liability: Bank loan Current liabilities: 6,015 1,500 Accounts payable 1,480 Short-term loan from Paul Sila 600 Accrued general expenses 1,350 Total capital and liabilities 3,430 10.945 Additional information: 1. During the year ended 31 December 2022, Riziki Ali only maintained the cash book, whose summary is as follows: 2. 3. Balance brought forward Receipts from debtors Additional capital Cash sales Rent income Cash summary Sh. "000" Sh. "000" 460 Bank loan repayment 1,000 8,950 Sila's loan repayment 500 4,800. Payments to creditors 6,750 4,250 Payment for general expenses 3,000 220 Drawings 1,700 Rates 160 Wages 1,190 Accounts receivable and accounts payable as at 31 December 2022 were Sh.1,320,000 and Sh.1,820,000 respectively. During the year ended 31 December 2022, proceeds from cash sales amounting to Sh. 1,650,000 were not recorded, but the amount was used as follows: Purchase of goods for sale Office stationery repayment Paul Sila Family use Sh."000" 1,000 Loan 100 150 400 1.650 456 5. 6. Accrued general expenses as at 31 December 2022 amounted to Sh.400,000. Inventory as at 31 December 2022 was valued at Sh. 1,480,000. Depreciation is to be provided on book values as follows: 7. . Buildings 10% per annum Equipment - 15% per annum Motor vehicles -20% per annum House furniture valued at Sh.250,000 was converted to business use. Depreciation on the furniture was to be provided at 12% per annum on this amount. Required: (a) Statement of profit or loss for the year ended 31 December 2022. (10 marks) (b) Statement of financial position as at 31 December 2022. (10 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started