Answered step by step

Verified Expert Solution

Question

1 Approved Answer

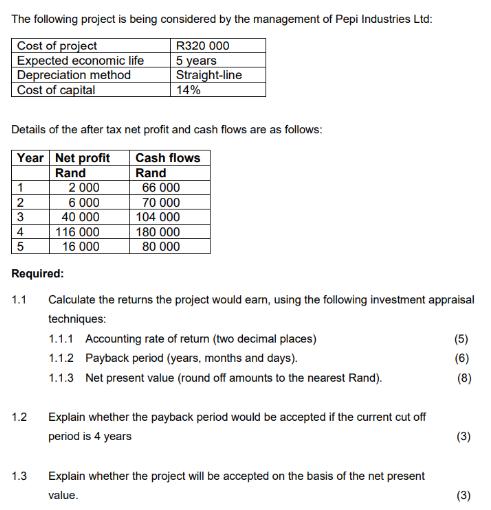

The following project is being considered by the management of Pepi Industries Ltd: Cost of project R320 000 5 years Expected economic life Depreciation

The following project is being considered by the management of Pepi Industries Ltd: Cost of project R320 000 5 years Expected economic life Depreciation method Straight-line 14% Cost of capital Details of the after tax net profit and cash flows are as follows: Year Net profit Cash flows Rand Rand 12345 Required: 1.1 1.2 1.3 2 000 6 000 40 000 116 000 16 000 66 000 70 000 104 000 180 000 80 000 Calculate the returns the project would earn, using the following investment appraisal techniques: 1.1.1 Accounting rate of return (two decimal places) 1.1.2 Payback period (years, months and days). 1.1.3 Net present value (round off amounts to the nearest Rand). Explain whether the payback period would be accepted if the current cut off period is 4 years Explain whether the project will be accepted on the basis of the net present value. (5) (6) (8)

Step by Step Solution

★★★★★

3.48 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

11 Investment appraisal techniques 111 Accounting rate of return The accounting rate of return is ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started