Answered step by step

Verified Expert Solution

Question

1 Approved Answer

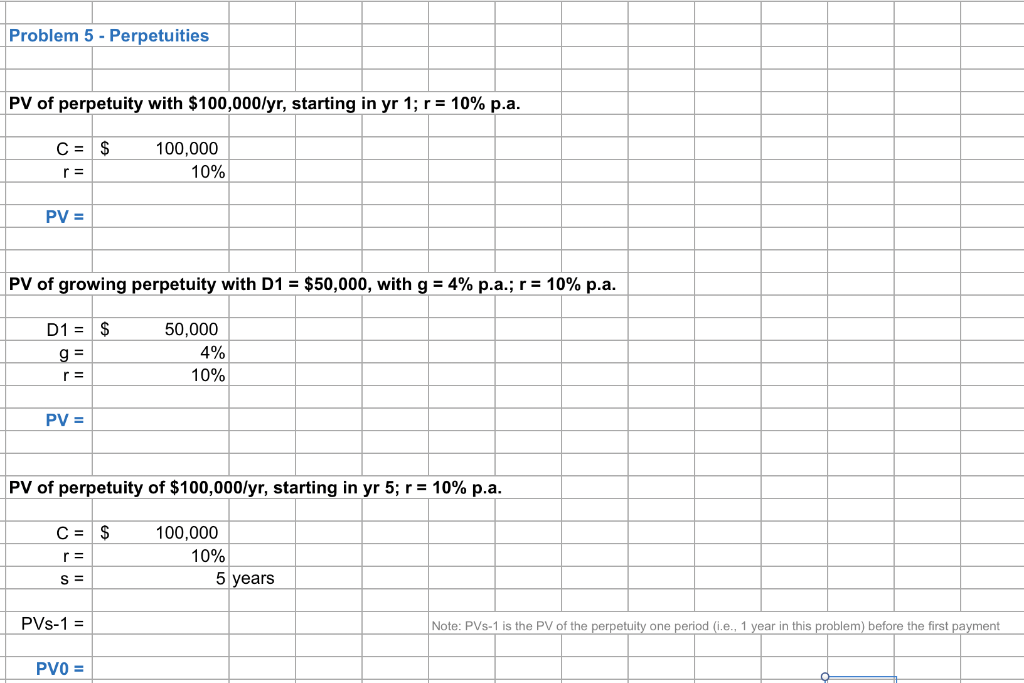

The following problem is similar, but not identical, to the second question in Problem 5. What is the present value (PV) today of a growing

The following problem is similar, but not identical, to the second question in Problem 5.

What is the present value (PV) today of a growing perpetuity that starts at $47,000 1 year from today, and then grows at a 4% annual rate? The appropriate discount rate is 16% p.a. Round your answer to the nearest dollar. Do not include the $ symbol nor the separating comma, if any. Thus, for example, if the PV is $24,323.55 write 24324 in the answer box.

- The three problems in the text should be straightforward.

- Well also solve a more challenging set of problems in class. They pertain to perpetuities in which the periodic payments occur once every several years, and whose initial CF may occur at any time (i.e., it does not necessarily occur at t = 1).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started