Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following is the two income statements for ABC Consulting firm for the year ended December 31. The left column is prepared before adjusting

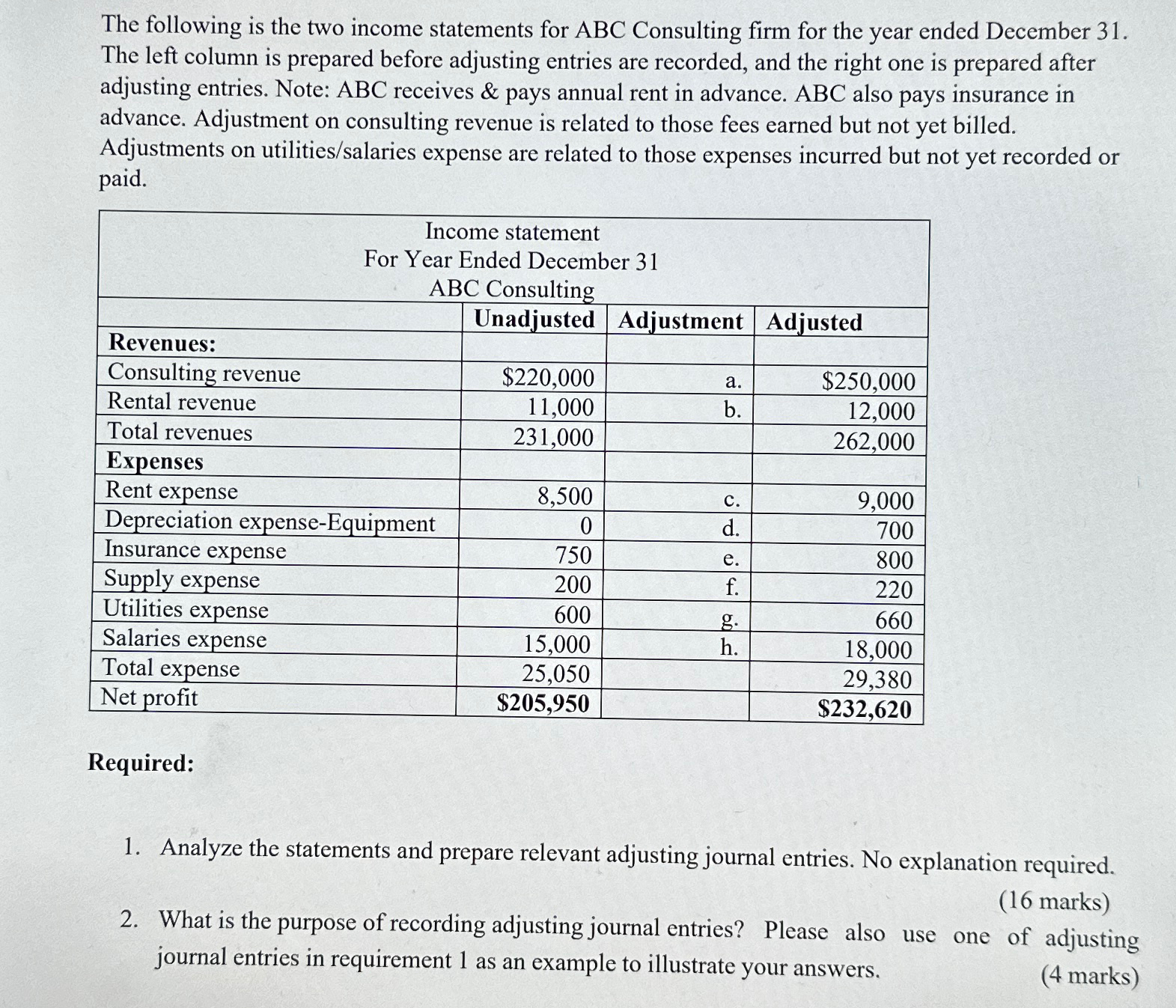

The following is the two income statements for ABC Consulting firm for the year ended December 31. The left column is prepared before adjusting entries are recorded, and the right one is prepared after adjusting entries. Note: ABC receives & pays annual rent in advance. ABC also pays insurance in advance. Adjustment on consulting revenue is related to those fees earned but not yet billed. Adjustments on utilities/salaries expense are related to those expenses incurred but not yet recorded or paid. Revenues: Consulting revenue Rental revenue Income statement For Year Ended December 31 ABC Consulting Unadjusted Adjustment Adjusted Total revenues Expenses Rent expense Depreciation expense-Equipment Insurance expense Supply expense Utilities expense Salaries expense Total expense Net profit Required: $220,000 a. $250,000 11,000 b. 231,000 12,000 262,000 8,500 C. 9,000 0 d. 700 750 e. 800 200 f. 220 600 g. 660 15,000 h. 18,000 25,050 29,380 $205,950 $232,620 1. Analyze the statements and prepare relevant adjusting journal entries. No explanation required. (16 marks) 2. What is the purpose of recording adjusting journal entries? Please also use one of adjusting journal entries in requirement 1 as an example to illustrate your answers. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started