Answered step by step

Verified Expert Solution

Question

1 Approved Answer

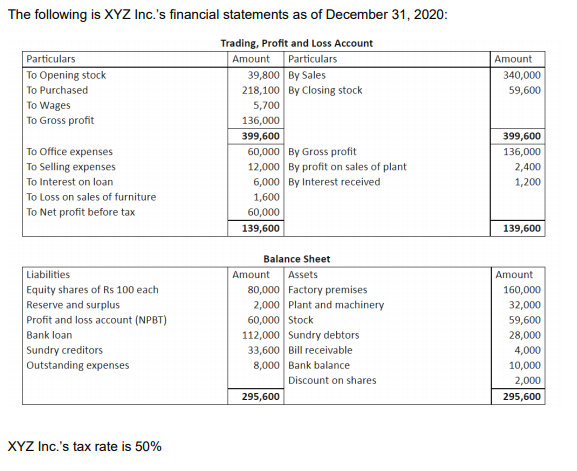

The following is XYZ Inc.'s financial statements as of December 31, 2020: Particulars To Opening stock To Purchased Trading, Profit and Loss Account Amount

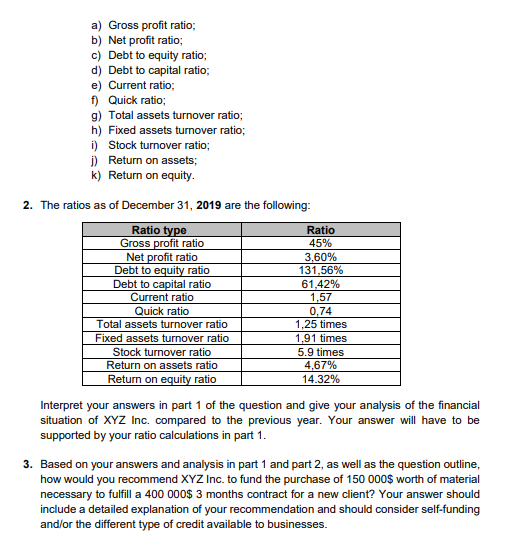

The following is XYZ Inc.'s financial statements as of December 31, 2020: Particulars To Opening stock To Purchased Trading, Profit and Loss Account Amount Particulars 39,800 By Sales 218,100 By Closing stock To Wages To Gross profit To Office expenses To Selling expenses To Interest on loan To Loss on sales of furniture To Net profit before tax Liabilities Equity shares of Rs 100 each Reserve and surplus Profit and loss account (NPBT) Bank loan Sundry creditors Outstanding expenses XYZ Inc.'s tax rate is 50% 5,700 Amount 340,000 59,600 136,000 399,600 399,600 60,000 By Gross profit 136,000 12,000 By profit on sales of plant 2,400 6,000 By Interest received 1,200 1,600 60,000 139,600 139,600 Balance Sheet Amount Assets Amount 80,000 Factory premises 160,000 2,000 Plant and machinery 32,000 60,000 Stock 59,600 112,000 Sundry debtors 28,000 33,600 Bill receivable 4,000 8,000 Bank balance 10,000 Discount on shares 2,000 295,600 295,600 a) Gross profit ratio; b) Net profit ratio; c) Debt to equity ratio; d) Debt to capital ratio; e) Current ratio; f) Quick ratio; g) Total assets turnover ratio; h) Fixed assets turnover ratio; i) Stock turnover ratio; j) Return on assets; k) Return on equity. 2. The ratios as of December 31, 2019 are the following: Ratio type Ratio Gross profit ratio 45% Net profit ratio 3,60% Debt to equity ratio 131,56% Debt to capital ratio 61,42% Current ratio Quick ratio 1,57 0,74 Total assets turnover ratio 1,25 times Fixed assets turnover ratio 1,91 times Stock turnover ratio 5.9 times Return on assets ratio 4,67% Return on equity ratio 14.32% Interpret your answers in part 1 of the question and give your analysis of the financial situation of XYZ Inc. compared to the previous year. Your answer will have to be supported by your ratio calculations in part 1. 3. Based on your answers and analysis in part 1 and part 2, as well as the question outline, how would you recommend XYZ Inc. to fund the purchase of 150 000$ worth of material necessary to fulfill a 400 000$ 3 months contract for a new client? Your answer should include a detailed explanation of your recommendation and should consider self-funding and/or the different type of credit available to businesses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started