Answered step by step

Verified Expert Solution

Question

1 Approved Answer

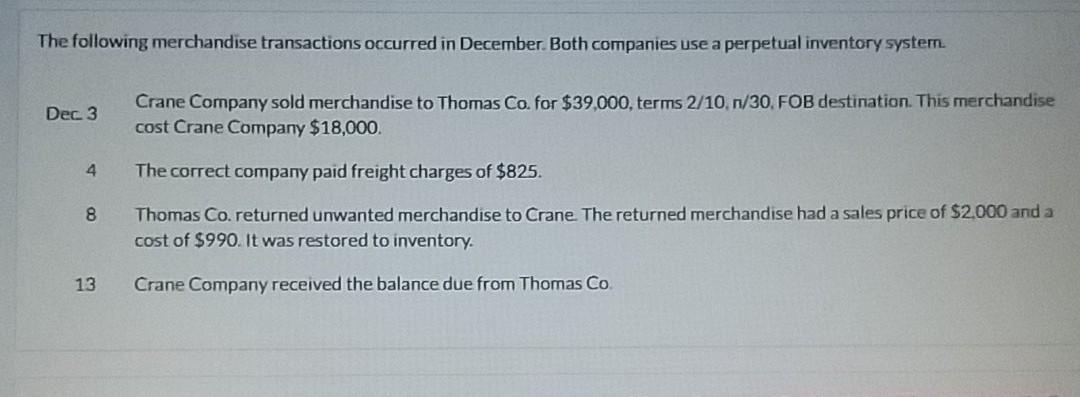

The following merchandise transactions occurred in December. Both companies use a perpetual inventory system. Dec 3 Crane Company sold merchandise to Thomas Co. for $39,000,

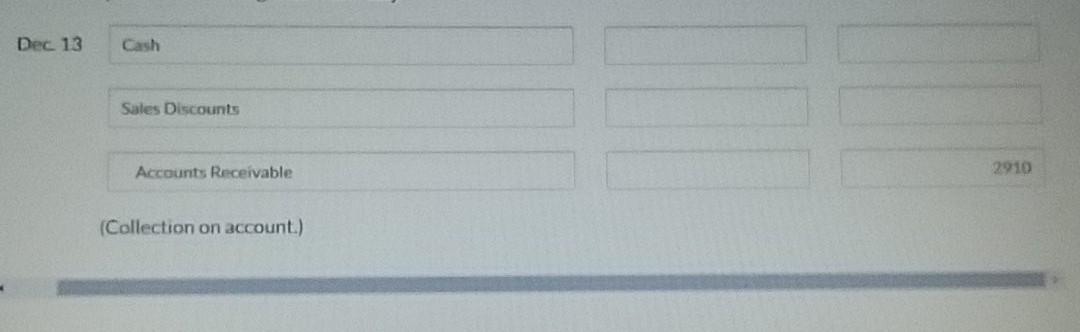

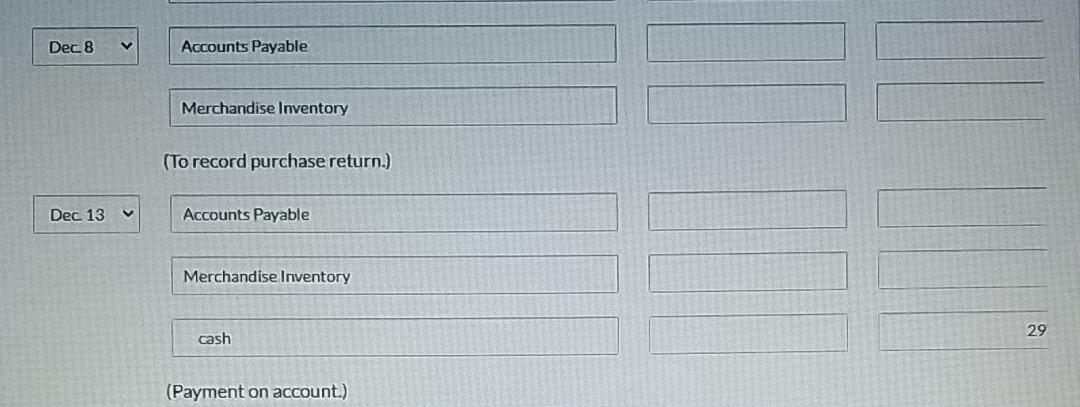

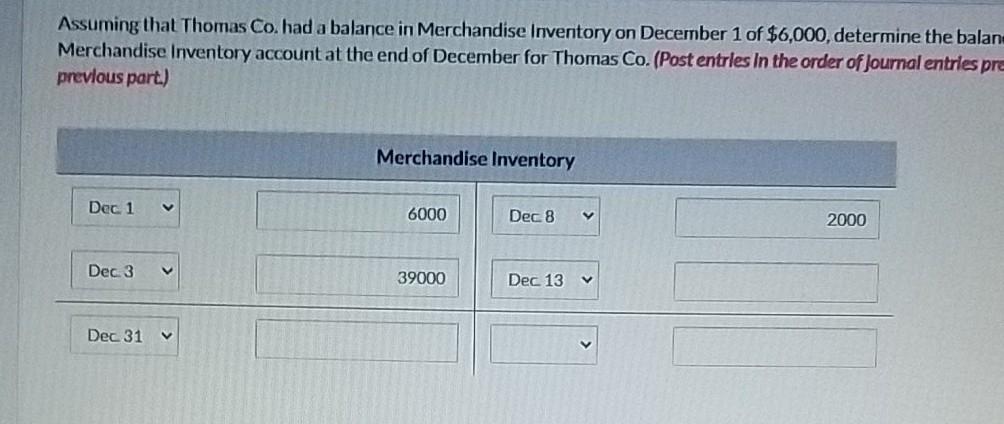

The following merchandise transactions occurred in December. Both companies use a perpetual inventory system. Dec 3 Crane Company sold merchandise to Thomas Co. for $39,000, terms 2/10, 1/30. FOB destination. This merchandise cost Crane Company $18,000. 4 The correct company paid freight charges of $825. 8 Thomas Co. returned unwanted merchandise to Crane. The returned merchandise had a sales price of $2.000 and a cost of $990. It was restored to inventory. 13 Crane Company received the balance due from Thomas Co Dec 13 Cash Sales Discounts Accounts Receivable 2910 (Collection on account.) Dec. 8 Accounts Payable Merchandise Inventory (To record purchase return.) Dec. 13 V Accounts Payable Merchandise Inventory 29 cash (Payment on account.) Assuming that Thomas Co. had a balance in Merchandise Inventory on December 1 of $6,000, determine the balan- Merchandise Inventory account at the end of December for Thomas Co. (Post entrles in the order of Journal entries pre previous part.) Merchandise Inventory Dec 1 6000 Dec 8 2000 Dec 3 39000 Dec 13 V Dec 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started