Answered step by step

Verified Expert Solution

Question

1 Approved Answer

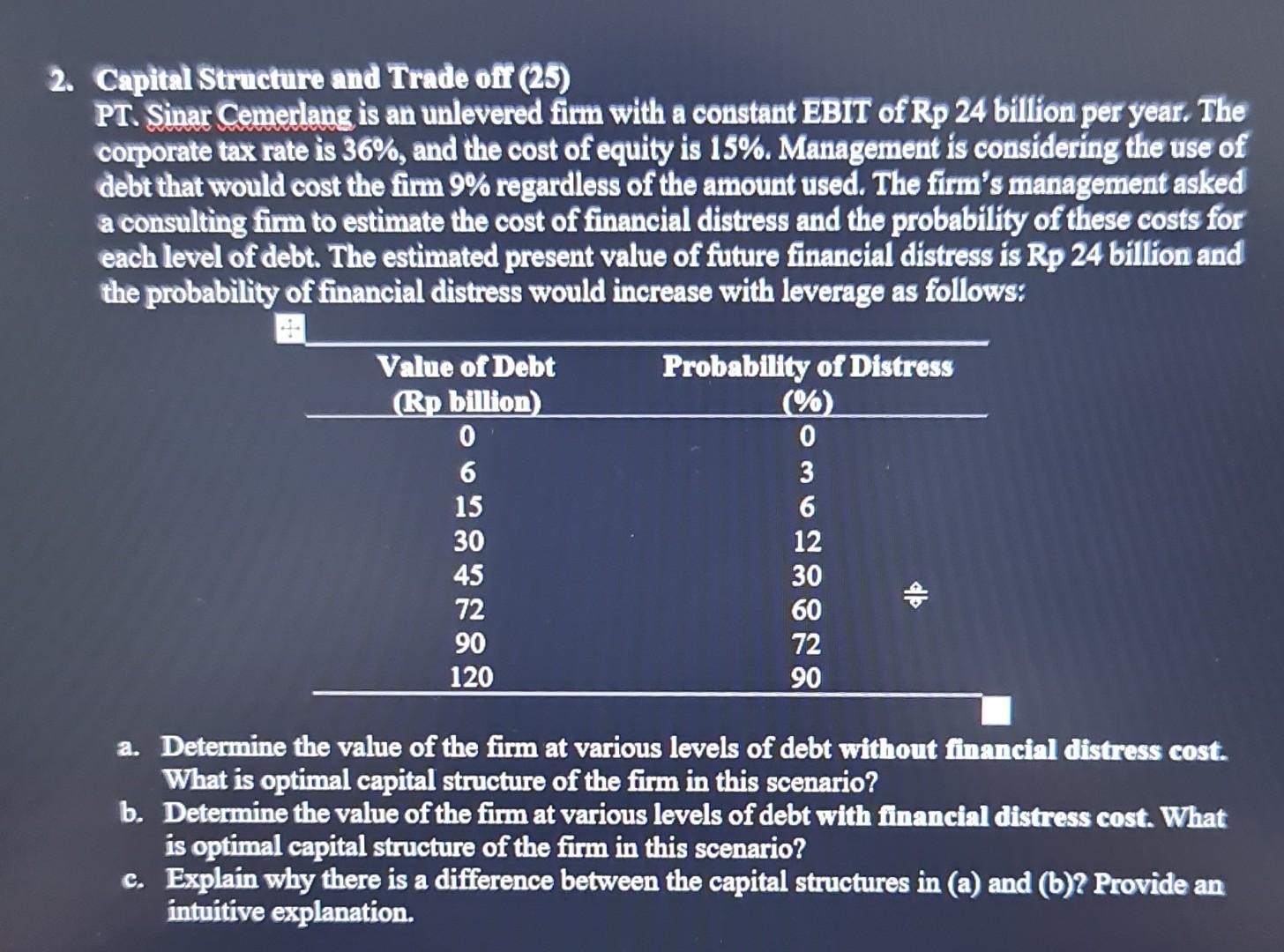

2. Capital Structure and Trade off (25) PT. Sinar Cemerlang is an unlevered firm with a constant EBIT of Rp 24 billion per year.

2. Capital Structure and Trade off (25) PT. Sinar Cemerlang is an unlevered firm with a constant EBIT of Rp 24 billion per year. The corporate tax rate is 36%, and the cost of equity is 15%. Management is considering the use of debt that would cost the firm 9% regardless of the amount used. The firm's management asked a consulting firm to estimate the cost of financial distress and the probability of these costs for each level of debt. The estimated present value of future financial distress is Rp 24 billion and the probability of financial distress would increase with leverage as follows: Value of Debt (Rp billion) 0 6 15 30 45 72 90 120 Probability of Distress (%) 0 3 6 12 30 60 72 90 db a. Determine the value of the firm at various levels of debt without financial distress cost. What is optimal capital structure of the firm in this scenario? b. Determine the value of the firm at various levels of debt with financial distress cost. What is optimal capital structure of the firm in this scenario? c. Explain why there is a difference between the capital structures in (a) and (b)? Provide an intuitive explanation.

Step by Step Solution

★★★★★

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Determine the value of the firm at various levels of debt without financial distress cost What is optimal capital structure of the firm in this scen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started