Answered step by step

Verified Expert Solution

Question

1 Approved Answer

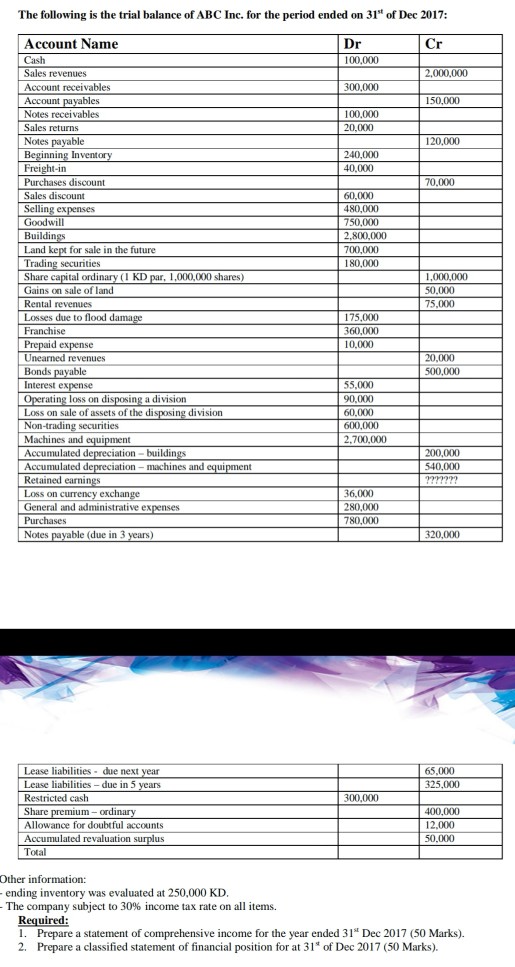

The following is the trial balance of ABC Inc. for the period ended on 31 of Dec 2017: Account Name Cash Sales revenues Account receivables

The following is the trial balance of ABC Inc. for the period ended on 31 of Dec 2017: Account Name Cash Sales revenues Account receivables 00,000 2,000,000 300,000 50,000 Notes receivables Sales returns Notes payable 00,000 20,000 120,000 240,000 40,000 inning Invent 0,000 Purchases discount Sales discount Selling ex Goodwill Buildin Land kept for sale in the future Trading securities Share capital ordinary (1 KD par, 1,000,000 shares) Gains on sale of land Rental revenues Losses due to flood dama Franchise 60,000 480,000 750,000 2,800,000 700,000 180,000 5,000 175,000 360,000 10,000 Unearned revenues Bonds payable Interest expense 20,000 500,000 55,000 90,000 60,000 600,000 2.700,000 Operating loss on disposing a division Loss on sale of assets of the disposing division Non-trading securities Machines and Accumulated d Accumulated depreciation ciation - buildin 200,000 540,000 machines and equi ent Retained earnin Loss onc General and administrative ex Purchases Notes payable (due in 3 36,000 280,000 780,000 exchan 320,000 Lease liabilities due next Lease liabilities-due in 5 vears Restricted cash Share Allowance for doubtful accounts Accumulated revaluation surplus 65,000 00,000 400,000 12,000 50,000 um- ordi Other information: ending inventory was evaluated at 250,000 KD The company subject to 30% income tax rate on all items. Required: I. Prepare a statement of comprehensive income for the year ended 31t Dec 2017 (50 Marks). 2. Prepare a classified statement of financial position for at 31 of Dec 2017 (50 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started