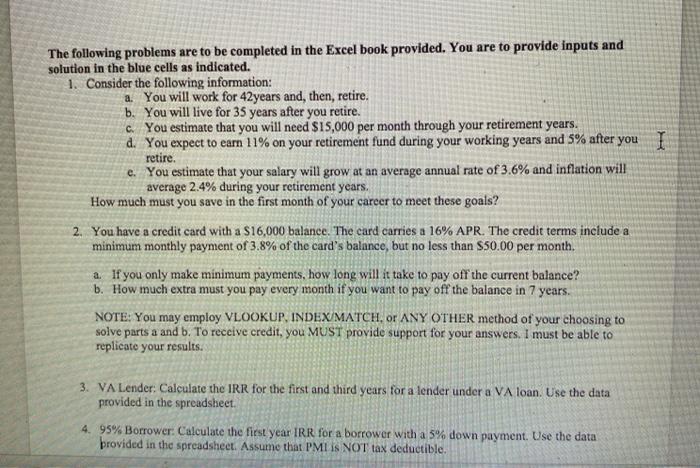

The following problems are to be completed in the Excel book provided. You are to provide inputs and solution in the blue cells as indicated. 1. Consider the following information: a. You will work for 42 years and, then, retire. b. You will live for 35 years after you retire. c. You estimate that you will need $15,000 per month through your retirement years. d. You expect to earn 11% on your retirement fund during your working years and 5% after you I retire. e. You estimate that your salary will grow at an average annual rate of 3.6% and inflation will average 2.4% during your retirement years. How much must you save in the first month of your career to meet these goals? 2. You have a credit card with a S16,000 balance. The card carries a 16% APR. The credit terms include a minimum monthly payment of 3.8% of the card's balance, but no less than $50.00 per month. a. If you only make minimum payments, how long will it take to pay off the current balance? b. How much extra must you pay every month if you want to pay off the balance in 7 years. NOTE: You may employ VLOOKUP. INDEX/MATCH. Or ANY OTHER method of your choosing to solve parts a and b. To receive credit, you MUST provide support for your answers. I must be able to replicate your results. 3. VA Lender: Calculate the IRR for the first and third years for a lender under a VA loan. Use the data provided in the spreadsheet. 4. 95% Borrower: Calculate the first year IRR for a borrower with a 5% down payment. Use the data provided in the spreadsheet. Assume that PMI IS NOT tax deductible. The following problems are to be completed in the Excel book provided. You are to provide inputs and solution in the blue cells as indicated. 1. Consider the following information: a. You will work for 42 years and, then, retire. b. You will live for 35 years after you retire. c. You estimate that you will need $15,000 per month through your retirement years. d. You expect to earn 11% on your retirement fund during your working years and 5% after you I retire. e. You estimate that your salary will grow at an average annual rate of 3.6% and inflation will average 2.4% during your retirement years. How much must you save in the first month of your career to meet these goals? 2. You have a credit card with a S16,000 balance. The card carries a 16% APR. The credit terms include a minimum monthly payment of 3.8% of the card's balance, but no less than $50.00 per month. a. If you only make minimum payments, how long will it take to pay off the current balance? b. How much extra must you pay every month if you want to pay off the balance in 7 years. NOTE: You may employ VLOOKUP. INDEX/MATCH. Or ANY OTHER method of your choosing to solve parts a and b. To receive credit, you MUST provide support for your answers. I must be able to replicate your results. 3. VA Lender: Calculate the IRR for the first and third years for a lender under a VA loan. Use the data provided in the spreadsheet. 4. 95% Borrower: Calculate the first year IRR for a borrower with a 5% down payment. Use the data provided in the spreadsheet. Assume that PMI IS NOT tax deductible