Question

The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $600,000; Office salaries, $120,000; Federal income taxes withheld, $180,000; State income

The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $600,000; Office salaries, $120,000; Federal income taxes withheld, $180,000; State income taxes withheld, $40,000; Social security taxes withheld, $44,640; Medicare taxes withheld, $10,440; Medical insurance premiums, $14,500; Life insurance premiums, $11,500; Union dues deducted, $8,500; and Salaries subject to unemployment taxes, $65,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%.

1&2. Using the above information, complete the below table and prepare the journal entries to record accrued payroll and a cash payment of the net payroll for July.

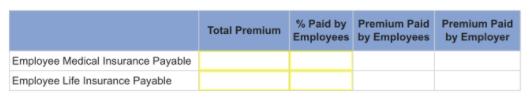

3. Using the above information, complete the below table.

4. Record the accrued employer payroll taxes and all other employer-paid expenses and the cash payment of all liabilities for July-assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%.

% Paid by Premium Paid Premium Paid Employees by Employees by Employer Total Premium Employee Medical Insurance Payable Employee Life Insurance Payable

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 2 Answer Total Premium paid by employees Premium paid by employees Premium paid by employers 60 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started