Question

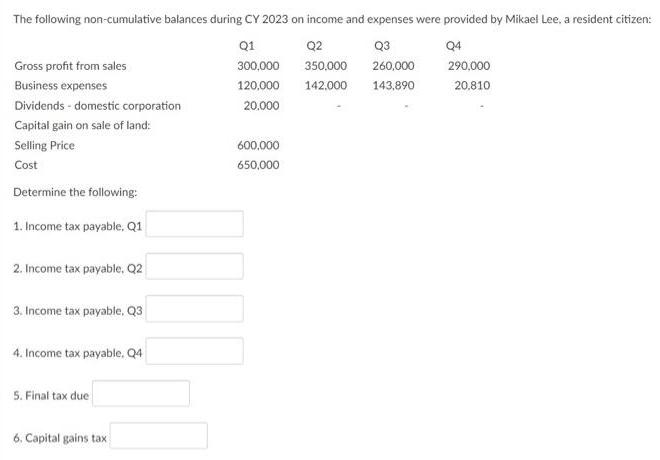

The following non-cumulative balances during CY 2023 on income and expenses were provided by Mikael Lee, a resident citizen: Q1 Q2 Q3 300,000 350,000

The following non-cumulative balances during CY 2023 on income and expenses were provided by Mikael Lee, a resident citizen: Q1 Q2 Q3 300,000 350,000 260,000 142.000 143,890 120,000 20,000 Gross profit from sales Business expenses Dividends - domestic corporation Capital gain on sale of land: Selling Price Cost Determine the following: 1. Income tax payable, Q1 2. Income tax payable, Q2 3. Income tax payable, Q3 4. Income tax payable. Q4 5. Final tax due 6. Capital gains tax 600,000 650,000 Q4 290,000 20,810

Step by Step Solution

3.61 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

calculate income tax for each quarter 1 Income Tax Payable Q1 Gross profit for Q1 300000 Business expenses for Q1 120000 Dividends from a domestic cor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Jan Williams, Susan Haka, Mark S Bettner, Joseph V Carcello

16th edition

1259692396, 77862384, 978-0077862381

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App