Question

The following is the structure of the Balance Sheet of Dempsey Bank Ltd: Using the following assumptions on the runoff cash flows. 1) Fixed-rate mortgages

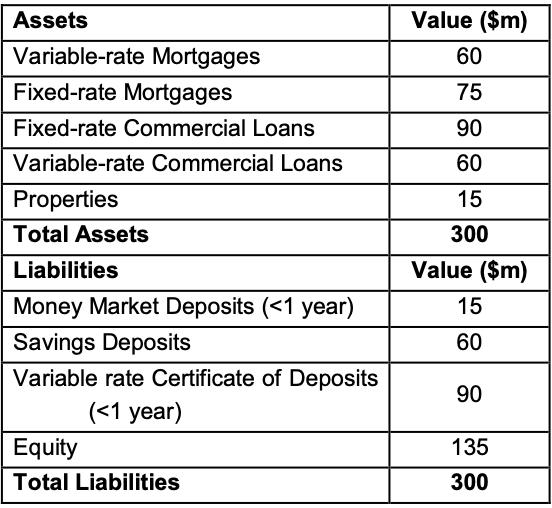

The following is the structure of the Balance Sheet of Dempsey Bank Ltd:

Using the following assumptions on the runoff cash flows.

1) Fixed-rate mortgages repaid during the year is 20%;

2) Variable-rate commercial loans repaid during the year is 30%;

3) Proportion of savings deposits that are rate-sensitive is 25%.

Required:

a) Perform a basic gap analysis on risk-sensitive assets and liabilities.

b) What will be the net interest income at the year-end if the interest rate increases by 1 percent, from 8 percent to 9 percent per annum?

1) What happens to the income if the Bank decides to convert $45 m of its existing fixed-rate mortgages into variable-rate mortgages?

2) What happens to the income if the Bank revises the estimate of the percentage of the saving deposits that are rate-sensitive from 25% to 15%?

c) If a CEO of Dempsey Bank Ltd was quite certain that interest rates were going to rise within the next six months, how should the bank manager adjust the bank’s six-month repricing gap to take advantage of this anticipated rise? What if the manager believed rates would fall in the next six months.

Assets Variable-rate Mortgages Fixed-rate Mortgages Fixed-rate Commercial Loans Variable-rate Commercial Loans Properties Total Assets Liabilities Money Market Deposits (

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Required a Perform a basic gap analysis on risksensitive assets and liabilities ANSWER The gap analysis would reveal that the bank has a shortfall of risksensitive assets compared to risksensitive lia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started