Answered step by step

Verified Expert Solution

Question

1 Approved Answer

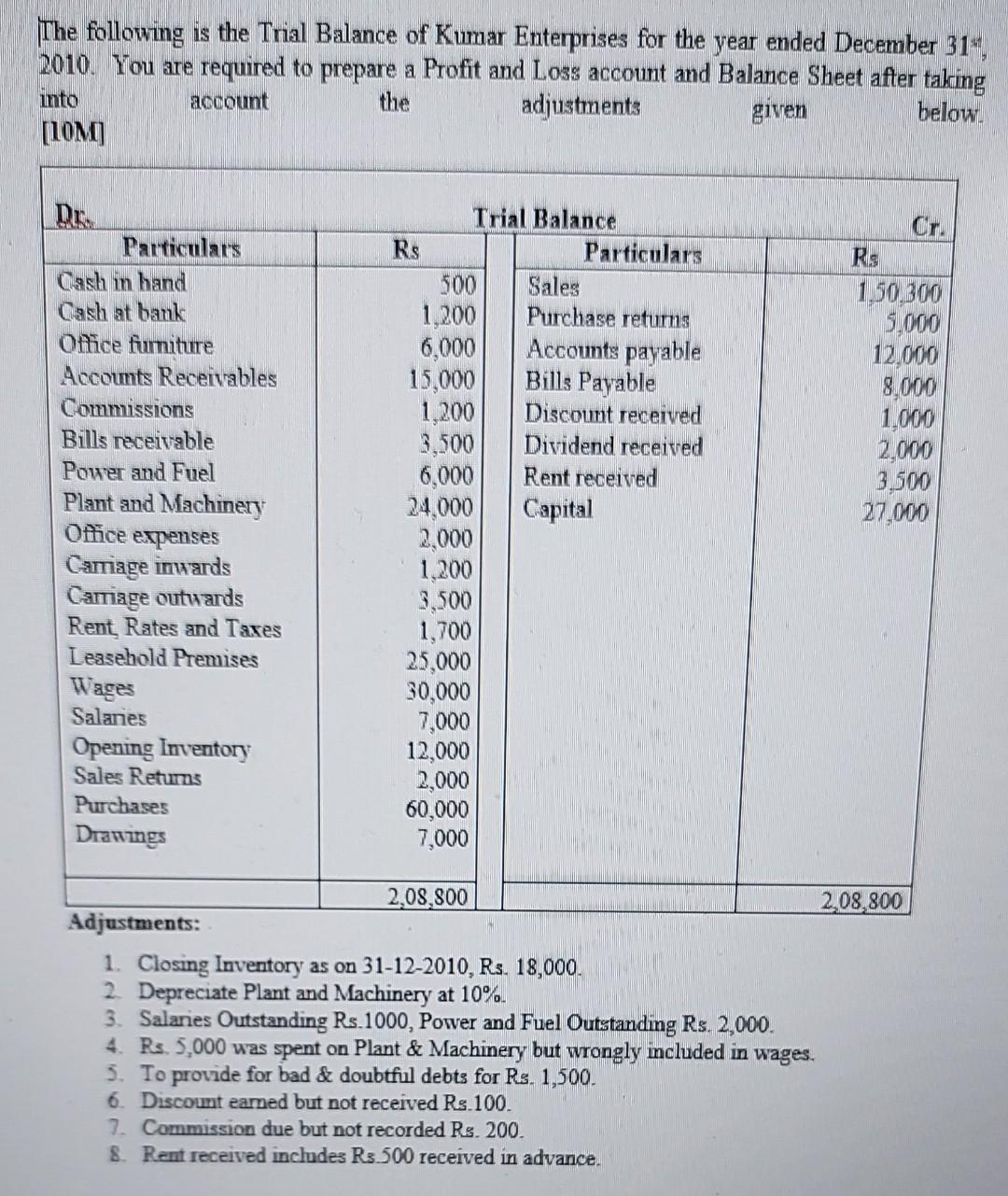

The following is the Trial Balance of Kumar Enterprises for the year ended December 31*, 2010. You are required to prepare a Profit and

The following is the Trial Balance of Kumar Enterprises for the year ended December 31*, 2010. You are required to prepare a Profit and Loss account and Balance Sheet after taking adjustments into account the given below. (10M] Dr. Trial Balance Cr. Rs 1,50.300 5,000 12,000 8,000 1,000 2,000 3,500 27,000 Particulars Rs Particulars Sales Purchase returns Accounts payable Bills Payable Discount received Dividend received Rent received Cash in hand Cash at bank Ofice furniture Accounts Receivables 500 1,200 6,000 15,000 1,200 3,500 6,000 24,000 2,000 1,200 3,500 1,700 25,000 30,000 7,000 12,000 2,000 60,000 7,000 Commissions Bills receivable Power and Fuel Plant and Machinery Office expenses Carriage inwards Carriage outwards Rent Rates and Taxes Leasehold Premises Capital Wages Salanes Opening Inventory Sales Returms Purchases Drawings 2,08.800 2,08,800 Adjustments: 1. Closing Inventory as on 31-12-2010, Rs. 18,000. 2 Depreciate Plant and Machinery at 10%. 3. Salaries Outstanding Rs.1000, Power and Fuel Outstanding Rs. 2,000. 4. Rs. 5,000 was spent on Plant & Machinery but wrongly ncluded in wages. 5. To provide for bad & doubtful debts for Rs. 1,500. 6. Discount eaned but not received Rs.100. 7. Commission due but not recorded Rs. 200. 8. Rent received includes Rs.500 received in advance.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

4120 answers Trading and Profit Loss AC For the year ended December 31 2010 Particulars Rs Rs Partic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started