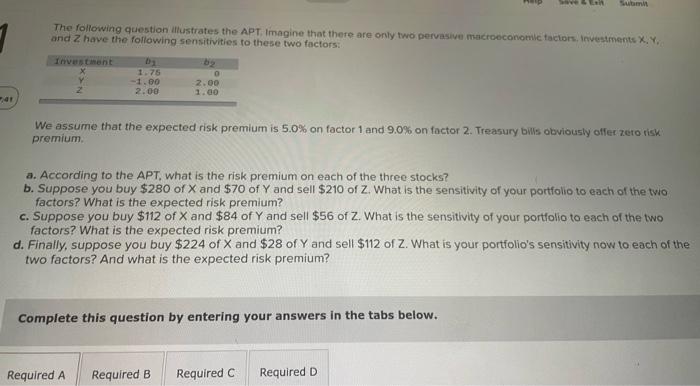

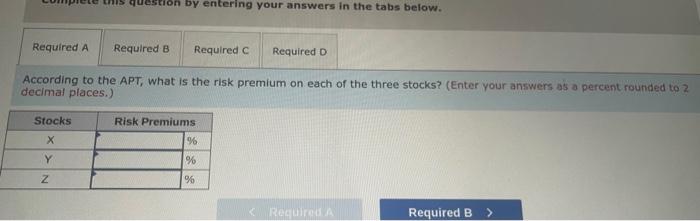

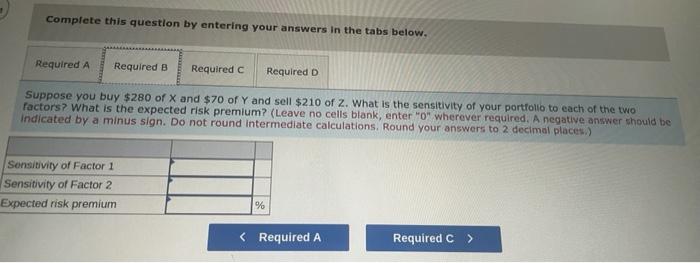

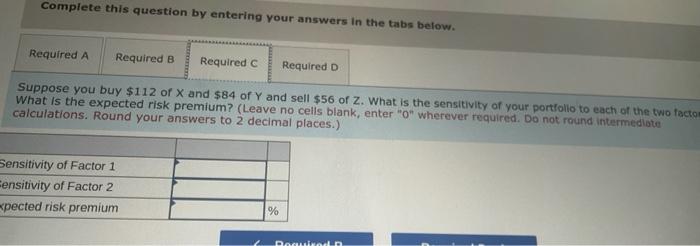

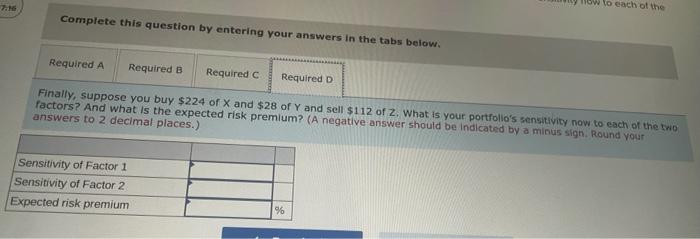

The following question illustrates the APT. Imagine that there are orly two pervasiue macroeconotule factors, invastments X, Y, and Z have the following sensitivities to these two factors: We assume that the expected risk premium is 5.0% on factor 1 and 9.0% on factor 2. Treasury bus obviously offer zeto risk premium. a. According to the APT, what is the risk premium on each of the three stocks? b. Suppose you buy $280 of X and $70 of Y and sell $210 of Z. What is the sensitivity of your portfolio to each of the two factors? What is the expected risk premium? c. Suppose you buy $112 of X and $84 of Y and sell $56 of Z. What is the sensitivity of your portfolio to each of the two factors? What is the expected risk premium? d. Finally, suppose you buy $224 of X and $28 of Y and sell $112 of Z. What is your portfolio's sensitivity now to each of the two factors? And what is the expected risk premium? Complete this question by entering your answers in the tabs below. According to the APT, what is the risk premium on each of the three stocks? (Enter your answers as a percent rounded to 2 decimal places.) Complete this question by entering your answers in the tabs below. Suppose you buy $280 of X and $70 of Y and sell $210 of z. What is the sensitivity of your porttollo to each of the two factors? What is the expected risk premlum? (Leave no cells blank, enter "0" wherever required, A negative answer should be ndicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal plices) Complete this question by entering your answers in the tabs below. Suppose you buy $112 of X and $84 of Y and sell $56 of Z. What is the sensitivity of your portfolio to each of the two factc What is the expected risk premium? (Leave no cells blank, enter " 0 " wherever required. Do not round intermediote calculations. Round your answers to 2 decimal places.) Complete this question by entering your answers in the tabs below, Finally, suppose you buy $224 of X and $28 of Y and sell $112 of Z, What is your portfollo's sensitivity now to each of the two factors? And what is the expected risk premium? (A negative answer should be indicated by a minus sign. Round your answers to 2 decimal places.)