Answered step by step

Verified Expert Solution

Question

1 Approved Answer

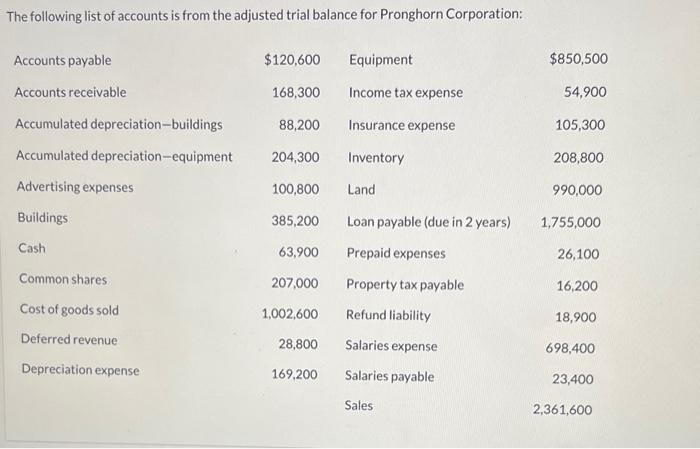

The following list of accounts is from the adjusted trial balance for Pronghorn Corporation: Accounts payable Accounts receivable Accumulated depreciation-buildings Accumulated depreciation-equipment Advertising expenses

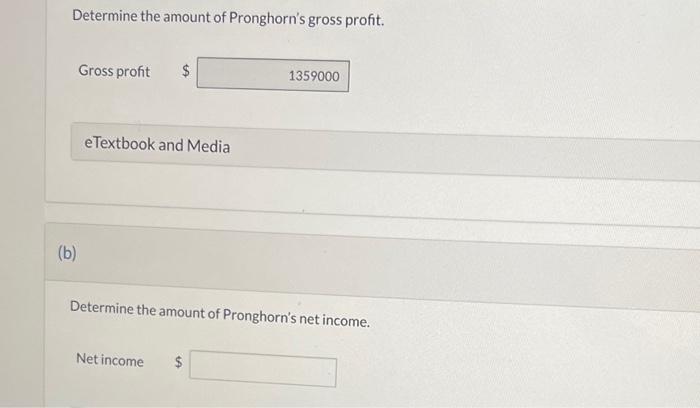

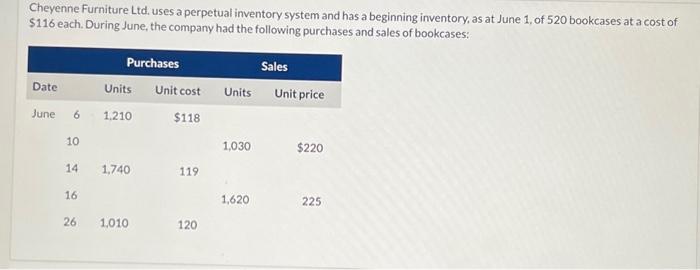

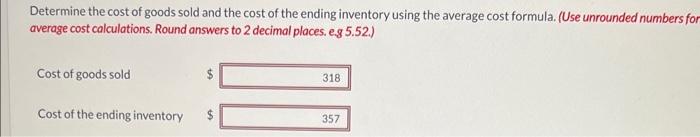

The following list of accounts is from the adjusted trial balance for Pronghorn Corporation: Accounts payable Accounts receivable Accumulated depreciation-buildings Accumulated depreciation-equipment Advertising expenses Buildings Cash Common shares Cost of goods sold Deferred revenue Depreciation expense $120,600 168,300 88,200 204,300 100,800 385,200 63,900 207,000 1,002,600 28,800 169,200 Equipment Income tax expense Insurance expense Inventory Land Loan payable (due in 2 years) Prepaid expenses Property tax payable Refund liability Salaries expense Salaries payable Sales $850,500 54,900 105,300 208,800 990,000 1,755,000 26,100 16,200 18,900 698,400 23,400 2,361,600 Determine the amount of Pronghorn's gross profit. (b) Gross profit $ GA eTextbook and Media 1359000 Determine the amount of Pronghorn's net income. Net income $ Cheyenne Furniture Ltd. uses a perpetual inventory system and has a beginning inventory, as at June 1, of 520 bookcases at a cost of $116 each. During June, the company had the following purchases and sales of bookcases: Date June 6 10 14 16 Purchases Units 1,210 1,740 26 1,010 Unit cost $118 119 120 Units 1,030 1,620 Sales Unit price $220 225 Determine the cost of goods sold and the cost of the ending inventory using the average cost formula. (Use unrounded numbers for average cost calculations. Round answers to 2 decimal places. e.g 5.52.) Cost of goods sold Cost of the ending inventory 318 357

Step by Step Solution

★★★★★

3.25 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Pronghorn Corporation Gross profit can be calculated as Sales Cost of Goods Sold Substituting the va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started