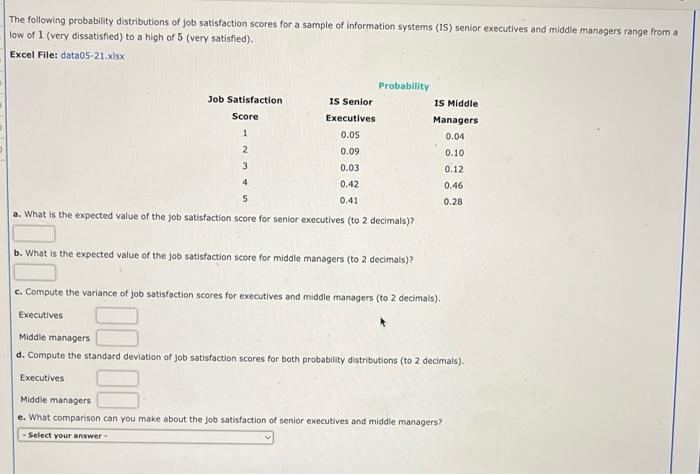

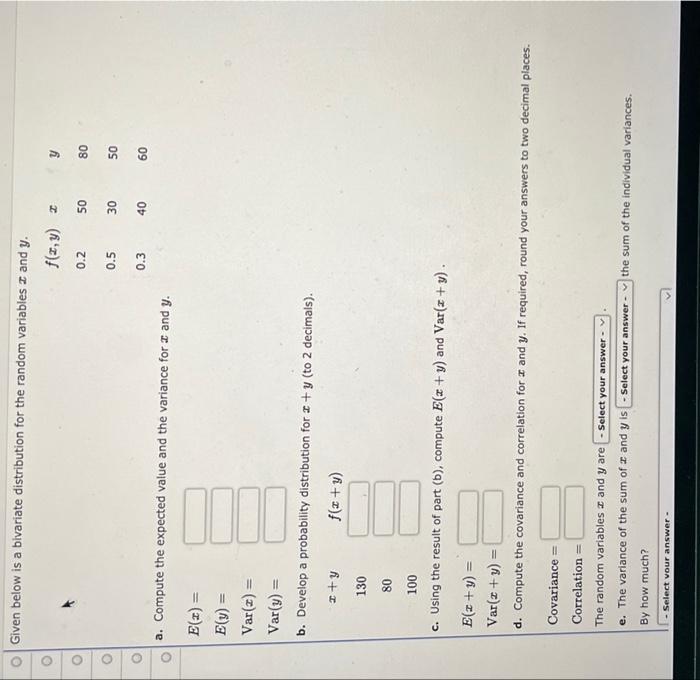

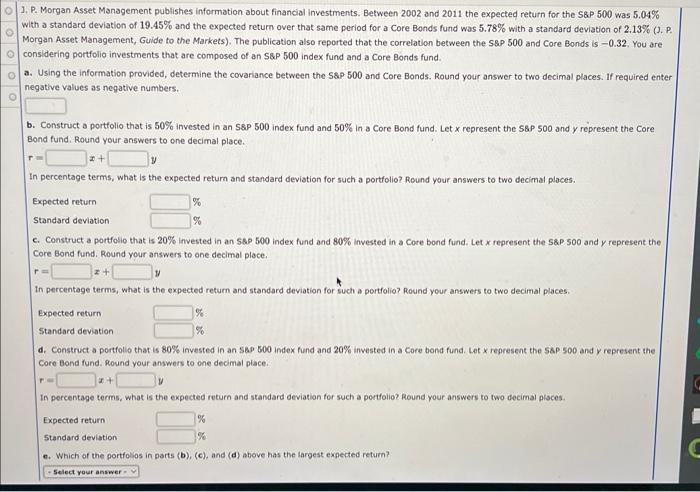

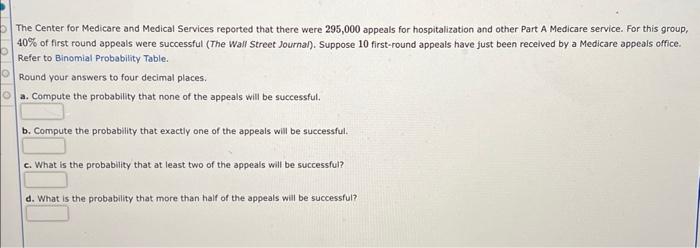

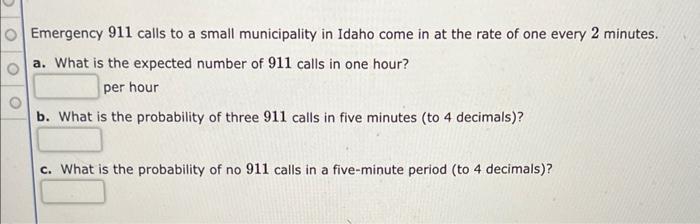

The following probability distributions of job satisfaction scores for a sample of information systems (IS) senior executives and middie managers range from a low of 1 (very dissatisfied) to a high of 5 (very satisfied). Excel File: data05-21.xisx a. What is the expected value of the job satisfaction score for senior executives (to 2 decimals)? b. What is the expected value of the job satisfaction score for middle managers (to 2 decimais)? c. Compute the variance of job satisfaction scores for executives and middle managers (to 2 decimals). Executives Middle managers d. Compute the standard deviation of job satisfaction scores for both probability distributions (to 2 decimals). Executives Middle managers e. What comparison can you make about the job satisfaction of senior executives and middle managers? Given below is a bivariate distribution for the random variables x and y. a. Compute the expected value and the variance for x and y. E(x)=E(y)=Var(x)=Var(y)= b. Develop a probability distribution for x+y (to 2 decimals). x+yf(x+y) 130 80 100 c. Using the result of part (b), compute E(x+y) and Var(x+y). E(x+y)=Var(x+y)= d. Compute the covariance and correlation for x and y. If required, round your answers to two decimal places. Covariance = Correlation = The random variables x and y are e. The variance of the sum of x and y is the sum of the individual variances. By how much? - Select vour answer - P. Morgan Asset Management publishes information about financial investments. Between 2002 and 2011 the expected return for the SaP 500 was 5.04% with a standard deviation of 19.45% and the expected return over that same period for a Core Bonds fund was 5.78% with a standard deviation of 2.13% (1. P. Morgan Asset Management, Guide to the Markets). The publication also reported that the correlation between the 5s.500 and Core Bonds is 0.32. You are considering portfolio investments that are composed of an S\&P 500 index fund and a Core Bonds fund. a. Using the information provided, determine the covariance between the Ssp 500 and Core Bonds. Round your answer to two decimal places. If required enter negative values as negative numbers. b. Construct a portfolio that is 50% invested in an S\&P 500 index fund and 50% in a Core Bond fund. Let x represent the SsP 500 and y represent the Core Bond fund. Round your answers to one decimal place. r= In percentage terms, what is the expected return and standard devistion for such a portfolio? Round your answers to two decimal places. c. Construct a portfolio that is 20% invested in an 5AD500 index fund and 80% invested in a Core bond fund. Let x represent the sap soo and y represent the Core Bond fund. Round your answers to one decimal place. r= In percentage terms, what is the expected return and standard deviation for such a portfolio? Round your answers to two decimal places. d. Construct a portfolio that is 80% invested in an SEP. 600 index fund and 20% invested in a Core bond fund. Let x represent the 58P500 and y represent the Core Bond fund. Round your answers to one decimal place. r=5 In percentage terms, what is the expected return and standard deviation for such a portfolio? Round your answers to two decimal places. -. Which of the portfolios in parts (b), (c), and (d) above has the targest expected return? The Center for Medicare and Medical Services reported that there were 295,000 appeals for hospitalization and other Part A Medicare service. For this group, 40% of first round appeals were successful (The Wall Street Journal). Suppose 10 first-round appeais have just been received by a Medicare appeals office. Refer to Binomial Probability Table. Round your answers to four decimal places. a. Compute the probability that none of the appeals will be successful. b. Compute the probability that exactly one of the appeals will be successful. c. What is the probability that at least two of the appeals will be successful? d. What is the probability that more than half of the appeals will be successful? Emergency 911 calls to a small municipality in Idaho come in at the rate of one every 2 minutes. a. What is the expected number of 911 calls in one hour? per hour b. What is the probability of three 911 calls in five minutes (to 4 decimals)? c. What is the probability of no 911 calls in a five-minute period (to 4 decimals)