Answered step by step

Verified Expert Solution

Question

1 Approved Answer

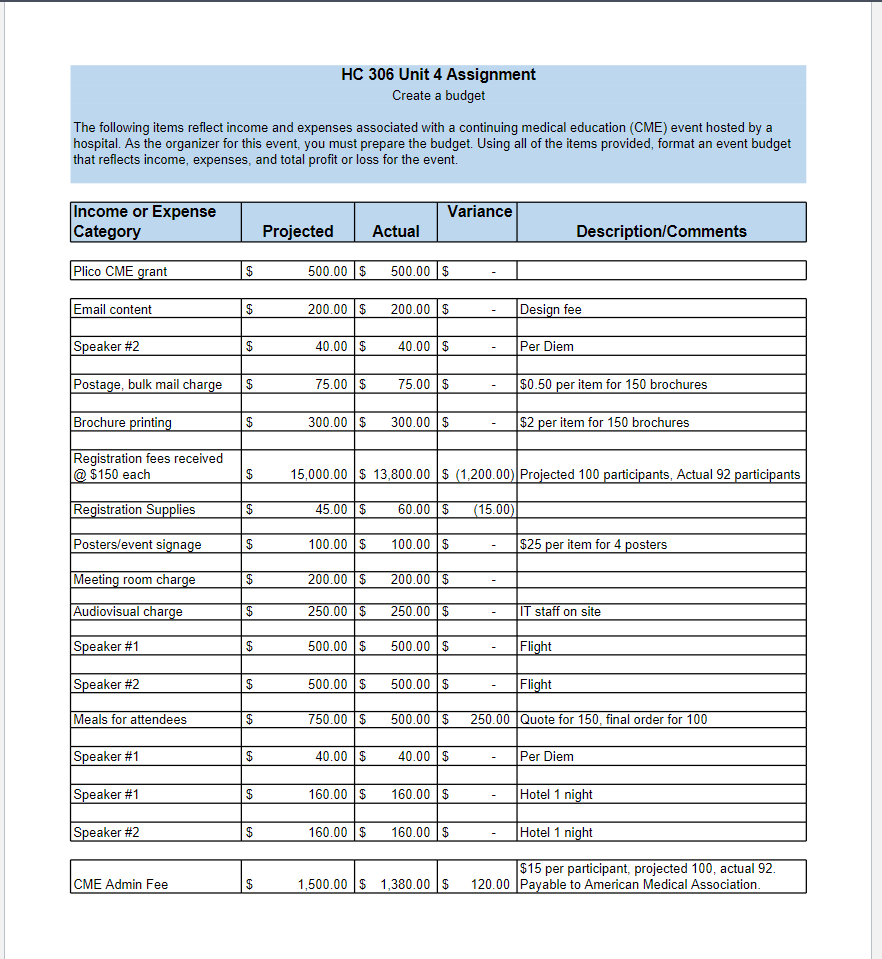

HC 306 Unit 4 Assignment Create a budget The following items reflect income and expenses associated with a continuing medical education (CME) event hosted

HC 306 Unit 4 Assignment Create a budget The following items reflect income and expenses associated with a continuing medical education (CME) event hosted by a hospital. As the organizer for this event, you must prepare the budget. Using all of the items provided, format an event budget that reflects income, expenses, and total profit or loss for the event. Income or Expense Variance Category Projected Actual Description/Comments Plico CME grant $ 500.00 $ 500.00 $ Email content $ 200.00 $ 200.00 $ Design fee Speaker #2 $ 40.00 $ 40.00 $ Per Diem Postage, bulk mail charge $ 75.00 $ 75.00 $ $0.50 per item for 150 brochures Brochure printing $ 300.00 $ 300.00 $ Registration fees received @ $150 each $ Registration Supplies $ 45.00 $ 60.00 $ $2 per item for 150 brochures 15,000.00 $13,800.00 $ (1,200.00) Projected 100 participants, Actual 92 participants (15.00) Posters/event signage 100.00 $ 100.00 $ $25 per item for 4 posters Meeting room charge $ 200.00 $ 200.00 $ Audiovisual charge $ 250.00 $ 250.00 $ - Speaker #1 $ 500.00 $ 500.00 $ IT staff on site Flight Speaker #2 $ 500.00 $ 500.00 $ - Flight Meals for attendees $ 750.00 $ 500.00 $ 250.00 Quote for 150, final order for 100 Speaker #1 $ 40.00 $ 40.00 $ - Per Diem Speaker #1 $ 160.00 $ 160.00 $ Hotel 1 night Speaker #2 $ 160.00 $ 160.00 $ Hotel 1 night CME Admin Fee $ 1,500.00 $ 1,380.00 $ $15 per participant, projected 100, actual 92. 120.00 Payable to American Medical Association.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres a formatted event budget based on the provided income and expense categories Category Income P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started