Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following problem will be used to answer the next question. Elsinore Company is considering the purchase of a new brewing equipment. The new

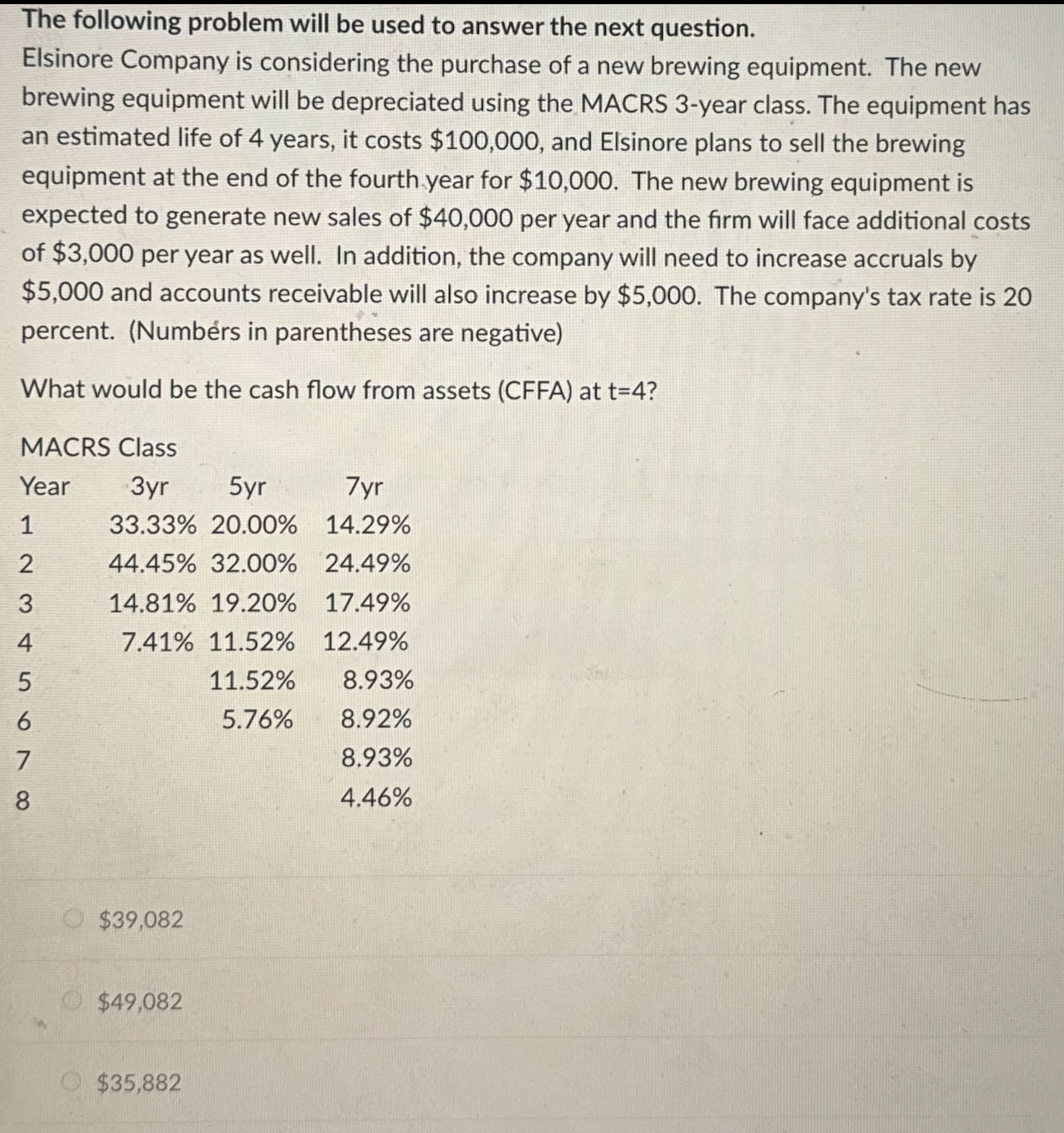

The following problem will be used to answer the next question. Elsinore Company is considering the purchase of a new brewing equipment. The new brewing equipment will be depreciated using the MACRS 3-year class. The equipment has an estimated life of 4 years, it costs $100,000, and Elsinore plans to sell the brewing equipment at the end of the fourth year for $10,000. The new brewing equipment is expected to generate new sales of $40,000 per year and the firm will face additional costs of $3,000 per year as well. In addition, the company will need to increase accruals by $5,000 and accounts receivable will also increase by $5,000. The company's tax rate is 20 percent. (Numbers in parentheses are negative) What would be the cash flow from assets (CFFA) at t=4? MACRS Class Year 3yr 5yr 7yr 1 33.33% 20.00% 14.29% 2 44.45% 32.00% 24.49% 3 14.81% 19.20% 17.49% 7 45678 8 7.41% 11.52% 12.49% 11.52% 8.93% 5.76% 8.92% $39,082 $49,082 $35,882 8.93% 4.46%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started