Answered step by step

Verified Expert Solution

Question

1 Approved Answer

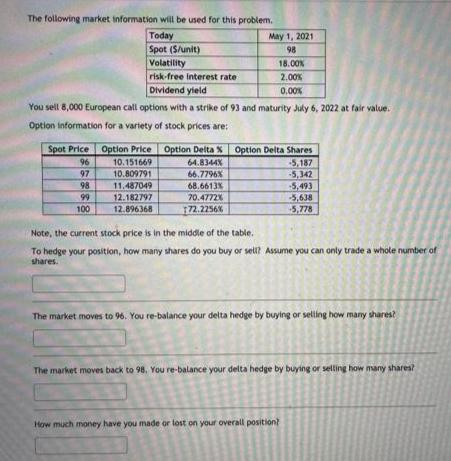

The following market information will be used for this problem. Today Spot (S/unit) May 1, 2021 98 Volatility risk-free Interest rate 18.00X 2.00% Dividend

The following market information will be used for this problem. Today Spot (S/unit) May 1, 2021 98 Volatility risk-free Interest rate 18.00X 2.00% Dividend yleld 0.00% You sell 8,000 European call options with a strike of 93 and maturity July 6, 2022 at fair value. Option information for a varlety of stock prices are: Spot Price Option Price Option Delta % Option Delta Shares -5,187 -5,342 -5,493 -5,638 5,778 96 10.151669 10.809791 64.8344X 66.7796X 97 11.487049 12.182797 12.896368 98 68.6613% 99 100 70.4772X 172.2256% Note, the current stock price is in the middle of the table. To hedge your position, how many shares do you buy or sell? Assume you can only trade a whole number of shares. The market moves to 96. You re-balance your delta hedge by buying or seliing how many sharest The market moves back to 98. You re-balance your delta hedge by buying or selling how many shares? How much money have you made or lost on your overall position?

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

ANSWERA NO OF SHARES BOUGHT TO HEDGE YOUR POSITION OPTION DELTA NO OF OPTIONS SOLD 686613 8...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started