Answered step by step

Verified Expert Solution

Question

1 Approved Answer

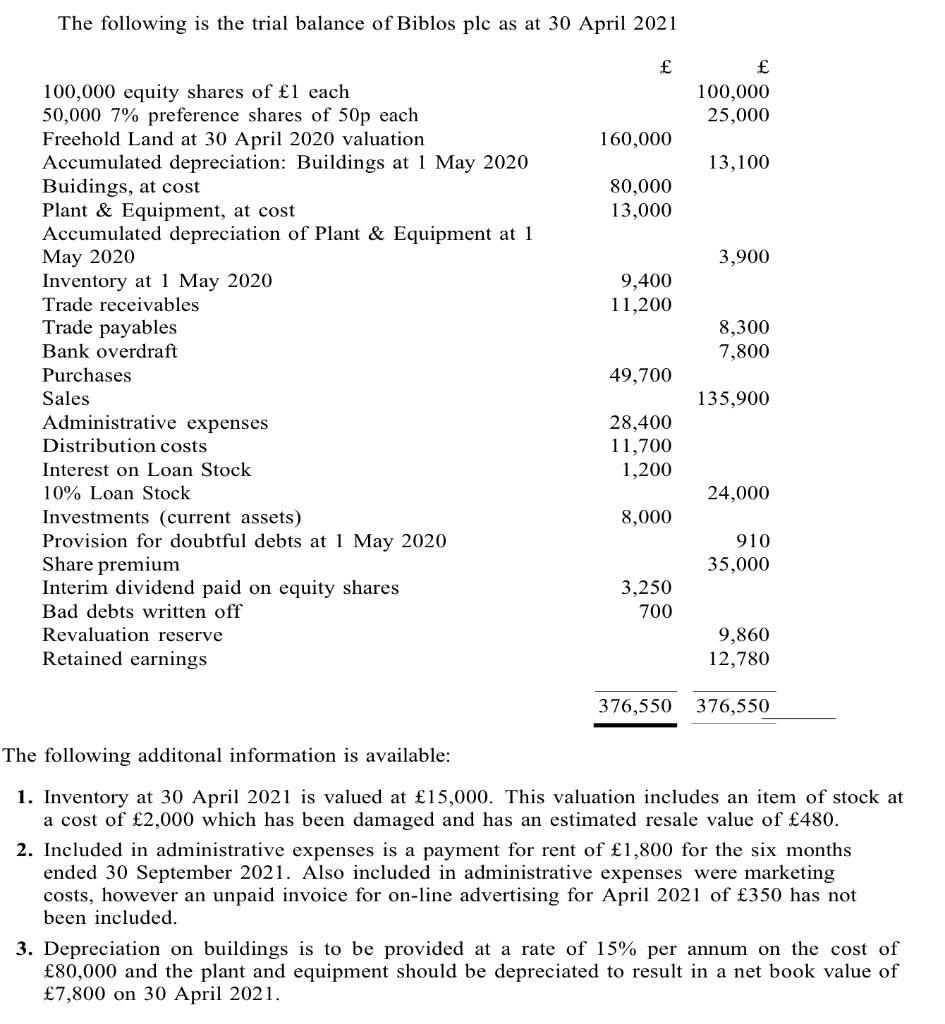

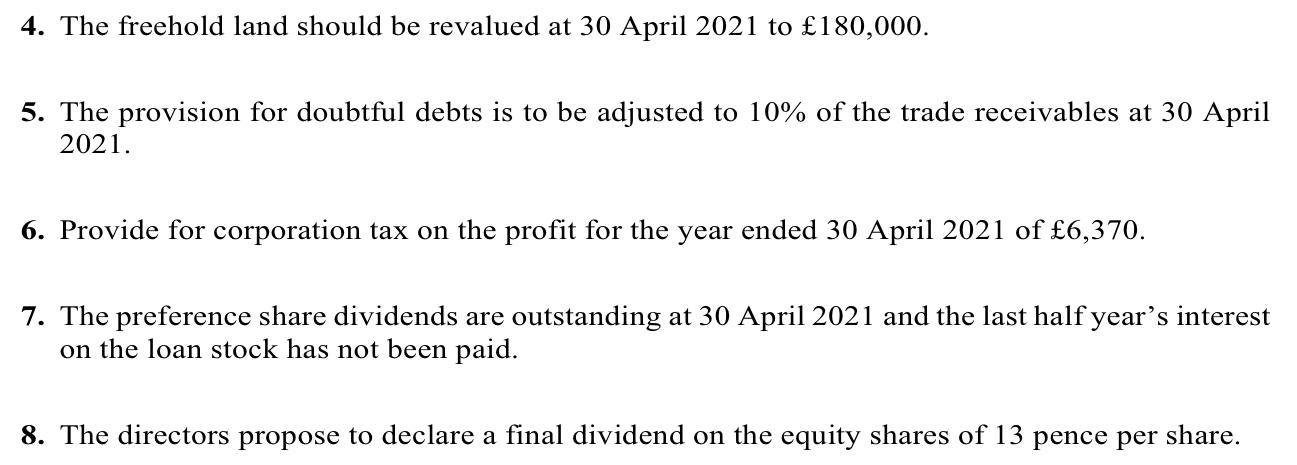

The following is the trial balance of Biblos plc as at 30 April 2021 100,000 equity shares of 1 each 50,000 7% preference shares

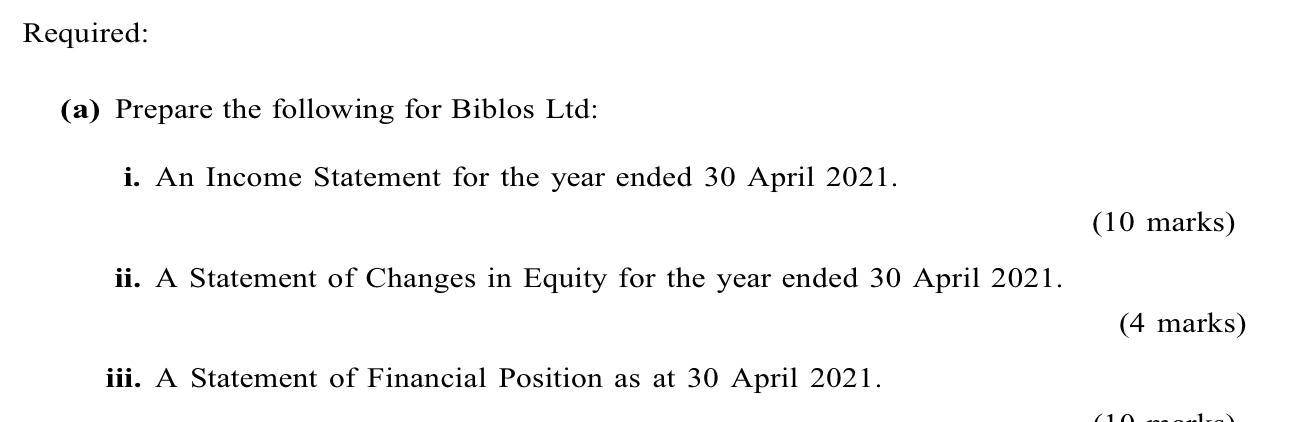

The following is the trial balance of Biblos plc as at 30 April 2021 100,000 equity shares of 1 each 50,000 7% preference shares of 50p each Freehold Land at 30 April 2020 valuation Accumulated depreciation: Buildings at 1 May 2020 Buidings, at cost Plant & Equipment, at cost Accumulated depreciation of Plant & Equipment at 1 May 2020 Inventory at 1 May 2020 Trade receivables Trade payables Bank overdraft Purchases Sales Administrative expenses Distribution costs Interest on Loan Stock 10% Loan Stock Investments (current assets) Provision for doubtful debts at 1 May 2020 Share premium Interim dividend paid on equity shares Bad debts written off Revaluation reserve Retained earnings 160,000 80,000 13,000 9,400 11,200 49,700 28,400 11,700 1,200 8,000 3,250 700 100,000 25,000 13,100 3,900 8,300 7,800 135,900 24,000 910 35,000 9,860 12,780 376,550 376,550 The following additonal information is available: 1. Inventory at 30 April 2021 is valued at 15,000. This valuation includes an item of stock at a cost of 2,000 which has been damaged and has an estimated resale value of 480. 2. Included in administrative expenses is a payment for rent of 1,800 for the six months ended 30 September 2021. Also included in administrative expenses were marketing costs, however an unpaid invoice for on-line advertising for April 2021 of 350 has not been included. 3. Depreciation on buildings is to be provided at a rate of 15% per annum on the cost of 80,000 and the plant and equipment should be depreciated to result in a net book value of 7,800 on 30 April 2021. 4. The freehold land should be revalued at 30 April 2021 to 180,000. 5. The provision for doubtful debts is to be adjusted to 10% of the trade receivables at 30 April 2021. 6. Provide for corporation tax on the profit for the year ended 30 April 2021 of 6,370. 7. The preference share dividends are outstanding at 30 April 2021 and the last half year's interest on the loan stock has not been paid. 8. The directors propose to declare a final dividend on the equity shares of 13 pence per share. Required: (a) Prepare the following for Biblos Ltd: i. An Income Statement for the year ended 30 April 2021. ii. A Statement of Changes in Equity for the year ended 30 April 2021. iii. A Statement of Financial Position as at 30 April 2021. (10 marks) (4 marks) (10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a i Biblos Ltd Income Statement for the year ended 30 April 2021 Revenue 135900 Cost of sales 49900 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started