Question

The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $360,000; Office salaries, $72,000; Federal income taxes withheld, $108,000; State income

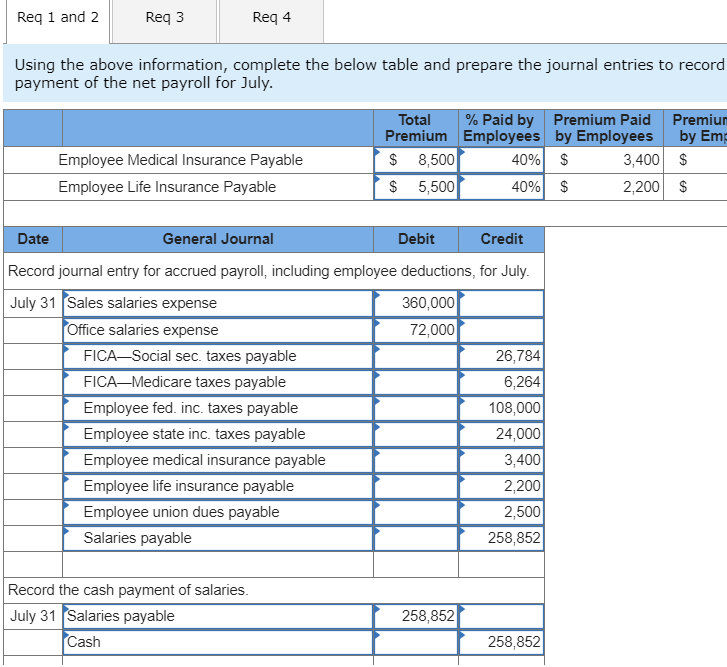

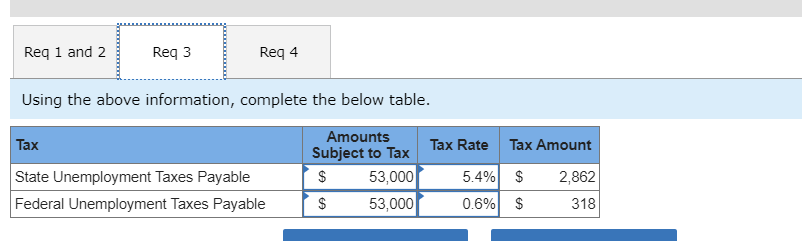

The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $360,000; Office salaries, $72,000; Federal income taxes withheld, $108,000; State income taxes withheld, $24,000; Social security taxes withheld, $26,784; Medicare taxes withheld, $6,264; Medical insurance premiums, $8,500; Life insurance premiums, $5,500; Union dues deducted, $2,500; and Salaries subject to unemployment taxes, $53,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%.

1&2. Using the above information, complete the below table and prepare the journal entries to record accrued payroll and cash payment of the net payroll for July.

3. Using the above information, complete the below table.

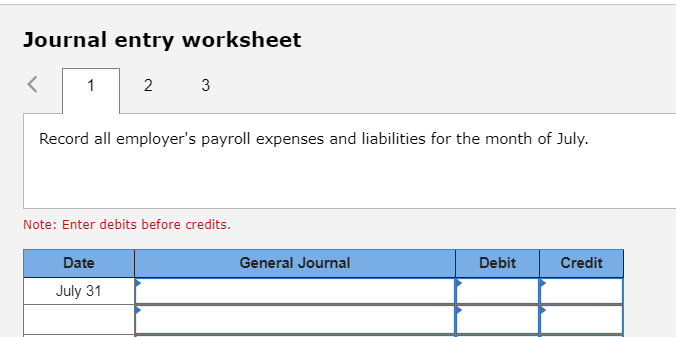

4. Record the accrued employer payroll taxes and all other employer-paid expenses and the cash payment of all liabilities for July-assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%.

1.

2.

3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started